Americans Want Crypto for Christmas—Even as Inflation Squeezes Budgets

Americans are feeling the pressure of higher living costs, but they are not stepping away from crypto.

A new holiday spending survey from Visa Inc. shows a growing appetite for digital assets as gifts, even as inflation continues to limit disposable income and keep consumers cautious. The contrast highlights a deeper shift in how households adapt when money feels tight.

Inflation Is Cooling, but Budgets Still Feel Tight

Inflation has eased from its post-pandemic peak, but prices remain elevated across essentials such as housing, food, insurance, and utilities.

Wages have broadly kept pace with inflation, preventing a sharp drop in purchasing power. Still, the margin is thin.

After covering necessities, many households have less flexibility for investing or discretionary spending than they did before 2022.

This environment has not stopped spending outright. Instead, it has changed behavior. Consumers shop earlier, compare prices more aggressively, and rely on technology to stretch each dollar further.

Financial confidence remains fragile, but economic participation continues. That caution shows up clearly in how people spend—and what they choose to buy.

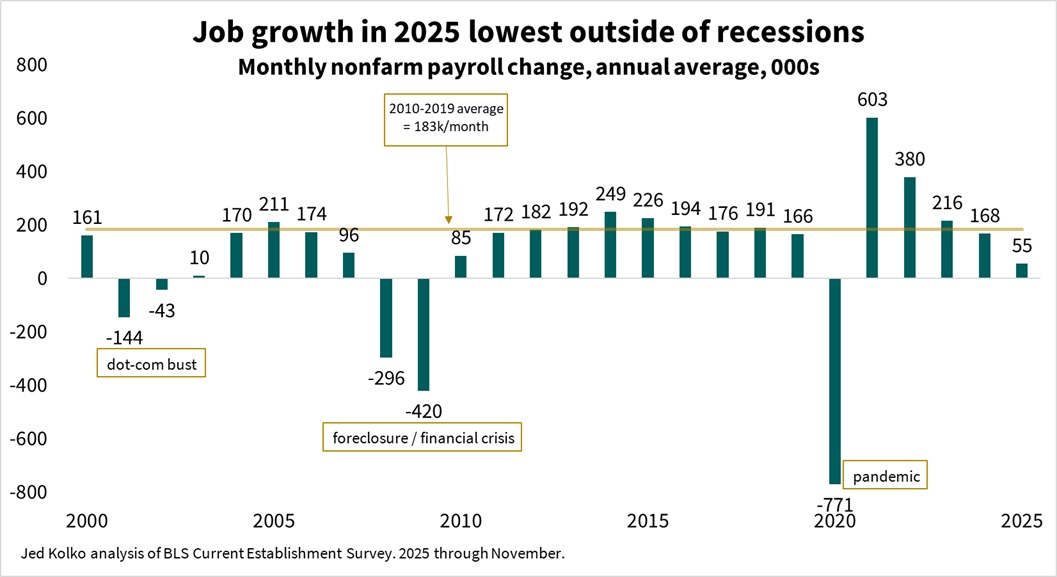

US Job Growth Over the Years. Source: X/Jed Kolko

US Job Growth Over the Years. Source: X/Jed Kolko

Crypto Emerges as a “Lean Budget” Gift

Visa’s December survey reveals that 28% of Americans would be excited to receive crypto as a holiday or Christmas gift, a figure that jumps to 45% among Gen Z.

The appeal is not about luxury. It reflects a preference for assets that feel flexible, digital-first, and potentially long-term in value.

At the same time, 47% of US shoppers reported using AI tools to assist with holiday purchases, primarily to find gift ideas and compare prices. This signals a consumer mindset focused on optimization rather than excess.

Younger shoppers lead the shift. Gen Z respondents show higher adoption of crypto payments, digital wallets, biometric authentication, and cross-border shopping than any other age group.

For them, crypto fits naturally into a broader digital financial identity.

The data suggests crypto gifting is not crowding out essentials. Instead, it replaces traditional discretionary items at a time when consumers remain selective.

What This Says About the US Economy

The combination of easing inflation and persistent budget pressure points to a cautious but stable economy.

Americans are not retreating, but they are adapting. Spending continues, yet it leans toward tools and assets that promise efficiency, optionality, or future upside.

Crypto’s growing acceptance as a gift—despite tighter disposable income—signals cultural normalization rather than speculative exuberance.

It also helps explain why digital assets continue to attract interest even during periods of economic restraint.

For markets, the message is clear. Inflation may be cooling, but confidence has not fully returned.

In that gap, technology and alternative assets are filling a role that traditional consumption no longer does.

Americans may feel stretched, but they are still betting—carefully—on the future.