Ethereum looks set to resume consolidation as SEC may not approve spot ETH ETFs

- Ethereum longs could suffer a hit as inside sources have told Reuters that the SEC will likely deny a spot ETH ETF.

- Issuers may go to court to force SEC's hand.

- Whales remain positive on Ethereum despite recent price setbacks.

Ethereum (ETH) appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after insider sources informed Reuters of the unlikelihood of the Securities & Exchange Commission (SEC) approving a spot ETH ETF in May.

Read more: Ethereum dips slightly amid Renzo depeg, BlackRock spot ETH ETF amendment

Daily digest market movers: spot Ethereum ETFs unlikely

Ethereum spot ETFs are in the news today following recent unveilings. Here are key Ethereum market movers for today:

- While Hong Kong has approved spot ETH ETFs to go live on April 30, the US SEC seems set to take an opposite move. According to Reuters, a group of unnamed individuals who participated in a meeting between issuers and the SEC claimed the regulator's staff didn't discuss specific details about the product. The individuals claimed that issuers argued that the SEC's approval of futures ETH ETF in May "set a precedent for spot Ether products."

Chief legal officers of Coinbase and Grayscale, Paul Grewal and Craig Salm, respectively, have also maintained the same position. The individuals said while SEC staff listened, they didn't ask questions or raise any concern, suggesting the regulator would deny the filings, stated Reuters. Bloomberg analysts Eric Balchunas and James Seyffart have earlier lowered their odds of a spot ETH ETF approval in May, stating the SEC's lack of engagement as the major reason.

One of the sources told Reuters, "It's entirely possible we'll eventually see Ether ETFs. But not until somebody is denied and goes to the courts."

The president of The ETF Store, Nate Geraci, has previously stated that the SEC may face a lawsuit if it fails to approve spot ETH ETFs.

Also read: Ethereum shows signs of a potential rally as suspected Justin Sun wallet buys heavily

- Despite the seemingly bearish news, a suspected Justin Sun wallet has continued scooping up ETH. The wallet bought a total of 28,675 ETH worth $89.84 million on Thursday, according to Lookonchain. Since April 8, it has purchased 176,117 ETH worth $559.7 million at an average price of $3,172.

Whales seem to be bullish on Ethereum, buying heavily at every slight market downturn. Data from Spot On Chain confirms several whales bought ETH on Thursday following the decline.Whales appear to remain bullish with $ETH despite the recent market crash!

— Spot On Chain (@spotonchain) April 25, 2024

Will the $ETH price recover soon?

Follow @spotonchain and set alerts for $ETH to know the next significant whale activity now: https://t.co/js2Cq7crji pic.twitter.com/fLbWyLDJ3I

Technical analysis: ETH to resume consolidation

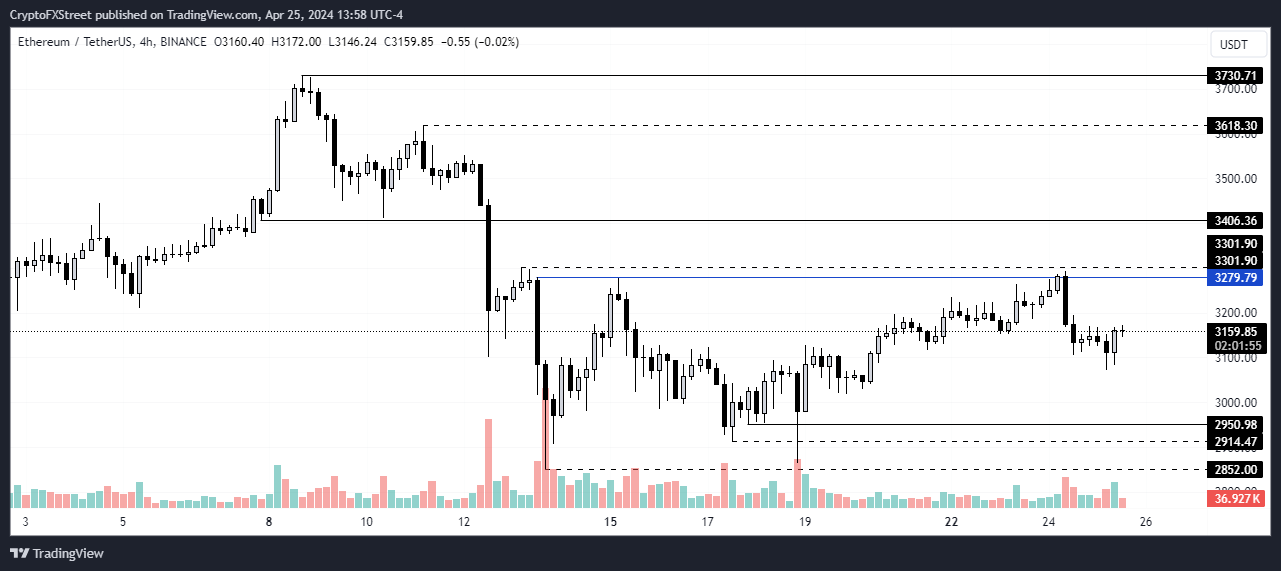

Ethereum seems to be returning to consolidation on Thursday after declining in the past 24 hours. Long liquidations began increasing again, hitting $35.1 million in the past 24 hours.

Read more: Ethereum continues hinting at rally following reduced long liquidations

The $2,852 to $3,300 range appears very strong—both on the upper and lower level—as ETH has been trading inside it for the past 13 days. With the recent decline, ETH may remain inside the range, especially as spot ETH ETFs look highly unlikely with every new piece of information.

ETH/USDT 4-hour chart

However, Bitcoin's price movement will continue to be a deciding factor in how ETH moves in the short term. If Bitcoin resumes an upswing, ETH may likely follow suit and see higher price boosts, considering its recent hint at a rally before the dip. An SEC spot ETH ETF denial may not necessarily snag the Ethereum price as it appears to have already been priced in.

ETH is trading at $3,160, down 0.6% at the time of writing.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.