Pi Network Price Forecast: PI rebounds on creator event, PI payments updates

- Pi Network is up over 3% on Thursday, reversing upwards after Wednesday’s Doji candle broke a six-day declining trend.

- Pi Network announces a creator event and new updates to support easy Pi payment integration, aiming to expand access to app creation

- PiScan data shows a surge in token withdrawal crossing 1 million PI over the last 24 hours, signaling reduced selling pressure.

Pi Network (PI) recovers by over 3% at press time on Thursday, after a steady declining trend. The rebound aligns with the announcement of new updates to the network, including the integration of PI payments and a community-centered creator event. Investors removing over 1 million PI tokens from Centralized Exchanges (CEXs) adds to the easing in supply pressure.

Retail demand strengthens amid Pi Network plans to boost ecosystem

Pi Network announced plans on Wednesday to boost the ecosystem, including a creator event, integration of the PI payments system into apps built on the network, and extended access to app creation. However, the PI payments support is limited to Test-Pi, and new or non-migrated Pioneers can now deploy app iterations by watching ads instead of paying fees. The ad-supported application building on Pi App Studio could reduce the financial burden of creating Pi applications.

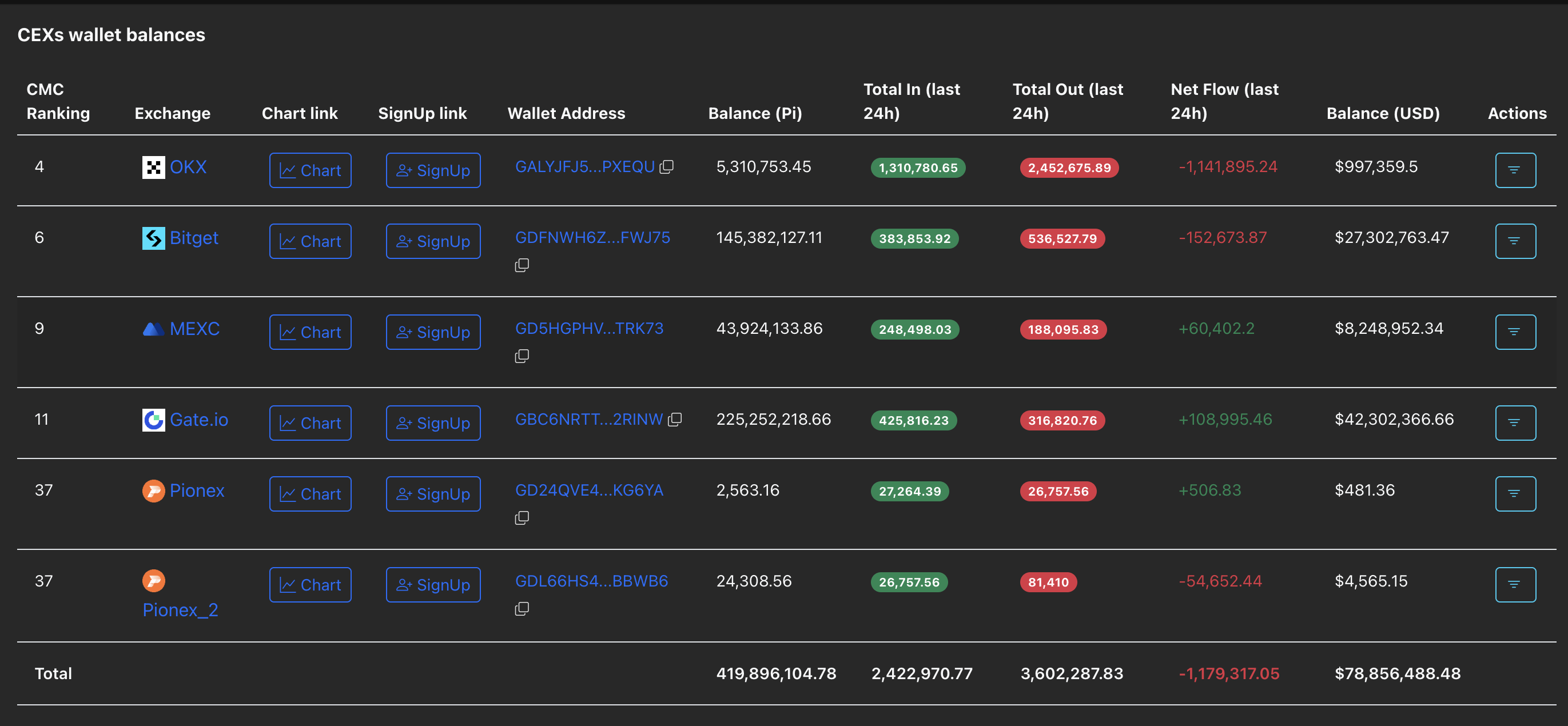

Meanwhile, the announcement is warming up the retail demand. PiScan data shows that the users have removed 1.17 million PI tokens from CEXs over the past 24 hours, reducing their wallet reserves and selling pressure.

Technical outlook: Will Pi Network resurface above $0.20?

Pi Network's sudden recovery of over 3% so far on Thursday reduces this week’s loss to under 7%. Still, the rebound on the back of new updates remains under intense pressure from the prevailing downtrend.

PI should sustain a decisive close above the $0.1919 support-turned-resistance level, marked by the October 11 low, to further extend the rally, potentially targeting the December 19 high at $0.2177.

Technical indicators on the daily chart suggest a minor relief from consistent bearish momentum. The Relative Strength Index (RSI) is pointing upwards at 32 and recovering from the oversold zone, while the Moving Average Convergence Divergence (MACD) extends below the signal line but red histogram bars contract.

However, a potential reversal would shift PI into the support discovery phase with a deeper zone present between the October 10 and January 19 lows at $0.1533 and $0.1502, respectively.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.