Largest XRP Whales Are Making a Move – Will Price Respond?

XRP price has rebounded from recent lows, rising nearly 4% from yesterday’s bottom and stabilizing after a modest pullback. While the broader trend remains cautious, a new metric suggests downside momentum may be fading.

With the XRP issuer recently moving closer to regulated-banking status, the focus now shifts to whether large holders continue to step in to confirm a real trend change.

Bullish Divergence Forms as Largest Whales Begin Adding

On the daily chart, the XRP price has flashed a bullish divergence between December 1 and December 12. During this period, price made a lower low, while the Relative Strength Index (RSI) formed a higher low. RSI measures momentum, and this pattern often appears when selling pressure weakens before a rebound.

Reversal Pattern Surfaces: TradingView

Reversal Pattern Surfaces: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This setup has already triggered a bounce, but what makes it more compelling is whale behavior. The two largest XRP holder groups have already started responding.

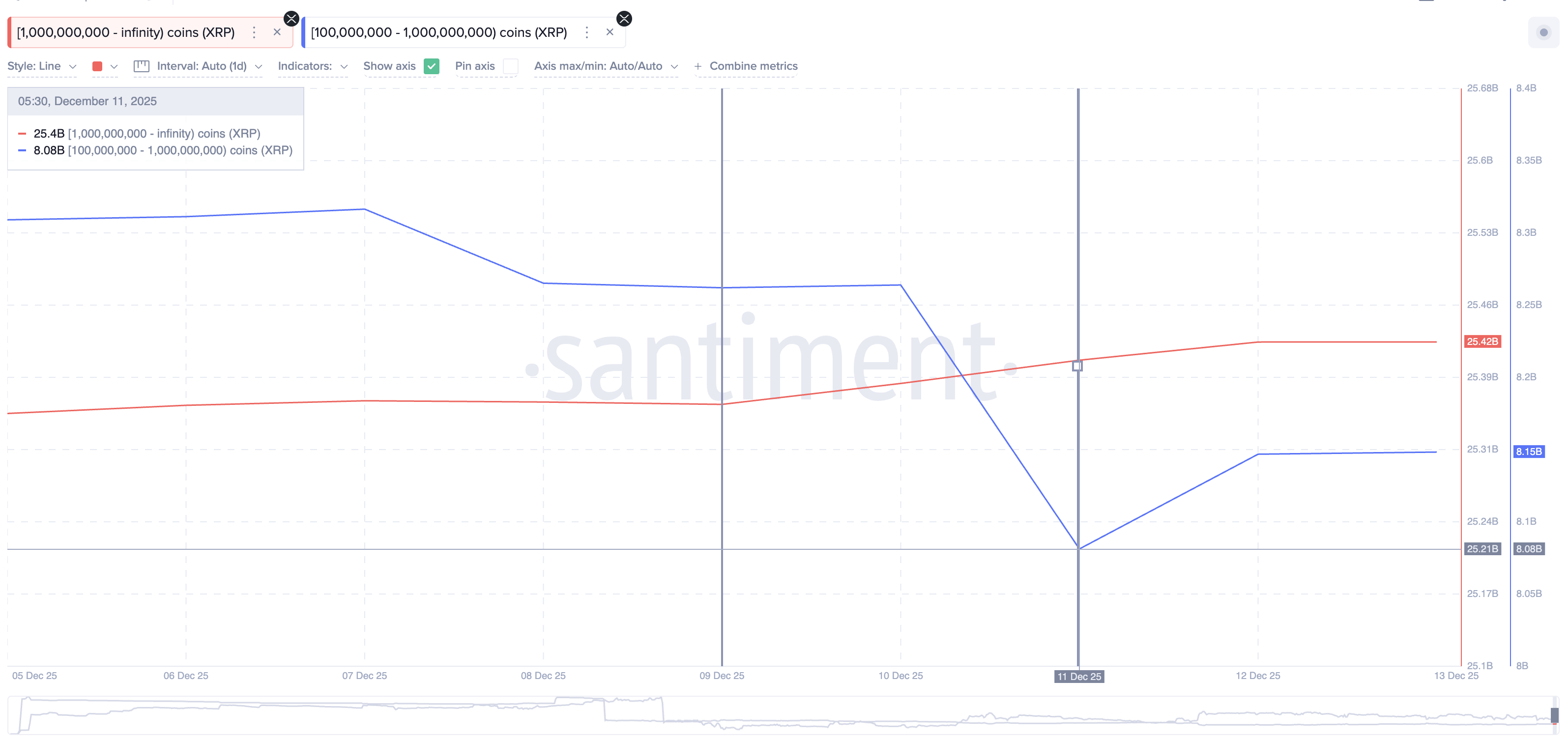

Wallets holding more than 1 billion XRP increased their holdings from 25.36 billion on December 9 to 25.42 billion. At the same time, wallets holding between 100 million and 1 billion XRP reversed their selling trend, rising from 8.08 billion on December 11 to 8.15 billion at press time.

XRP Whales: Santiment

XRP Whales: Santiment

In total, these two cohorts added roughly 130 million XRP. At the current price, that equals about $265 million in net accumulation. This confirms that the biggest holders are not just watching the divergence, they are acting on it.

The timing also matters. Ripple recently moved closer to securing a US banking license, reinforcing its long-term institutional narrative. That regulatory backdrop gives added weight to whale interest at these levels.

XRP Price Levels That Decide If the Reversal Holds

For the bullish divergence to stay valid, the XRP price needs follow-through. The first level that matters is $2.11. A daily close above it would mark a 3.72% move from current levels and confirm that buyers are regaining short-term control. XRP has not held above $2.11 since early December.

If that level breaks, the next resistance sits at $2.21. Only a sustained move above $2.21 would shift the structure bullish and reopen the path toward $2.58 or higher.

XRP Price Analysis: TradingView

XRP Price Analysis: TradingView

On the downside, risk remains clearly defined. If the XRP price falls below $1.96 while RSI weakens, the bullish divergence would be invalidated. That scenario would expose $1.88 first, followed by $1.81 if selling accelerates.

Right now, the setup is constructive but unfinished. Momentum indicators show improvement, and whales have already responded once. For this reversal to fully play out, those large holders need to keep adding support, not just react briefly.