Top Crypto Gainers: Midnight, Humanity Protocol, MYX Finance sustain upward trends

- Midnight holds 9% gains from Monday, with bulls aiming for $0.10.

- Humanity Protocol is up nearly 3% on Tuesday, marking its fourth straight day of gains.

- MYX Finance steadies after a nearly 4% jump on Monday amid rising buying pressure.

Midnight (NIGHT), Humanity Protocol (H), and MYX Finance (MYX) sustain an upward trend, emerging as top gainers over the last 24 hours. Midnight and Humanity Protocol extend their recovery, while MYX Finance inches toward a bullish flip in the Supertrend indicator.

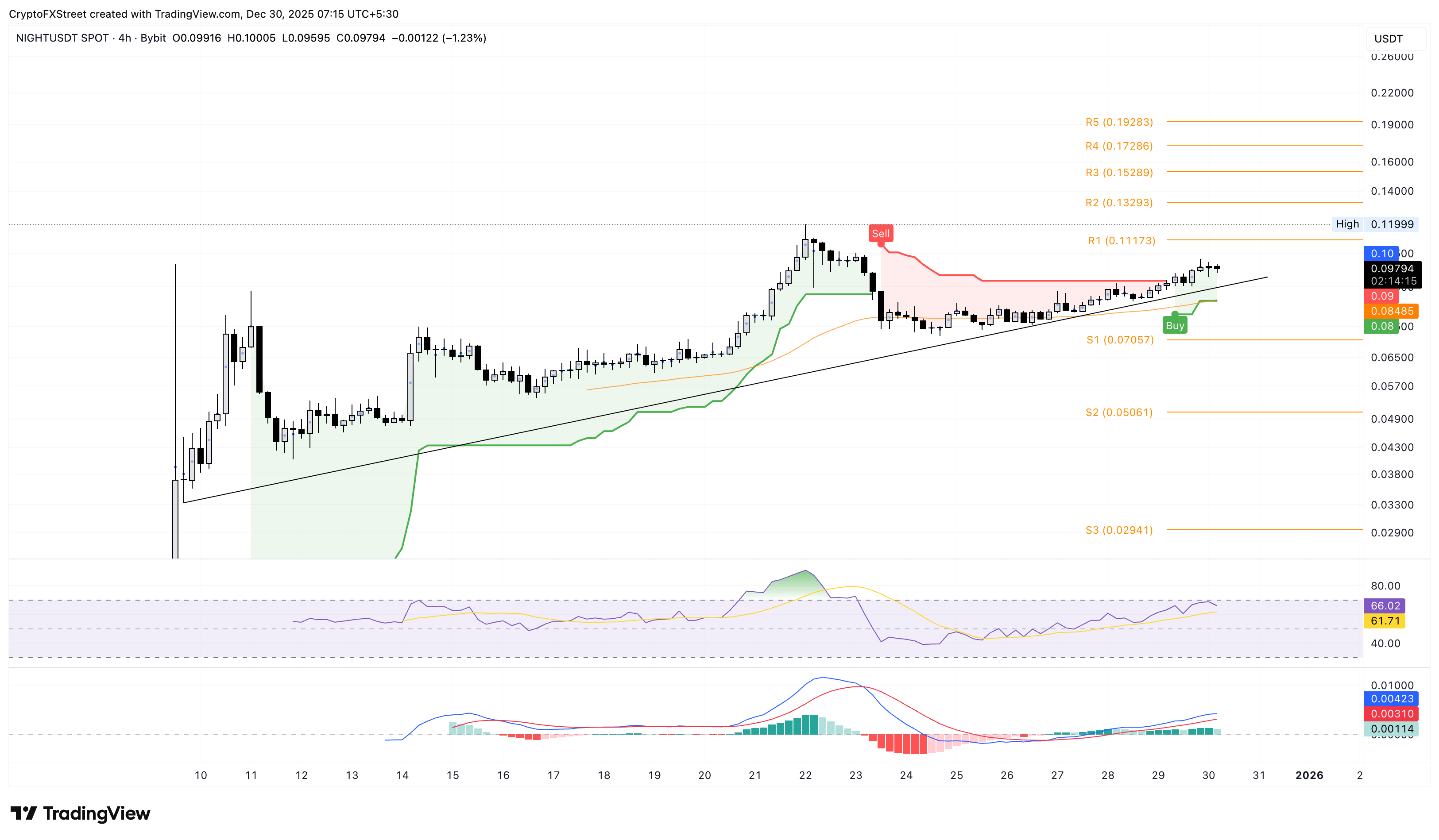

Midnight extends its recovery run, eyeing $0.10

Midnight holds steady above $0.095 at press time on Tuesday, following a 9% jump on Monday. The bullish start to the week crossed the Supertrend indicator line near $0.093, triggering a buy signal and a fresh bull cycle.

If the NIGHT token reclaims $0.100, it could aim for the R1 Pivot Point at $0.117, followed by its record high of $0.119 from December 22.

The Relative Strength Index (RSI) at 66 on the 4-hour chart indicates intense buying pressure. Additionally, the Moving Average Convergence Divergence (MACD) indicates a steady upward trend, suggesting persistent bullish momentum.

Looking down, a potential flip below $0.090 could extend the decline to the 50-period Exponential Moving Average (EMA) at $0.0848.

