Ripple’s UK License Quietly Changed XRP’s Positioning

When Ripple announced its new UK approvals from the Financial Conduct Authority (FAC) today, most of the community focused on the headline – another regulatory win. XRP’s price barely moved, and the news cycle moved on.

But inside the wording of Ripple’s press release sits a much more important story for XRP holders.

A Big Win For XRP that Went Unnoticed

On paper, Ripple just got permission to exist in the UK. But it’s more critical than that. Ripple actually secured the legal ability to operate a full digital-asset payment stack inside one of the world’s strictest financial systems.

Now, that changes how XRP can be used by institutions in ways that markets do not price in overnight.

The key line was that UK institutions can now send cross-border payments “using digital assets” through Ripple’s licensed platform. Ripple then explicitly reminded readers that its infrastructure runs on XRPL, where XRP is the native asset for settlement.

This matters because regulated financial firms do not care about crypto narratives. They care about compliance, counterparty risk, and operational simplicity.

So, the EMI licence and crypto registration give Ripple the ability to handle the regulated fiat side of transactions in the UK. That removes one of the biggest barriers to crypto settlement adoption – the banking rails.

When those rails work smoothly, XRP can quietly do what it was designed to do.

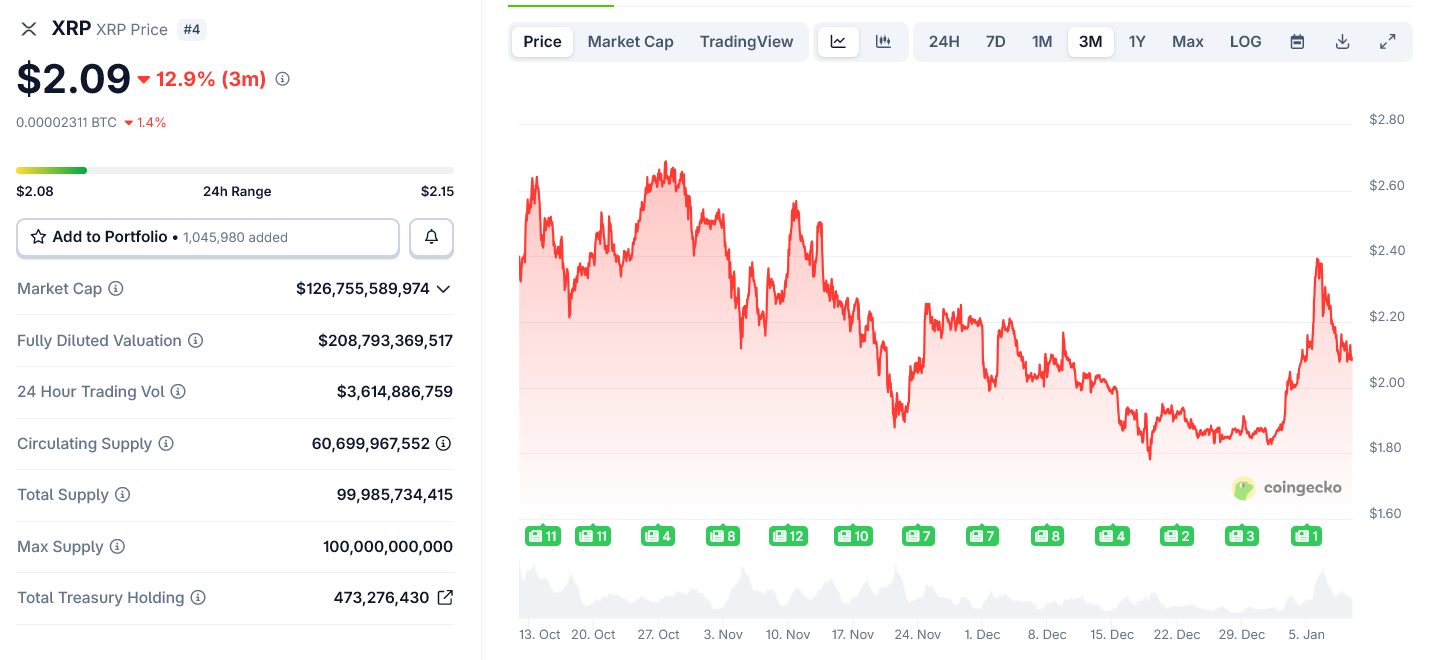

XRP Price Chart Over the Last 3 Months. Source: CoinGecko

XRP Price Chart Over the Last 3 Months. Source: CoinGecko

Why This Matters for XRP, Not Just Ripple

Most banks and payment firms do not directly interact with blockchains. They want a regulated intermediary that abstracts that complexity away. Ripple Payments now does exactly that in the UK.

Once funds enter Ripple’s licensed system, Ripple can choose the most efficient settlement method available.

Sometimes that will be stablecoins or direct fiat rails. But in corridors where speed, cost, and liquidity matter, XRP becomes a natural bridge asset.

The licence gives Ripple legal control over more of the payment flow. That means fewer partners, fewer compliance roadblocks, and fewer technical excuses not to route value through XRPL.

This is why the announcement included Ripple Prime, custody, clearing, FX, and even fixed-income services.

Ripple is building an institutional pipeline where digital assets move inside regulated finance, not outside it. XRP sits inside that pipeline.

Overall, this approval enables XRP to be used in UK-originating corridors, but traders will only react when Ripple starts onboarding banks, moving flows, and settling value on XRPL.

When that happens, XRP demand shows up as liquidity needs.

That is the kind of utility that takes time to build and is rarely obvious when the paperwork gets signed.