Ripple Price Annual Forecast: XRP eyes record high breakout in 2026 as Ripple scales infrastructure

- XRP has traded under pressure, but short-term support keeps hopes of a sustainable recovery in 2026 alive.

- The launch of XRP ETFs and regulatory clarity in the US pave the way for institutional adoption.

- Ripple's investments, infrastructure growth, acquisitions and strategic partnerships could build momentum for XRP.

Ripple (XRP) is trading near $2.00 ahead of the New Year after a volatile 2025 that saw the cross-border remittance token swing to a new record high of $3.66 in July.

The resolution of the lawsuit against Ripple filed by the United States (US) Securities and Exchange Commission (SEC) in July paved the way for the adoption of XRP as an institutional-grade digital asset, with active corporate treasuries.

The launch of XRP spot Exchange Traded Funds (ETFs) in the US in November promises a bullish outlook in 2026, especially with inflows holding steady. XRP's growth in 2025 accelerated it to the fourth-largest cryptocurrency, with a market capitalization of $120 billion, according to CoinGecko.

On the other hand, Ripple undertook a complete reinvention while staying grounded in the company's core business of facilitating cross-border transactions powered by a fast, secure, and affordable blockchain.

Characterised by strategic partnerships, real-world assets (RWA) tokenization on the XRP Ledger (XRPL), expansion through acquisitions and stablecoin launch, Ripple's ambitious growth phase was driven by a fresh crypto-friendly regulatory tide in the US at the onset of President Donald Trump's second term.

XRP in 2025: SEC vs. Ripple lawsuit, institutional adoption and new record high

The SEC's lawsuit against Ripple, filed in 2020, concluded in 2025 after the agency dropped its appeal and reached a settlement agreement in May. Ripple agreed to pay the SEC $50 million in penalty fees. The court had ruled in August 2024 that Ripple violated the US Securities Act by selling unregistered securities directly to institutional investors. In the ruling, programmatic sales of XRP via third-party platforms such as crypto exchanges did not constitute securities, handing Ripple a partial win.

Both parties worked hand in hand, requesting the court for an indicative ruling dissolving the injunction on the future sale of XRP to institutional investors. While the court dealt a blow to the motion in June, citing the failure to demonstrate beyond a reasonable doubt the need to modify a final judgment, Ripple and the SEC filed a joint motion in August to dismiss their appeals, effectively ending the lawsuit.

Ending the litigation paved the way for institutional adoption, with companies such as Evernorth holding $1 billion in XRP reserves, Trident Digital Tech Holdings with $500 million, Webus International with $300 million, VivoPower International with over $100 million committed and Wellgistics Health with over $50 million among others.

Multiple fund managers applied to the SEC for XRP spot ETFs, including Bitwise Asset Management, Franklin Templeton, Canary Capital, Grayscale Investments, REX Shares/Osprey Funds, Amplify ETFs, 21Shares, Teucrium Trading, and Volatility Shares, among others.

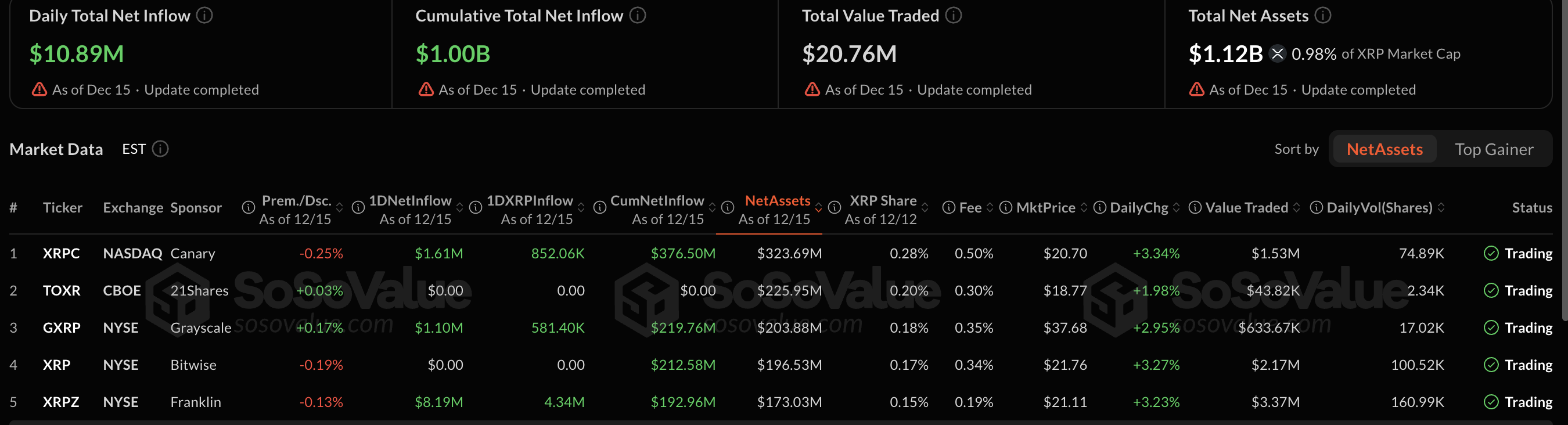

Four XRP spot ETFs were approved in November: Canary Capital's XRPC, Grayscale's XRPG, Bitwise's XRP and Franklin Templeton's XRPZ. Demand for XRP ETFs has steadied since their debut on November 13, with cumulative inflows reaching $1 billion and net assets at $1.12 billion as of December 16.

