Pi Network Price Forecast: PI holds key support as momentum coils

- Pi Network holds above key psychological support and the 20-day SMA despite a decline of nearly 2% so far this week.

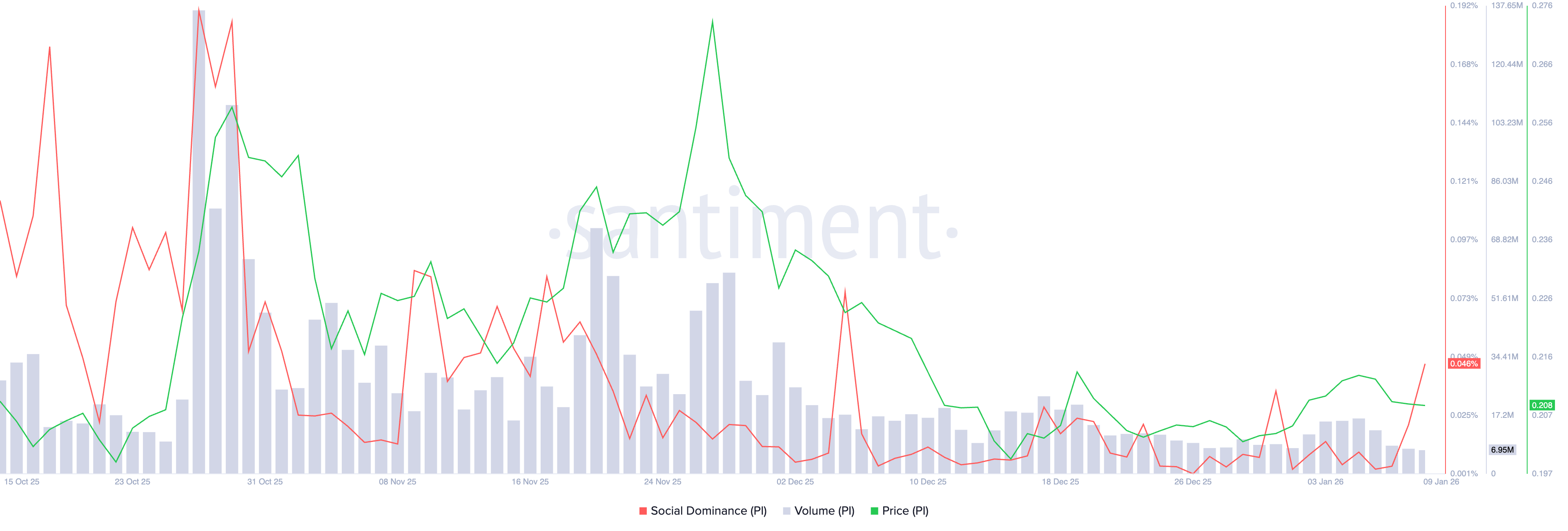

- A steady decline in volume and a largely sideways OBV indicator suggests dormant demand despite a surge in social dominance.

- The technical outlook is mixed for PI as trend momentum wanes.

Pi Network (PI) trades close to $0.2100 at press time on Friday, stabilizing after a two-day decline of nearly 2%. The PI token's trading volume steadily declines, while a surge in social dominance suggests a potential spike in retail interest. The technical outlook for PI remains mixed as the Bollinger Bands squeeze, suggesting a breakout on either side.

Social dominance surge could fuel retail demand

Sanitment data shows that the social dominance of PI is up to 0.046%, from 0.004% on Wednesday, indicating a rise in social buzz surrounding Pi Network. A steady increase could lead to a spike in retail interest, fueling the next recovery run.

Pi Network’s hold at key moving averages risks further decline

Pi Network trades above the 20-day Simple Moving Average (SMA) at $0.2068 on the daily chart, following a mild correction earlier this week. The PI token is broadly stabilizing above the $0.2000 level as the Bollinger Bands squeeze, suggesting a sideways shift and coiling momentum.

Additionally, the Squeeze Momentum indicator, which tracks periods of low volatility before a directional move, has flipped from red bars to green, indicating a bullish shift.

On the other hand, a declining trend in the trading volume and a sideways trend in the On Balance Volume (OBV) indicator suggest a phase of dormant demand. In short, the technical indicators suggest the shift in bullish momentum lacks strength.

To reinstate an upward trend, PI should cross the December 19 high at $0.2177 with a decisive daily close, which could extend the rally to the R1 Pivot Point at $0.2321.

If PI slips below $0.2068, it could threaten the $0.2000 psychological support, potentially extending the decline to the S1 Pivot Point at $0.1835.