TradingKey 2025 Markets Recap & Outlook | Bitcoin Price Repeatedly Hits New Highs Last Year, 2026 Can BTC Write Another Legend?

TradingKey - In 2025, the U.S. frequently released positive news, including Federal Reserve interest rate cuts, the establishment of Bitcoin (BTC) strategic reserves, a change in SEC chairmanship, the passage of a stablecoin bill, and the overturning of the Biden administration's crypto regulatory policies, among other factors, stimulating bitcoin price to surge and continuously reach new all-time highs, proudly surpassing the $120,000 mark, outperforming all others.

With the arrival of 2026, it signifies the market will enter a four-year cycle bear market, leading investors to worry about a potential crash in Bitcoin prices. However, many Wall Street institutions, particularly some investment banks, believe that the cryptocurrency market's four-year cycle has become invalid and that Bitcoin prices will reach new highs again. Nevertheless, has the crypto four-year cycle become obsolete? Will Bitcoin prices plummet as they have in the past, or will they defy expectations and set new records? Let us wait and see what the next chapter holds for Bitcoin.

2025 Bitcoin Price: Continues to Hit New Highs

On January 20, 2025, coinciding with Donald Trump assuming office as the new President of the United States, Bitcoin's price surged 9% that day, approaching $110,000, surpassing historical highs from previous bull markets. However, Bitcoin's price rally was not sustained, subsequently declining by over 30% and reaching a low of approximately $74,000 on April 7, 2025.

Bitcoin Price Chart, Source: TradingView.

Bitcoin Price Chart, Source: TradingView.

On April 10, 2025, the U.S. Senate voted to confirm President Trump's nominee, Paul Atkins, as the new Chairman of the U.S. Securities and Exchange Commission (SEC), and Bitcoin's price skyrocketed over 10% that day, completely reversing the downtrend of the first half of the year. On April 22, the SEC announced that Paul Atkins had been sworn in as SEC Chairman, and Bitcoin's price again surged over 6% that day, further boosting market confidence.

From July to October 2025, Bitcoin's price repeatedly reached new all-time highs. On July 14, Bitcoin's price broke above $120,000 for the first time, rising to approximately $123,000; in August of the same year, Bitcoin's price surged again to $124,000, setting a new historical record; on October 6, Bitcoin's price rose to $126,000, establishing an all-time high.

What factors drive Bitcoin's price trend?

Over the past year, Bitcoin's price rally has primarily been driven by three categories of favorable factors: (1) market sentiment, including post-halving expectations and the bullish sentiment ignited by Trump's presidential election, primarily occurring in the first quarter; (2) regulatory and reserve policies, including stablecoin legislation, a change in SEC chairmanship, and the introduction of a series of new regulatory frameworks by the SEC, predominantly taking place in the second quarter; (3) economic policies, primarily driven by interest rate cuts from the U.S. central bank, the Federal Reserve, largely unfolding in the third quarter.

In 2024, Donald Trump made numerous cryptocurrency-related policy promises during his presidential campaign, which quickly ignited bullish market sentiment following his victory. Furthermore, historical data indicates that the year following a Bitcoin halving event typically sees a significant price surge, and 2025 happens to be the year after the fourth halving, leading to heightened market FOMO.