Ripple USD stablecoin outlook

Ripple launched Ripple USD (RLUSD), a US Dollar (USD) dominated stablecoin in December 2024. The stablecoin redeemable 1:1 for USD was issued under a regulatory charter issued by the New York Department of Financial Services (NYDFS).

Ripple at the nexus of crypto and TradFi, as institutions adopt XRP

Ripple has made deep-rooted inroads into the financial system, building on existing collaborations and signing new strategic partnerships globally. The collaborations span enterprise-grade crypto assets custody, stablecoin and cross-border payments and RWA tokenization.

Regulatory compliance has been one of Ripple's strongest suits, enabling easy integration with traditional finance (TradFi). The XRPL's cost efficiencies, security and speed continue to attract institutional interest and adoption. This has bolstered Ripple as a bridge between the blockchain industry and the global banking infrastructure.

XRP Ledger powers treasuries, RWA tokenization

Ondo Finance, in collaboration with Ripple, launched the Ondo Short-Term US Government Treasuries (OUSG) on the XRP Ledger. The offering allows qualified purchasers to seamlessly subscribe to and redeem OUSG on the blockchain using RLUSD.

In its quest to become a financial powerhouse, Ripple also filed with the Office of the Comptroller of the Currency (OCC) to form Ripple National Trust Bank, which will have its headquarters in New York. This bank is expected to hold trust powers and offer digital asset custody services.

XRP in 2026: Volatility, utility-driven demand and potential new record high

Since July, XRP has been on a general downtrend alongside other major assets such as Bitcoin (BTC) and Ethereum (XRP). Several factors, among them macroeconomic uncertainty, the October 10 deleveraging event and continued profit-taking, have driven XRP to $1.25 before it printed a subtle recovery above $2.00.

As of writing, XRP is trading above support at $2.00 as the dust settles following volatility triggered by macroeconomic uncertainty. As attention shifts to 2026, patterns will form around institutional adoption through ETFs and other XRP-related investment products, retail demand, and utility-driven demand through the structures Ripple has built to support cross-border payments.

Lacie Zhang, Research Analyst of Bitget Wallet, told FXStreet in an exclusive commentary that XRP will likely remain volatile in 2026, with downside risks pointing to $1.40 and upward potential to a new record high above $4.00 by the end of the year.

"XRP’s trajectory entering 2026 is likely to remain volatile, reflecting a market still adjusting to macroeconomic uncertainty despite the Fed’s recent easing cycle. In the near term, XRP could see a further correction toward the $1.40 range as broader risk sentiment remains fragile. However, the medium-term outlook is more constructive,” Zhang stated.

Zhang added that the next phase could depend on macroeconomic factors stabilizing while institutional participation expands, utility-driven adoption and continued regulatory clarity. These are some of the factors that could give XRP a significant leg up despite short-term volatility.

Meanwhile, the Supply in Profit on-chain metric shows that potential selling pressure is narrowing, which could precede a sustained recovery in the coming months.

Nearly 37 billion XRP tokens are currently in profit, down from a nine-year high of 64 billion XRP, the highest record in 2025, reached in July.

Aggressive selling for profit reduces potential selling pressure. If the drop in supply in profit persists, it could pave the way for a rebound in XRP's price. Investors are unlikely to continue selling when facing unrealized losses.

XRP Technical Analysis: Will XRP hit $3.00?

XRP is trading around $2.00 at the time of writing, weighed down by low retail interest. The cross-border remittance has traded since its record high of $3.66 in July amid volatility, declining below a descending trendline. A break above this key trendline is required to shift the overall thesis back to a bullish stance.

