Crypto Today: Bitcoin, Ethereum, XRP upside remains limited as institutional interest returns modestly

- Bitcoin remains limited below $90,000 as ETFs record minimal inflows.

- Ethereum slips toward the $2,900 support level amid weak technical indicators, with the MACD signaling a bearish trend.

- XRP ETFs extend a four-day streak of inflows, but price recovery is capped below $2.00.

Bitcoin (BTC) is pressing down toward $88,000 support at the time of writing on Tuesday. The King of crypto remains trapped between the $88,000 and $90,000 levels, unable to break out despite recording minimal inflows into Exchange-Traded Funds (ETFs), signaling tepid institutional appetite.

Ethereum (ETH) holds above support at $2,900, although a weak technical structure could accelerate downside momentum.

Meanwhile, Ripple (XRP) continues to attract sustained institutional interest, yet bulls have failed to reclaim the psychological $2.00 threshold, underscoring the broader crypto market’s inability to establish a convincing recovery trajectory.

Bitcoin, Ethereum, and XRP attract mild ETF interest

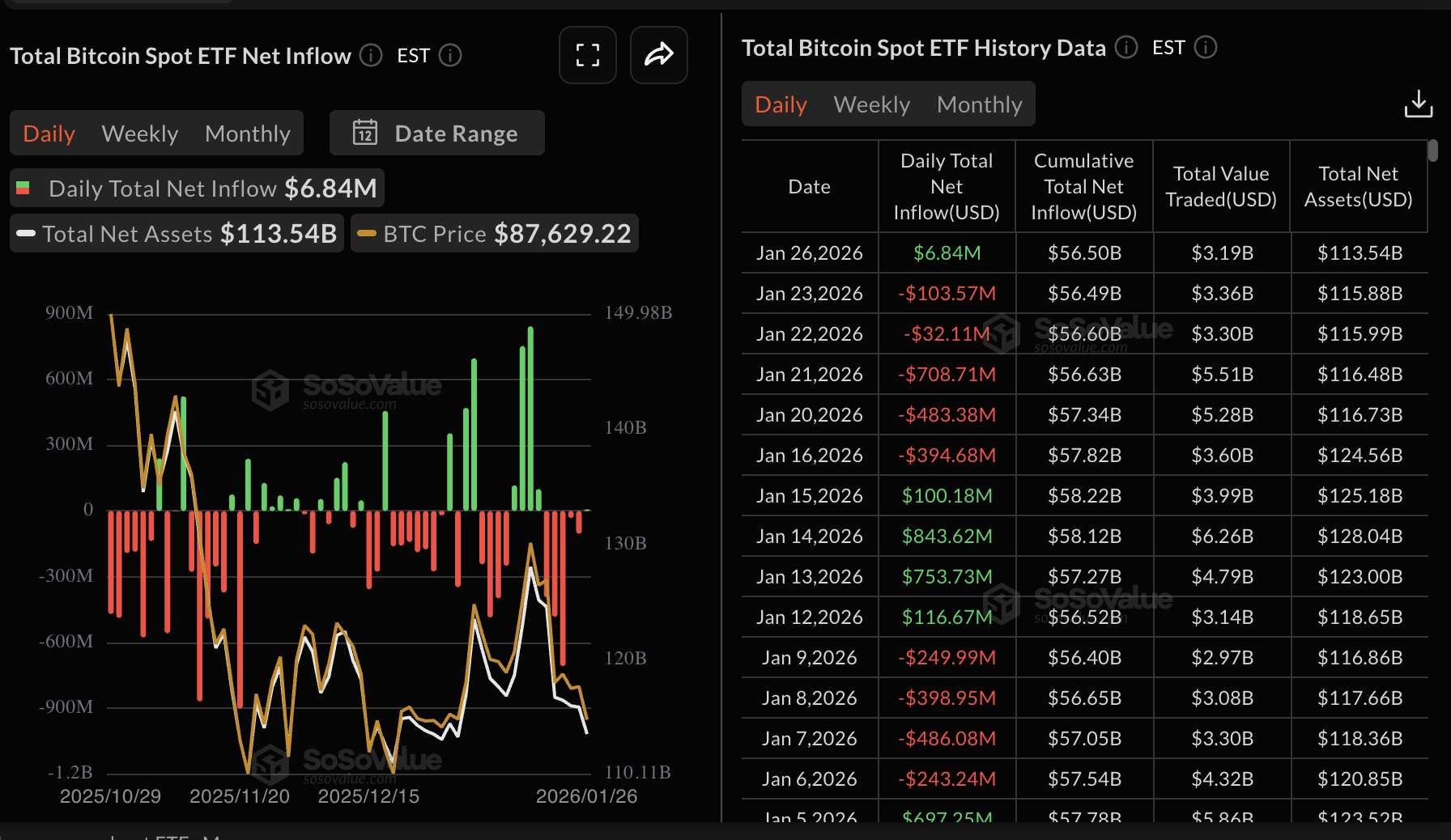

Bitcoin spot ETFs recorded modest inflows of about $6.84 million on Monday, marking the first positive day after five consecutive days of net outflows.

Monday’s mild inflow broke a short-term redemption trend that mirrored risk-off sentiment in the wider crypto market. However, the cumulative inflow remains positive at over $56 billion, while total net assets stand at $113.5 billion.

Investors remain cautious amid geopolitical tensions, macroeconomic uncertainty and regulatory headwinds in the United States (US). A decisive break above $90,000 could stabilize interest, as BTC ETF products become more attractive to investors.