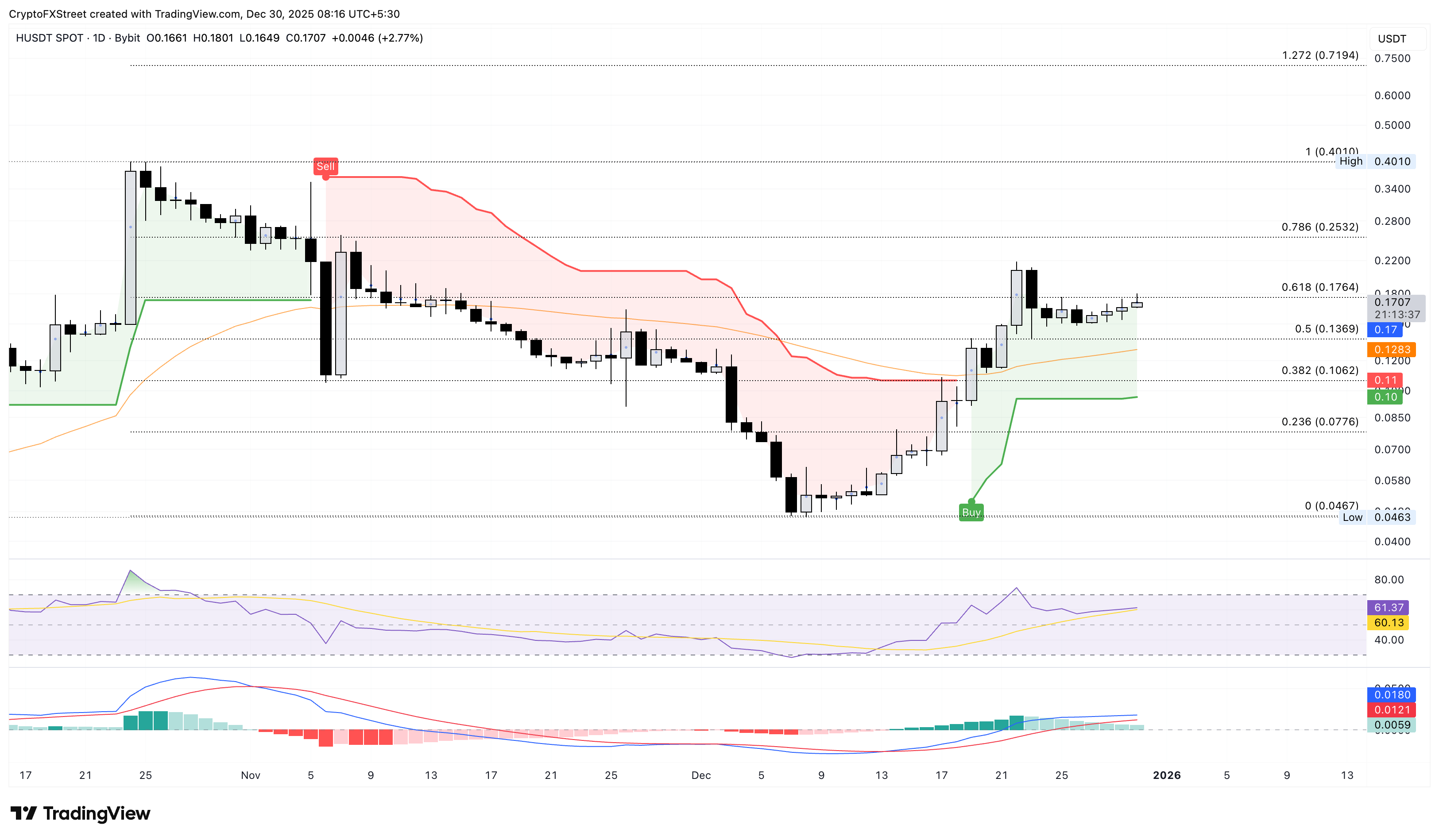

Humanity Protocol’s reversal hits key resistance

Humanity Protocol reverses upward from $0.1500, marking its fourth consecutive day of gains. At the time of writing, Humanity Protocol is up nearly 3% on Tuesday, aiming to surpass the 61.8% Fibonacci retracement level at $0.1780, ranging from the October 24 high of $0.4010 and the December 7 low of $0.0467 on the daily logarithmic chart.

A decisive close above this level could extend the rally to the 78.6% Fibonacci retracement level at $0.2532.

The RSI at 61 maintains a broad upward trend on the daily timeframe, indicating sustained bullish pressure. However, the MACD on the same chart risks crossing below the signal line, threatening a bearish flip in trend momentum.

If Humanity Protocol reverses from $0.1764, it could retest the 50% Fibonacci retracement level at $0.1369.

MYX Finance inches closer to a fresh bullish trend

MYX Finance trades above $3.50 at press time on Tuesday after a nearly 4% rise on Monday. At the time of writing, MYX is on the verge of crossing the Supertrend indicator at $3.62, which would trigger a renewed uptrend and a buy signal.

The immediate resistance for the MYX recovery lies at $4.46, marked by the October 5 low.

The RSI at 61 approaches the overbought zone, suggesting a rise in buying pressure. At the same time, the MACD continues to rise with green histogram bars after crossing the signal line on Friday, indicating a boost in bullish momentum.

On the flip side, the 50-day EMA at $3.25 could serve as the immediate support.