Canton Network (CC) Has Overtaken Top Coins As Price Hit 4-Week High

Canton Network price has surged sharply over recent weeks, capturing market attention with a near 40% weekly gain. The rally accelerated after Canton announced a strategic collaboration with The Depository Trust & Clearing Corporation earlier last week.

This development positioned CC at the center of institutional tokenization discussions, driving renewed investor interest.

Canton Network and DTCC Join Hands

DTCC and Canton Network confirmed a partnership last week to support the tokenization of assets custodied by The Depository Trust Company on the Canton Network. The initiative aims to enable compliant, privacy-enabled blockchain infrastructure for regulated financial institutions. This move highlights a shared commitment to advancing digital asset adoption.

The partnership highlights Digital Asset’s long-standing collaboration with DTCC on institutional-grade blockchain solutions. Market participants interpreted the announcement as a major validation of Canton’s architecture. As a result, demand for CC rose quickly, reflecting growing confidence in its role within regulated financial markets.

Canton Holders Outperform Chainlink

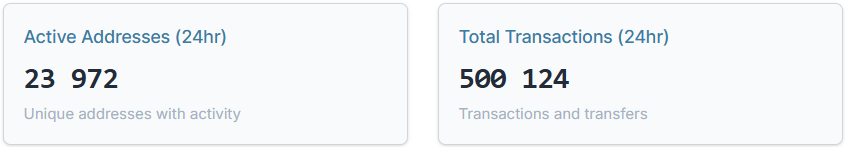

Investor participation has remained elevated throughout the past week, supporting the sustainability of the rally. On-chain data shows 23,972 active addresses over the last 24 hours. These addresses collectively executed more than 500,000 transactions, indicating strong network engagement.

For context, comparable activity across established tokens remains lower. XRP recorded roughly 39,000 active addresses, Cardano posted about 25,000, and Chainlink logged near 4,000. This comparison suggests CC’s price increase is driven by genuine usage rather than speculative spikes or thin liquidity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Canton Activity. Source: Cantonscan

Canton Activity. Source: Cantonscan

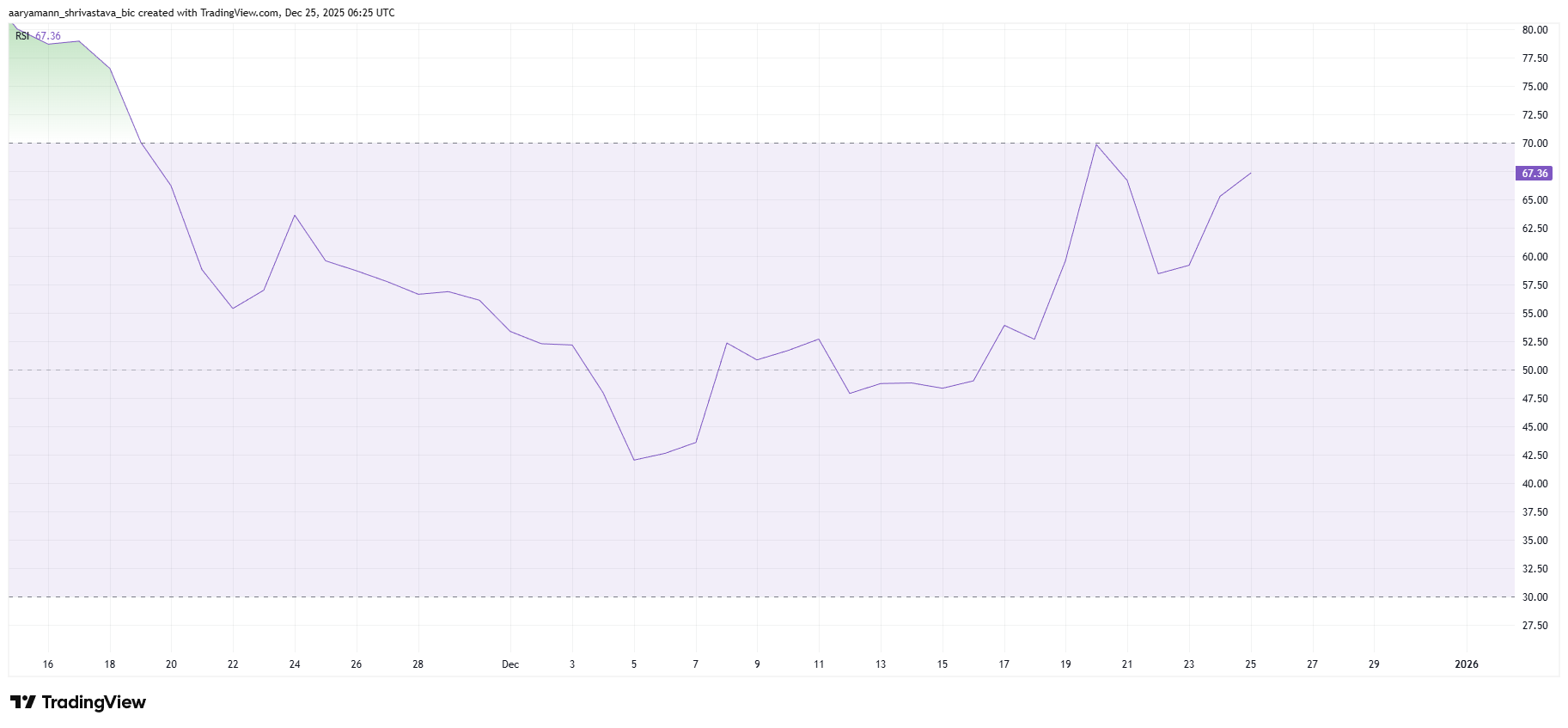

Technical indicators further support the bullish outlook. The Relative Strength Index currently sits above the neutral zero line, signaling positive momentum. This positioning confirms that buyers remain in control, aligning with the sustained rise in network activity and transaction volume.

However, caution is warranted as the RSI approaches overbought territory. Such conditions often precede short-term pullbacks. As long as the indicator avoids breaching extreme levels, CC’s broader uptrend remains technically intact.

CC RSI. Source: TradingView

CC RSI. Source: TradingView

CC Price Hits Monthly High

CC price traded near $0.106 at the time of writing, reflecting a near 40% weekly increase. The Parabolic SAR continues to signal an active uptrend. This indicator suggests the altcoin may extend gains if broader market conditions remain supportive.

A decisive break above the $0.109 resistance could push CC toward $0.118. Clearing that level may open the path to $0.133. Such a move would build on the token’s recent monthly high and reinforce bullish structure.

CC Price Analysis. Source: TradingView

CC Price Analysis. Source: TradingView

Downside risks persist if momentum weakens. Overbought conditions or profit-taking could pressure price action. A drop below $0.101 may expose CC to a decline toward $0.089, invalidating the current bullish thesis.