What Weak 2025 Token Listing Returns Suggest About Buy-and-Hold Investing

In 2025, crypto tokens listed on major exchanges largely struggled to maintain positive price performance, with weakness observed regardless of the listing venue.

This performance has fueled debate over whether the traditional buy-and-hold strategy still works in today’s crypto environment.

Binance, Coinbase, or DEXs: 2025 Listings Struggled Across the Board

According to data from CryptoRank, between January 1 and December 31, 2025, Binance listed 100 tokens, with 93 of them trading in the red. The median return on investment (ROI) for Binance-listed tokens stood at 0.22x. This indicated that the typical newly listed altcoin lost a significant portion of its value.

Bybit listed 150 tokens during the period, with 127 recording declines and a median ROI of 0.23x. MEXC, which led in listing activity with 878 new tokens, reported 747 tokens trading in the red and a median ROI of 0.21x.

Some exchanges showed relatively stronger outcomes, though declines still dominated. Coinbase listed 111 tokens, with 94 trading lower and a median ROI of 0.43x, the highest among major centralized exchanges.

Kraken followed a similar pattern. It posted a median ROI of 0.30x despite most of its newly listed tokens finishing in negative territory. It is also worth noting that many tokens were common across multiple exchanges, suggesting that performance was driven less by the listing venue and more by broader market conditions.

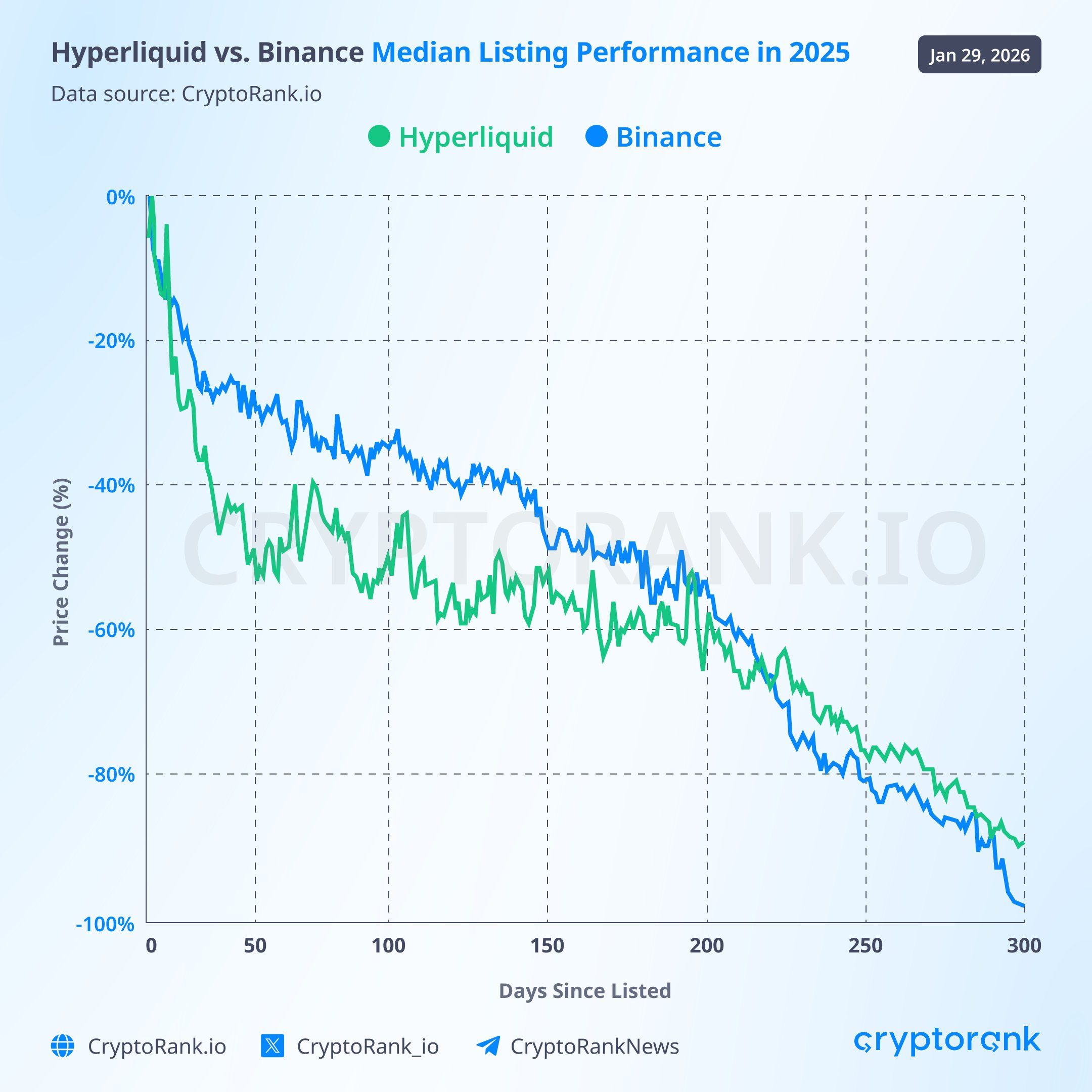

CryptoRank noted that this trend was not limited to centralized platforms. In a separate analysis, the firm examined listing performance on Hyperliquid, a major perpetual decentralized exchange, and found similar results.

“Given the recent FUD about @binance and its listing performance, we used @HyperliquidX’s public API data to compare results, and they were almost the same. It’s pretty obvious we’d see a similar pattern across exchanges, so it’s unlikely to be solely the exchange’s fault,” the post read.

Median Listing Performance of Binance Vs Hyperliquid. Source: X/CryptoRank

Median Listing Performance of Binance Vs Hyperliquid. Source: X/CryptoRank

Is Buy-And-Hold Still Relevant in Today’s Crypto Market?

CryptoRank attributed much of the weak performance to the sheer scale of token issuance in 2025. More than 11 million new tokens entered the market during the year, many of which the platform described as “low-quality.” The post added,

“Perhaps 2025 was not the best period for ‘buy and hodl.”

This raises a broader question about the future of passive investment strategies. Market data shows that the total crypto market capitalization stood below $3 trillion in January 2026, lower than at the start of 2025 and roughly in line with the previous cycle peak in 2021. Since October, the market has shed more than $1 trillion in value, underlining the pressure facing the sector.

Against this backdrop, investors are increasingly questioning whether broad buy-and-hold and dollar-cost averaging strategies can still work in this market.

Some analysts argue that changes in market structure have reduced the effectiveness of passive investment strategies. Analyst Aporia suggested that buy-and-hold strategies were more effective during crypto’s early growth phase, when the asset class was still being discovered.

“‘Just DCA and hold long-term’ worked when the asset class was being discovered. Now you’re competing with funds, algorithms, and literal scammers who treat your ‘conviction’ as exit liquidity. Passive strategies require passive markets. Crypto isn’t that. And holding isn’t a strategy. It’s the absence of one,” Aporia stated.

Changpeng Zhao, former CEO of Binance, offered a more nuanced perspective. He clarified that the “buy and hold” principle was never meant to apply to every cryptocurrency.

“If you ‘buy and hold’ all crypto ever created, you know how your portfolio will perform. Same as if you bought every internet or AI projects/companies,” CZ noted

His comment suggests that buy-and-hold may still work, but only for a small subset of high-quality projects, rather than as a broad strategy applied across all coins.