Monero (XMR) Price Drops 20% Below $500: Warning Sign or Strategic Pullback?

Monero’s price has faced a sharp pullback, triggering concern across the market. XMR dropped nearly 20% in a single day, briefly slipping below the $500 level.

The sudden move sparked panic among short-term traders. However, current data suggests the decline may represent a corrective reset rather than a trend reversal.

Monero Appears Safe From Further Selling

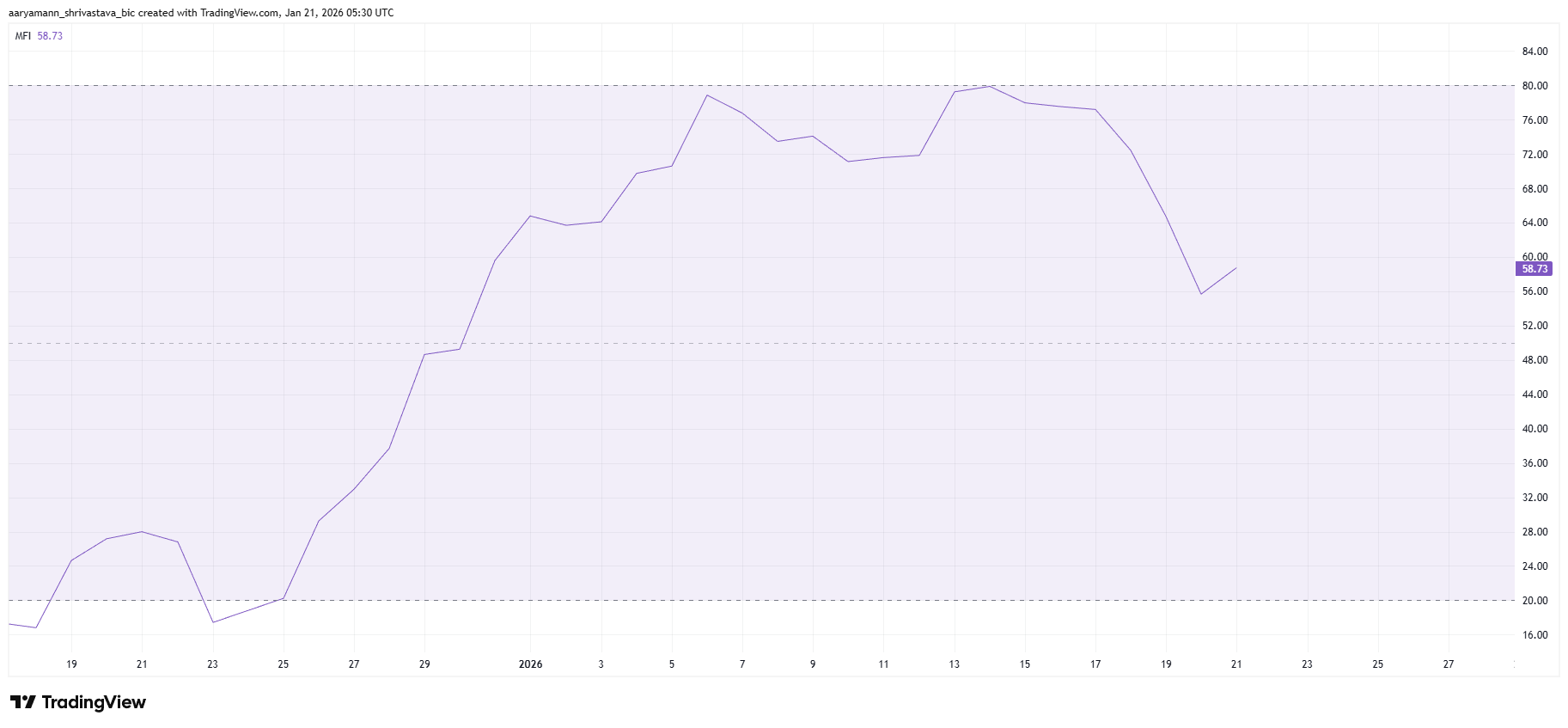

Despite the aggressive sell-off, XMR holders haven’t rushed for the exits. On-chain signals show selling pressure remains relatively muted. The Money Flow Index has pulled back, reflecting cooling buy-side momentum, but it’s still holding above the neutral 50 level — a key tell that bears haven’t seized control.