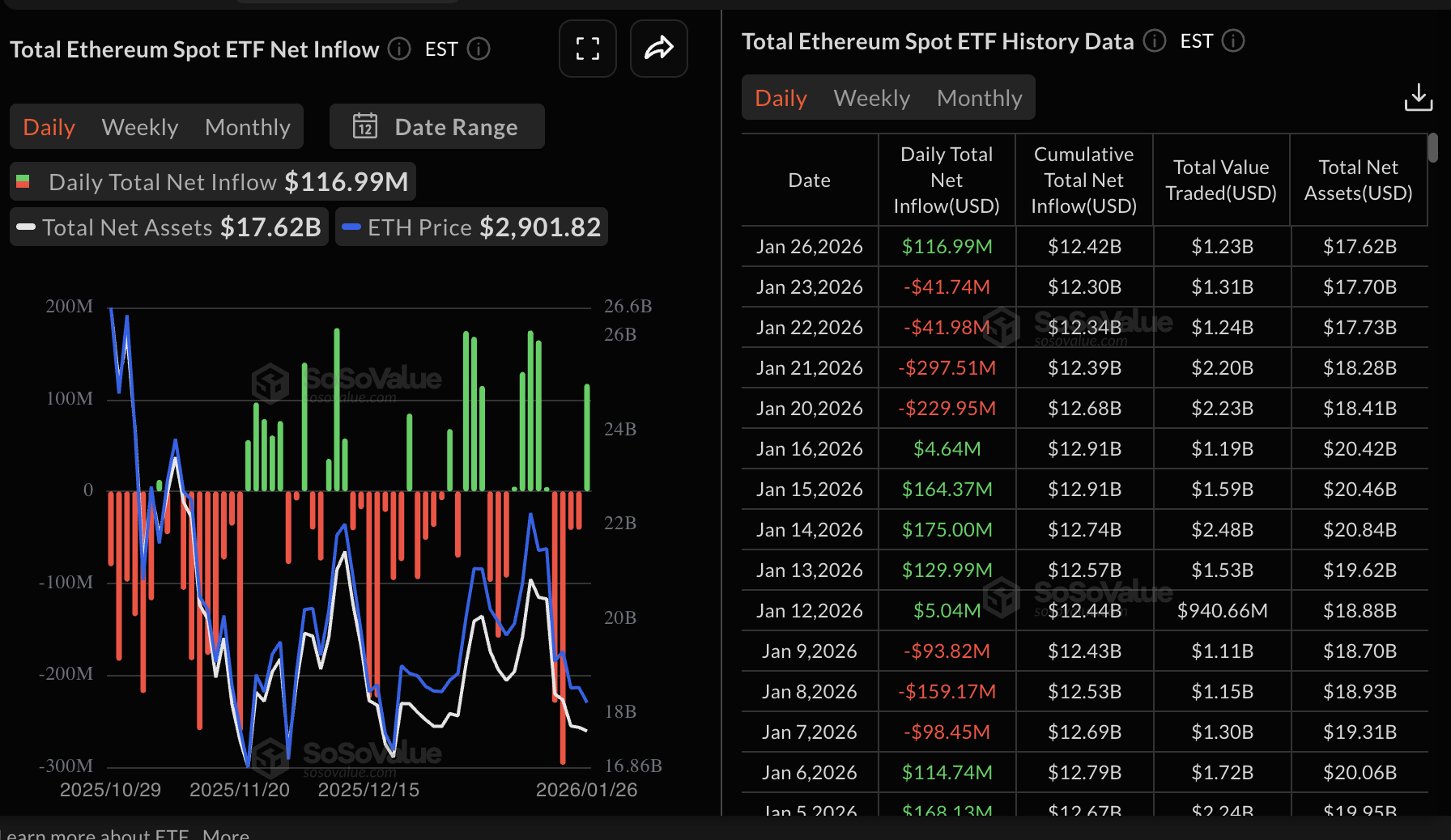

Ethereum ETFs outperformed on Monday, with net inflows of about $117 million. The surge in demand for ETH spot ETFs followed four consecutive days of outflows, bringing the cumulative total inflow to $12.42 billion and the assets under management (AUM) to $17.62 billion.

