After the Golden Globes, Polymarket’s Near-Perfect Accuracy Raised Eyebrows

Polymarket users placed 27 bets on the outcomes of the Golden Globe Awards, with 26 of them turning out to be correct. As the leading prediction market grows in popularity, so do concerns over insider trading.

The partnership between Polymarket and the Golden Globes also raised questions about whether this will be the new normal for future awards ceremonies.

Polymarket Posts 96% Golden Globes Hit Rate

On Friday, the Golden Globes announced in a press release that it had partnered with the world’s largest prediction market for the annual awards show.

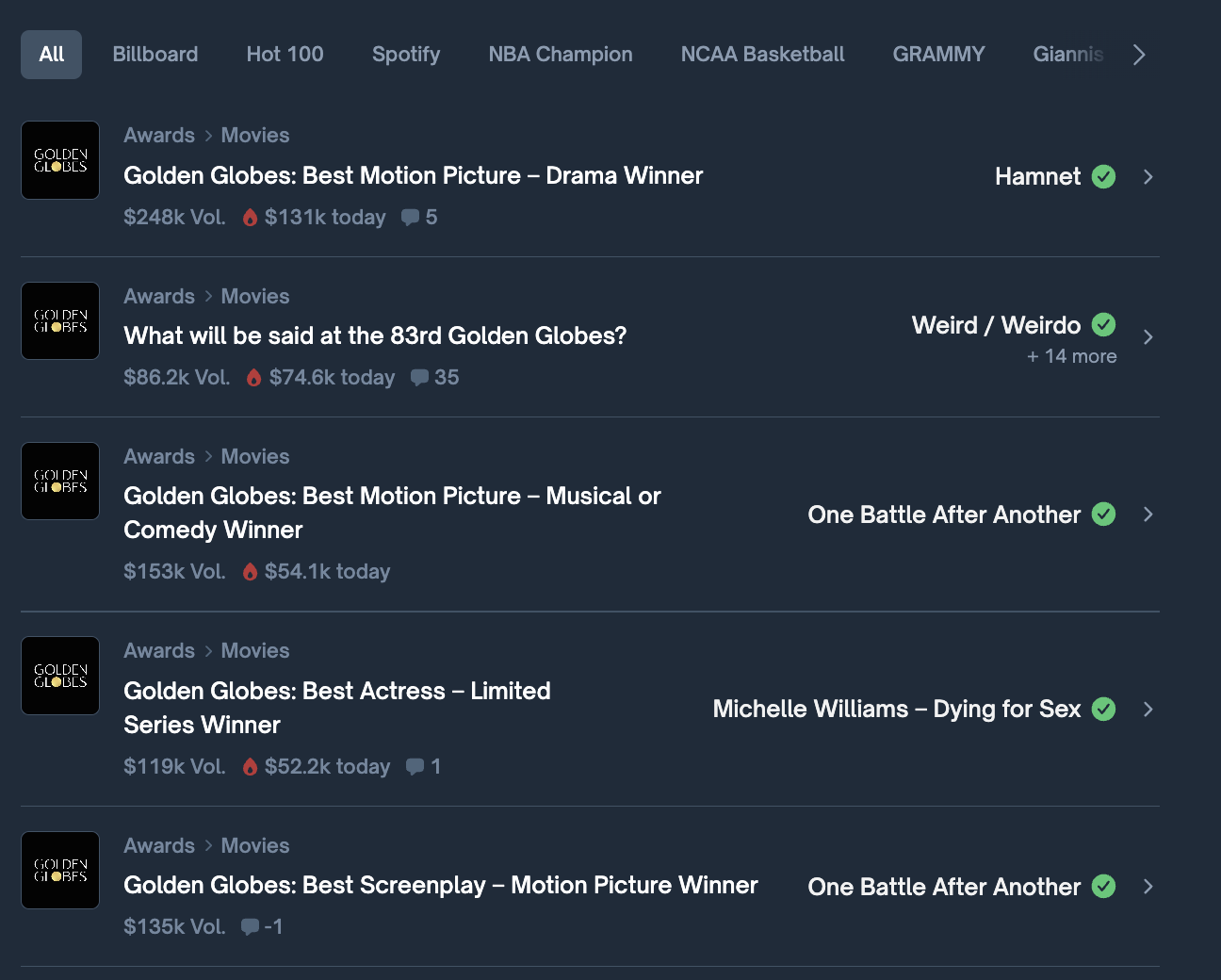

That same day, Polymarket created 28 Golden Globe-specific polls, with 27 of them exclusively focused on the outcomes of the various categories at stake.

In just three days, millions of users flocked to the platform to place their wagers on who this year’s winners would be. Polls ranged from Best Motion Picture to Best Podcast, with some trading volumes exceeding $275,000. In total, contracts amassed at least $2.5 million in bets.

Polymarket saw a surge in Golden Globe-related polls ahead of the awards ceremony. Source: Polymarket.

Polymarket saw a surge in Golden Globe-related polls ahead of the awards ceremony. Source: Polymarket.

On Sunday, the ceremony unfolded as expected. By the end of the night, onstage winners weren’t the only ones leaving with trophies.

Polymarket bettors had reason to celebrate too, with the platform correctly calling 26 of 27 categories, a 96% hit rate.

The only betters left to lick their woes were those who placed their money on Sean Penn as best supporting actor instead of Stellan Skarsgard, who won for his performance in Sentimental Value.

The last-minute partnership surprised many observers. Moreso, the outcomes drew renewed attention to concerns about potential insider trading on these loosely regulated platforms.

Trust Questions Grow Around Event Contracts

Though 2026 is only two weeks in, a series of events related to prediction market polls has raised several eyebrows.

On Wednesday, a controversy born out of the White House press room took place after Secretary Karoline Leavitt concluded her daily briefing at approximately 64 minutes and 30 seconds, just shy of the 65-minute mark that prediction market Kalshi had set as a betting threshold.

At the time, the market showed a 98% probability that the briefing would exceed the 65-minute mark. Traders who bet against this outcome saw returns of up to 50 times their investment within seconds.

The event quickly generated concern over potential insider trading. However, Kalshi later dismissed these claims as baseless, given that the poll saw a low trading volume.

Nonetheless, these concerns have fresh precedents that are hard to shrug off.

On January 3, just hours before the US announced it had captured and extradited Venezuela’s Nicolás Maduro, one Polymarket trader made over $400,000 by betting he would be removed from power before the end of the month.

Polymarket has also attracted politically connected capital. According to Axios, in 2025, the company announced that it had received an investment from 1789 Capital, a venture firm affiliated with Donald Trump Jr., who also joined its advisory board.

Taken together, these episodes have also drawn attention to the growing overlap between crypto and prediction markets.

Crypto Flows Rise With Betting Volumes

Polymarket is closely tied to on-chain rails. Users can transfer funds across various networks, including Ethereum, Polygon, Base, and Arbitrum, and deposit assets such as USDT and USDC.

As betting activity grows, demand for stablecoins in particular is likely to rise with it, pushing them further into the award betting scene.

With the Oscars roughly two months away, the Golden Globes outcome raises questions about whether similarly accurate prediction markets will become a familiar feature in future award shows.

The Academy Awards have not yet announced any partnership of the sort. Regardless, Polymarket has listed polls on category outcomes.

Among the 22 polls currently available, trading volumes range from $112,000 to $8 million.