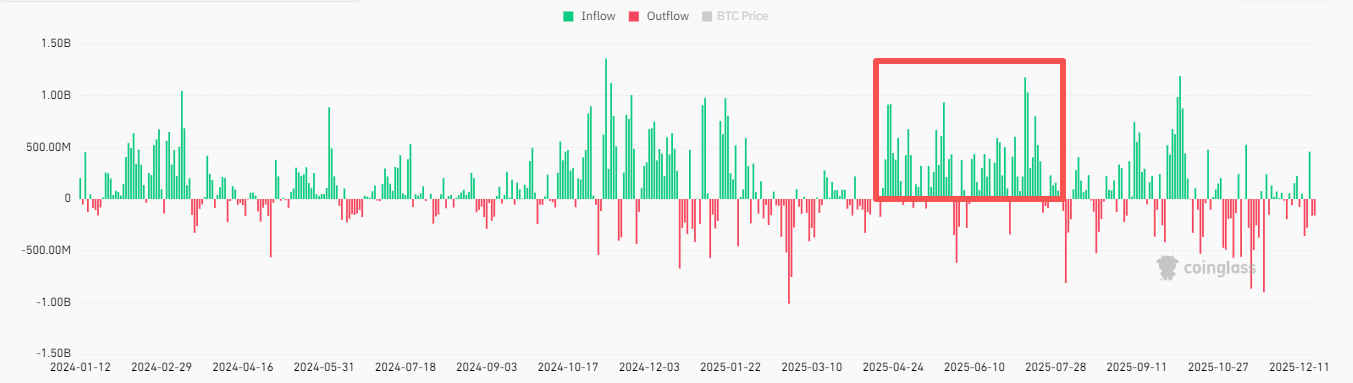

In the second quarter of 2025, Trump successively fulfilled his earlier promises, ending the hostile regulatory policies of the Biden administration and significantly improving the stance on cryptocurrency regulation. This included dismissing former SEC Chairman Gary Gensler, the SEC dropping charges against numerous crypto projects, establishing a crypto task force, building strategic Bitcoin reserves, and passing the GENIUS Act, as well as pardoning Changpeng Zhao and several other crypto figures. Driven by this series of policies, U.S. spot ETF inflows surged significantly, and numerous companies subsequently established Bitcoin treasuries, aggressively acquiring Bitcoin.

U.S. Bitcoin Spot ETF Flows, Source: Coinglass.

U.S. Bitcoin Spot ETF Flows, Source: Coinglass.

Although the Federal Reserve announced it would maintain interest rates at its May and June 2025 meetings, the market widely anticipated rate cuts to begin in the third quarter. As expected, the Federal Reserve initiated a 25-basis-point rate cut in September and continued with further cuts in October, pushing Bitcoin's price to an all-time high.

Is Wall Street actively bullish on Bitcoin price?

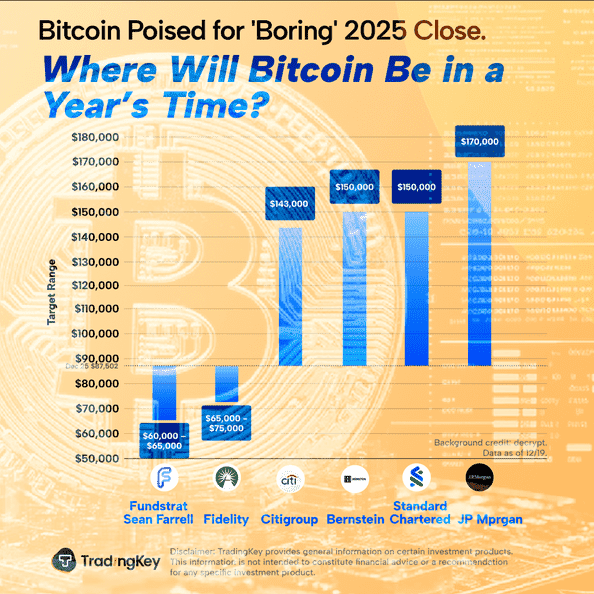

Currently, most institutions are bullish on Bitcoin, believing that the cryptocurrency bull market is not over yet and that Bitcoin prices will continue to rise, potentially even reaching new highs. Key proponents include J.P. Morgan, Bernstein, Bitwise, and Grayscale.

Both crypto asset management giants Grayscale and Bitwise believe that Bitcoin will break its traditional four-year cycle and reach new all-time highs. According to Matt Hougan, Chief Investment Officer at Bitwise, there are three primary drivers for Bitcoin's price increase: institutional capital inflow into Bitcoin spot ETFs, the adoption of cryptocurrencies by Wall Street and fintech firms, and improving regulatory policies.