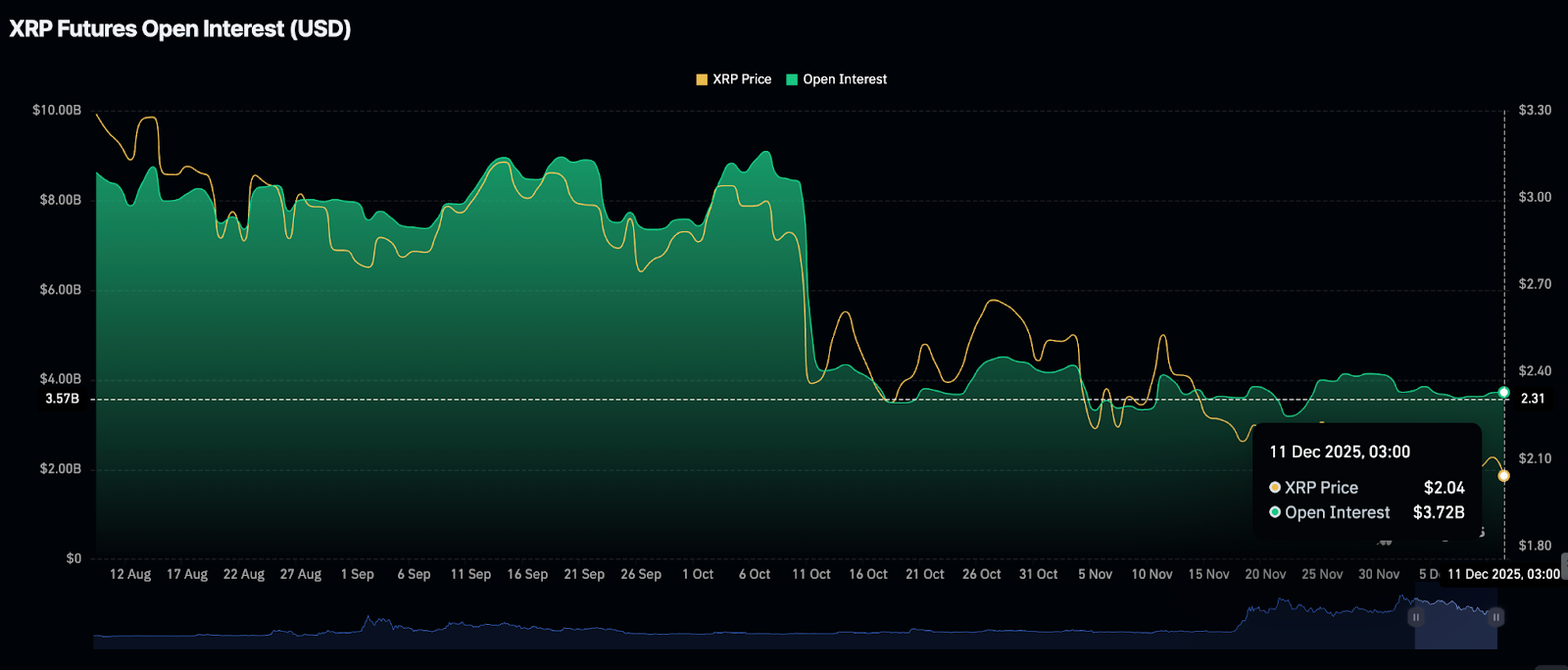

However, a weak derivatives market paints a grim picture for XRP, as conditions have deteriorated since the October 10 deleveraging event, which liquidated nearly $610 million in XRP-related long positions and $90 million in shorts in a single day.

XRP futures Open Interest (OI) remains at $3.72 billion at the time of writing, down 66% from the record high of $10.94 billion in July. OI is a measure of investor interest in an asset.

A steady decline or stability at lower levels indicates that investors are not convinced that XRP can sustain an uptrend in the short term. Looking ahead, the derivatives market, along with XRP ETFs, could help shape sentiment in 2026.

Meanwhile, XRP remains below the 50-day Exponential Moving Average (EMA) at $2.19, the 100-day EMA at $2.37 and the 200-day EMA at $2.44, all of which are sloping downward and affirming a bearish outlook in the short to medium term.

The Relative Strength Index (RSI) remains at 37 within the bearish region, indicating that bearish momentum is increasing. An extended decline toward oversold territory would accelerate the correction below $2.00.

Looking at the Moving Average Convergence Divergence (MACD) indicator on the same daily chart, sellers have an edge, with the blue line below the red signal line reinforcing the bearish grip.

If the blue MACD line remains below the red signal line, the path of least resistance would stay downward, increasing the odds that the down leg extends to April's support at $1.61. At the worst, XRP could sweep through liquidity at $1.25, which was tested as support on October 10.

On the other hand, if the MACD indicator steadily rises above the mean line, maintaining a buy signal, a recovery could ensue above the descending trendline and pave the way for a break past the 50-day EMA, the 100-day EMA and the 200-day EMA.

Breaking the multi-month descending trendline could mark a major shift from a bearish to a bullish trend and accelerate the price past the psychological $3.00 level. Above this resistance, the key target would be the resistance band at $3.40-$3.66, which, if broken, could pave the way for a price discovery rally past $4.00.

To sum up

XRP sits at a crossroads, weighed down by volatility across the cryptocurrency market and trading at almost a 50% discount from the record high of $3.66.

The derivatives market is significantly suppressed, with Open Interest remaining relatively flat, which implies that retail interest is extremely low compared to July, when OI averaged a record high of $10.94 billion.

However, demand for XRP spot ETFs holds steady, with total net inflows reaching $1 billion. Institutional interest, adoption and demand-driven utility as Ripple builds its cross-border infrastructure could be the highlights of 2026.

Demand and positive sentiment could propel XRP to new record highs around $4.00, but if downside risks persist, price could revisit the October 10 low of $1.25.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.