Crypto market dips, wiping out over $800 million in liquidations as the EU–US trade war triggers risk-off sentiment

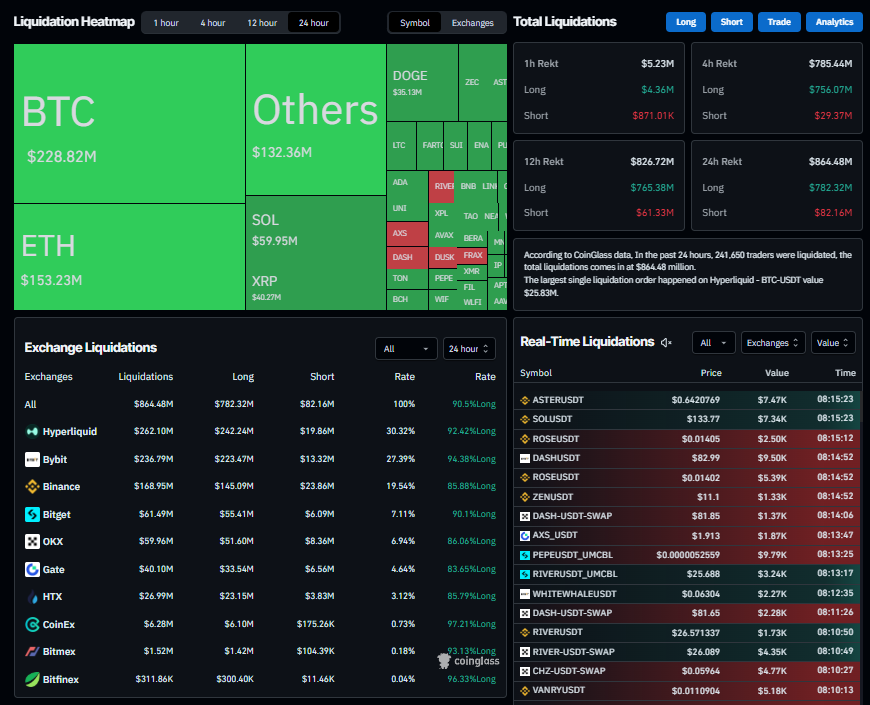

- CoinGlass data shows that over $800 million in leveraged positions were liquidated across crypto markets in the past 24 hours.

- Risk-off sentiment intensifies as EU capitals consider imposing tariffs of up to $101 billion on the US in response to President Trump’s threats.

- These liquidations were 90.5% long, and the largest single liquidation was a $25.83 million BTCUSD order on Hyperliquid.

The cryptocurrency market experienced a sharp correction on Monday, with total liquidation surpassing $800 million in the past 24 hours. The main reason for this price dip is the rising risk-off sentiment among traders amid growing trade-war tensions between the European Union (EU) and the United States of America (US).

Rising trade frictions curb appetite for risk assets

Crypto markets begin the week on a negative note, with Bitcoin (BTC) sliding below $93,000 on Monday and major altcoins such as Ethereum (ETH), Solana (SOL), and Cardano (ADA) following BTC’s lead. The downturn in crypto markets followed the US-EU trade tensions.

US President Donald Trump said he would slap tariffs on eight European nations that have opposed his plan to take Greenland. Trump announced a 10% tariff on goods from countries including Denmark, Sweden, France, Germany, the Netherlands, Finland, the United Kingdom (UK), and Norway, starting on February 1, until the US is allowed to buy Greenland.

According to a Financial Times report on Sunday, EU capitals are considering imposing €93 billion ($101 billion) in tariffs on the US or restricting American companies' access to the bloc’s market in response to Donald Trump’s threats.

These growing trade tensions triggered risk-off sentiment among traders, which does not bode well for risky assets such as crypto. The move sparked a wave of liquidations across the market, wiping out over $800 million in leveraged positions, according to Coinglass data.

Notably, 90.5% were long positions, underscoring the market’s overly bullish positioning. The largest single liquidation occurred on Hyperliquid, where a BTCUSDT position worth $25.83 million was liquidated.

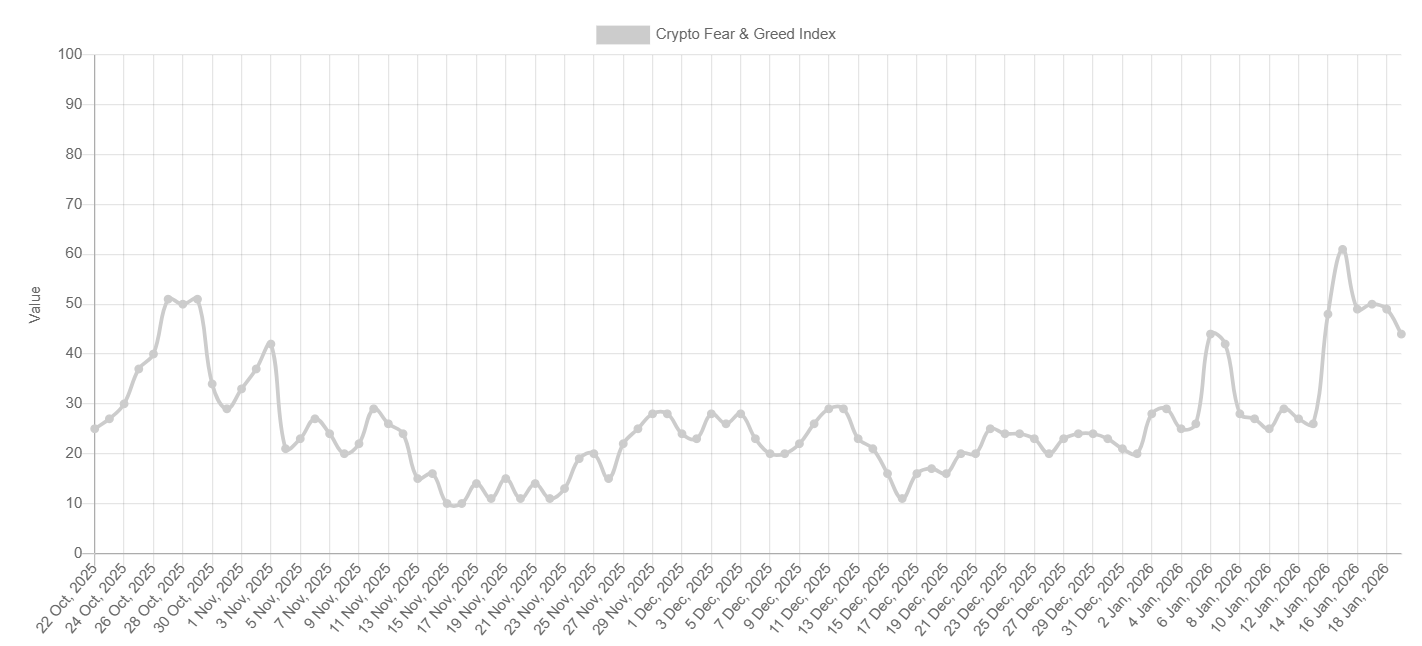

The Fear and Greed Index drops to 44 on Monday from Thursday’s high of 61, signaling a shift from optimism toward more cautious market sentiment.