Wall Street investment banks Bernstein and J.P. Morgan both believe that Bitcoin has broken its traditional four-year cycle, and that the crypto bull market is either not over or is currently in an extended bull cycle. Specifically, Bernstein predicts that Bitcoin's price will reach $150,000 in 2026, which is also the forecast price from Standard Chartered Bank.

Furthermore, Citi Bank believes that Bitcoin's price could rise to $143,000 in 2026, driven by the ETF capital influx and new regulations. J.P. Morgan's target price is even higher, anticipating Bitcoin to be close to $170,000 next year, with a key factor being MicroStrategy (MSTR), the largest corporate holder of Bitcoin.

However, not all Wall Street institutions are optimistic about Bitcoin's price performance in 2026. Notably, Morgan Stanley and Fidelity believe that the four-year crypto bull market has concluded. As early as November 2025, Morgan Stanley strategist Denny Galindo stated that Bitcoin was in the "autumn" phase of its four-year cycle, suggesting an impending winter and advising investors to lock in profits promptly in preparation for it.

In Fidelity's view, Bitcoin's rise to $125,000 in 2025 largely met expectations, but 2026 is likely to be a "dormant year" for Bitcoin. Jurien Timmer, Fidelity's Director of Global Macro, predicts that next year, Bitcoin's price support level will be between $65,000 and $75,000. Fundstrat is even more pessimistic, suggesting that Bitcoin's price could fall as low as $60,000.

Investment Bank | 2026 Bitcoin Price Forecast |

J.P. Morgan | $170,000 |

Bernstein | $150,000 |

Standard Chartered Bank | $150,000 |

Citi Bank | $143,000 |

Fidelity | $65,000-$75,000 |

Fundstrat (Sean Farrell) | $60,000-$65,000 |

What is the future price trend of Bitcoin?

From a fundamental perspective, the aforementioned positive factors for Bitcoin have largely materialized, including strategic Bitcoin reserves, a friendly regulatory environment, and the election of Trump as president. Although the Federal Reserve still has a rate decision to make, the market experienced a severe downturn after the December rate decision was announced this year. Furthermore, the dot plot indicates a weak signal for continued interest rate cuts in 2026, with a potential for rate hikes, which is clearly unfavorable for Bitcoin.

Next year, the United States will hold its midterm elections, and many may be optimistic about its impact on the crypto market. However, it is important to note that even if the Trump administration maintains its dominance, it is unlikely to introduce new initiatives or create a new narrative to attract capital inflows. Moreover, President Trump himself and his family's increasing involvement in cryptocurrencies have already drawn continuous criticism.

Currently, with positive factors largely materialized, global liquidity tightening, and a lack of new narratives, this could be the predicament Bitcoin faces in 2026. Under such unfavorable circumstances, Bitcoin may struggle to escape the fate of "history repeating itself" and could enter a new bear market, unless a new market paradigm shift emerges, such as the Federal Reserve continuing to inject liquidity, or, as the SEC Chairman stated, all U.S. assets being fully tokenized within two years.

From a technical analysis perspective, Bitcoin has strong support in the $75,000-$80,000 range. In the short term, it still has potential for a rebound, but its ceiling is the previous high of $125,000. Of course, should significant positive news or a new narrative emerge, Bitcoin could also break through its all-time high.

Bitcoin Price Chart, Source: TradingView.

Bitcoin Price Chart, Source: TradingView.

Conclusion

Multiple positive factors in 2025 propelled Bitcoin to new highs; however, many of these tailwinds have already been priced in. For 2026, Bitcoin faces challenges such as tightening liquidity, regulatory uncertainty, and monetary policy shifts. Wall Street's outlook on Bitcoin's future is divided, with target prices ranging from $65,000 to $170,000, indicating both the potential for new peaks and the risk of further corrections.