XRP: 600 Million Token Influx As Whales Make Their Presence Felt

The cryptocurrency market continues to grapple with volatility, and XRP has been no exception. After a promising start to the year, the price of XRP has mirrored the broader market slump triggered by Bitcoin’s correction. However, amidst the bearish sentiment, a different story is unfolding underwater – one involving deep-pocketed investors, or “whales,” accumulating the altcoin at a significant clip.

XRP Whales Accumulate Millions Despite Price Drop

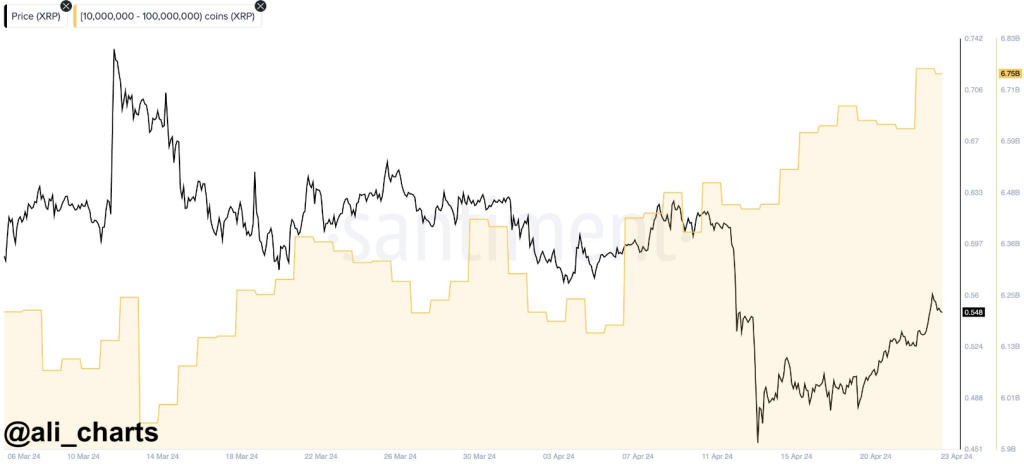

While the price of XRP has dipped considerably from its highs in March, whale addresses have been quietly going on a buying spree. According to data from market intelligence platform Santiment, analyzed by market researcher Ali Martinez, addresses holding between 10 million and 100 million XRP have been steadily adding to their holdings since early April.

This buying frenzy intensified after XRP’s sharp price drop in mid-April, with whales capitalizing on the lower prices in a classic “buy-the-dip” strategy.

$XRP dropped from $0.62 to $0.41, and #crypto whales took notice. They’ve bought over 31 million #XRP in just the past week! pic.twitter.com/3FCA3PR3hi

— Ali (@ali_charts) April 23, 2024

The data reveals that these whales have scooped up a staggering 30 million XRP tokens in the past week alone, bringing their cumulative holdings to a hefty 6.75 billion units. This buying spree indicates a potential shift in sentiment among these large investors, who seem unfazed by the short-term price fluctuations and might be betting on XRP’s long-term prospects.

Deeper Dive: Whale Activity Hints At Bullish Sentiment

Taking a deeper dive, latest data suggests that this accumulation trend began even earlier, on April 5th. Interestingly, this coincides with the tail end of a selling period by these same whales, where they offloaded some of their holdings.

However, since April 5th, the buying spree has been relentless, with whales amassing over 600 million XRP in just two weeks. This significant accumulation suggests a renewed confidence in XRP, potentially signaling a bullish outlook from these key market players.

Further bolstering this notion is the recent surge in the number of addresses holding at least 1 million XRP. These “mid-tier whales” have been steadily increasing, with their ranks reaching a near-record high of 2,013 on Tuesday. This broader participation from various tiers of large investors adds weight to the idea that XRP might be undervalued at its current price point.

XRP Outperforms Other Altcoins

The price of #XRP has jumped ahead of the #altcoin pack, jumping 6% and as high as $0.5687 today. The amount of wallets, 2,013, holding at least 1M $XRP has been surging over the past six weeks (rising 3.1%), and is within 1 wallet of the #AllTimeHigh. https://t.co/2ZfC9v79x9 pic.twitter.com/rqKgcOYJJx

— Santiment (@santimentfeed) April 22, 2024

Meanwhile, Santiment disclosed that XRP is outpacing the other altcoins in terms of wallet size. Wallets holding 1 million or more coins have increased, with a 3% gain over the last six weeks. The increase of significant XRP holdings indicates that investors’ interest and confidence are rising.

While whale activity can be a significant indicator of sentiment, it shouldn’t be the sole factor driving investment decisions. However, the recent buying spree by XRP whales is a noteworthy development, suggesting a potential shift in sentiment and a possible turning point for the coin’s price.

Featured image from Pixabay, chart from TradingView