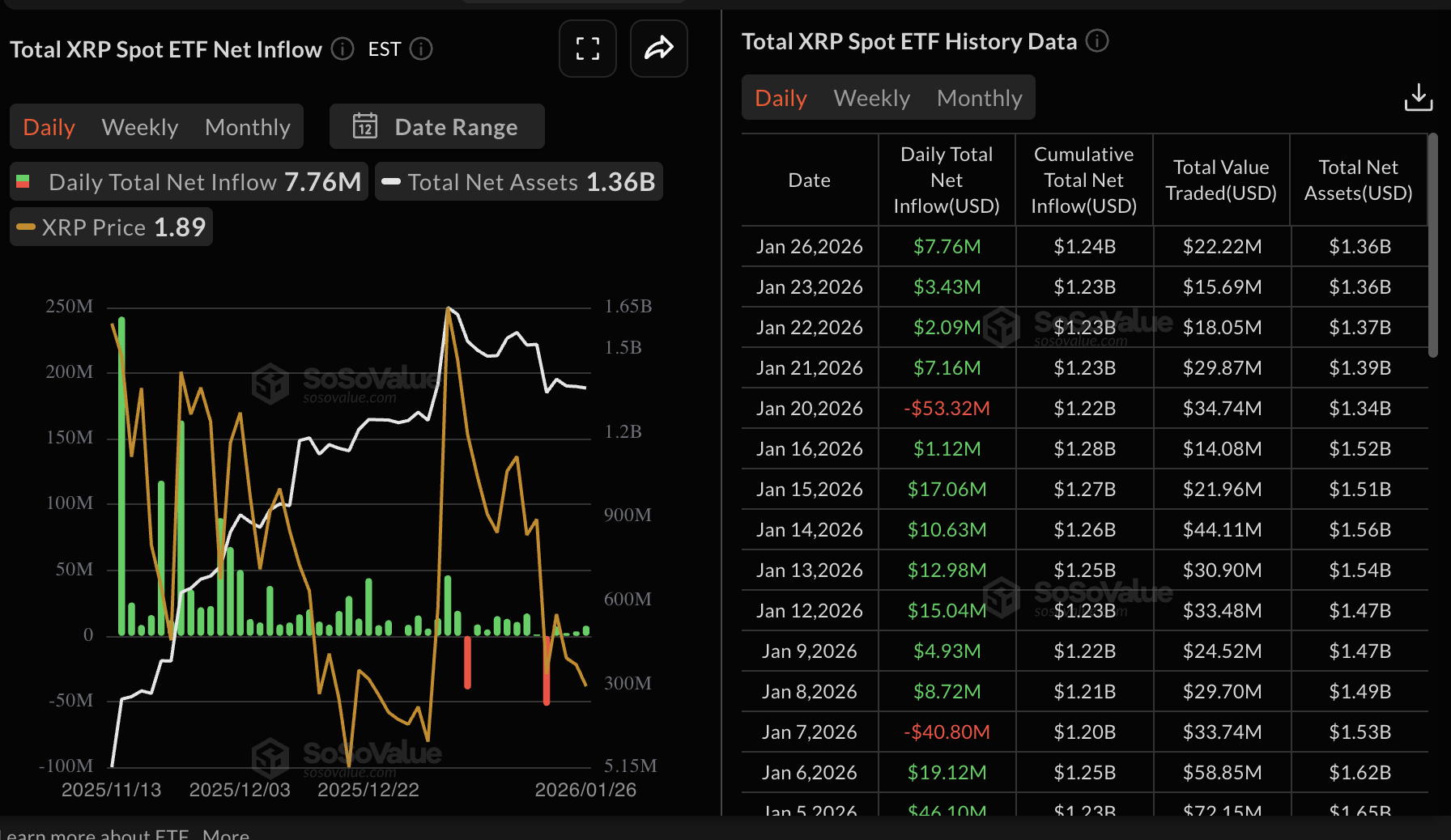

Meanwhile, XRP continues to attract sustained ETF interest with a four-day inflow streak. Data by SoSoValue shows that XRP spot ETFs drew nearly $8 million in inflows on Monday. The cumulative total inflow now stands at $1.24 billion, and net assets at $1.36 billion. Bitwise’s XRP ETF outpaced the rest of the products with an inflow of about $5.3 million.

Chart of the day: Bitcoin retests support

Bitcoin remains largely in bearish hands despite a sharp rebound on Monday to a high of $88,860. The area at $88,000 provides immediate support, but the downward-trending Relative Strength Index (RSI), which holds at 41 on the daily chart, suggests that bearish pressure could extend.

Closing below $88,000 is likely to encourage investors to reduce their risk exposure, as the Moving Average Convergence Divergence (MACD) indicator is below its signal line. Histogram bars expanding below the zero line hinge on the increasing bearish momentum.

As downs risks emerge, the odds of Bitcoin sliding to test Sunday’s low at $86,075 and the support on December 18 at $84,450 would increase significantly. Conversely, a push above the psychological hurdle at $90,000 could build interest in Bitcoin. Looking ahead, the 50-day Exponential Moving Average (EMA) caps the upside at $91,358, the 100-day EMA at $94,808 and the 200-day EMA at $98,528.

Altcoins technical outlook: Risk-sentiment deepens as Ethereum, XRP falter