Because the MFI blends price and volume, staying in positive territory implies demand still outweighs distribution. For XMR, this points to post-rally exhaustion rather than structural weakness. Holder behavior remains disciplined, helping prevent a cascade lower.

Monero MFI. Source: TradingView

Monero MFI. Source: TradingView

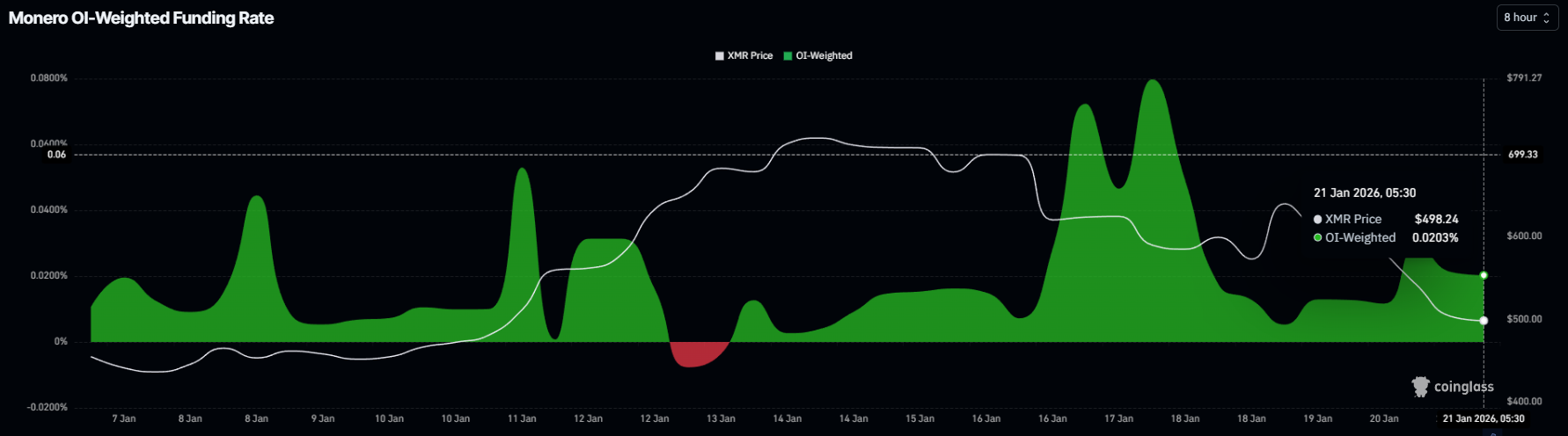

Derivatives data adds context. Open Interest dropped 20.8% over the past 48 hours, sliding from $624 million to $494 million. On the surface, that looks bearish. In reality, it more likely reflects a leverage flush as overextended longs got shaken out.

More importantly, XMR’s funding rates stayed positive throughout the drop. That means longs are still dominant, and traders are paying to stay positioned for upside. This bias suggests the market is leaning toward stabilization and recovery rather than continuation lower.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XMR OI and Funding Rate. Source: Glassnode

XMR OI and Funding Rate. Source: Glassnode

XMR Macro Outlook Looks Bullish

Analyst Matthew Hyland pointed to XMR’s decade-long ascending triangle. Price has consistently respected a rising diagonal support dating back to the 2016–2017 cycle, printing higher lows and maintaining a long-term bullish structure.

A major horizontal zone sits in the $400–$500 range, where price has historically stalled. Current price action shows XMR rotating back into this area, increasing pressure on sellers and setting the stage for a potential higher-timeframe move.

“IMO $10k–$125k over the next 5–20 years,” Matthew said, outlining his long-term outlook for XMR.

Monero Price Macro Outlook. Source: Matthew Hyland

Monero Price Macro Outlook. Source: Matthew Hyland

If XMR price can hold and bounce within this region, it would reinforce bullish continuation. A clean loss of this zone, however, could mean prolonged consolidation or a deeper retrace toward the rising trendline in the $200–$300 area before the next major impulse.