Ethereum edges lower, testing support at $2,900 at the time of writing on Tuesday while extending its multi-month downtrend. The leading altcoin remains under pressure below the 50-day EMA, which acts as immediate resistance at $3,100, followed by the 100-day EMA at $3,234 and the 200-day EMA at $3,305.

The RSI sits at 41 on the daily chart, heading toward oversold territory, as bearish momentum builds. The MACD line further reinforces the bearish outlook on the same chart, as it remains below the signal line.

Ethereum could extend its down leg to test the Sunday's low at $2,787, weighed down by the histogram printing expanding red bars below the zero line. Persistent downward pressure could see ETH drop toward support at $2,624, tested on November 21.

As for XRP, bears have the upper hand, capping price movement below the $2.00 psychological threshold. The cross-border remittance token is trading at $1.88 at the time of writing on Tuesday amid bearish signals.

After the RSI rose to 43 on Monday, it has declined to 41 on the daily chart, emphasizing that sellers remain in control. The MACD line on the same chart edges lower below the signal line amid lingering losses toward the support at $1.81, which was last tested on Sunday, and to April’s low at $1.61 if selling intensifies.

Still, if the bearish outlook eases and XRP decisively breaks above the $2.00 mark, the path of least resistance could shift upward. Also, investors should temper their expectations until the 50-day EMA turns into support at $2.02, and expands the scope on the upside to the 100-day EMA at $2.15 and the 200-day EMA at $2.38.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.