XMR Price Recovery Is The Likely Next Step

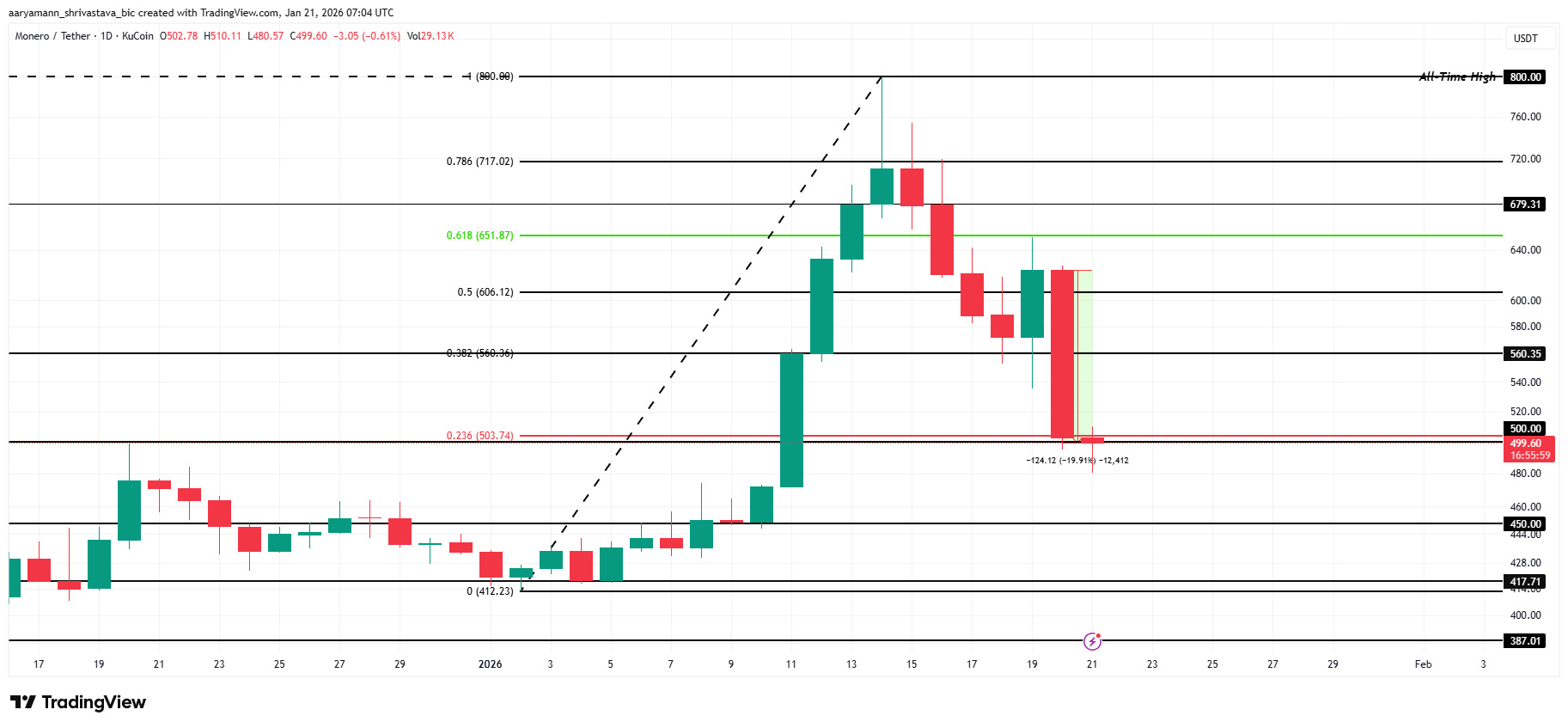

At the time of writing, Monero trades around $499 after shedding roughly 20% in the last 24 hours. The sell-off pushed the price below the 23.6% Fibonacci retracement, often viewed as a bear-market floor. Losing it warrants caution, but context matters.

A quick reclaim and hold above $500 would neutralize much of the downside risk. With no signs of aggressive distribution and longs still in control, a rebound remains likely. If buyers step back in, XMR could grind higher toward $560, with $600 back on the radar if momentum builds.

Monero Price Analysis. Source: TradingView

Monero Price Analysis. Source: TradingView

The bullish setup breaks if sentiment flips. An increase in profit-taking could pressure the XMR price lower. In that case, $450 becomes the next key support. Losing it would invalidate the recovery thesis and expose XMR to a deeper move toward $417, signaling a broader corrective phase.