3 Altcoins to Watch Ahead of the December FOMC Meeting

The upcoming US FOMC Meeting, scheduled for December 10, is expected to bring a 25-basis-point cut in interest rates. FOMC’s decision event could bring the interest rate to 3.50% – 3.75% and prove to be highly beneficial for the crypto market.

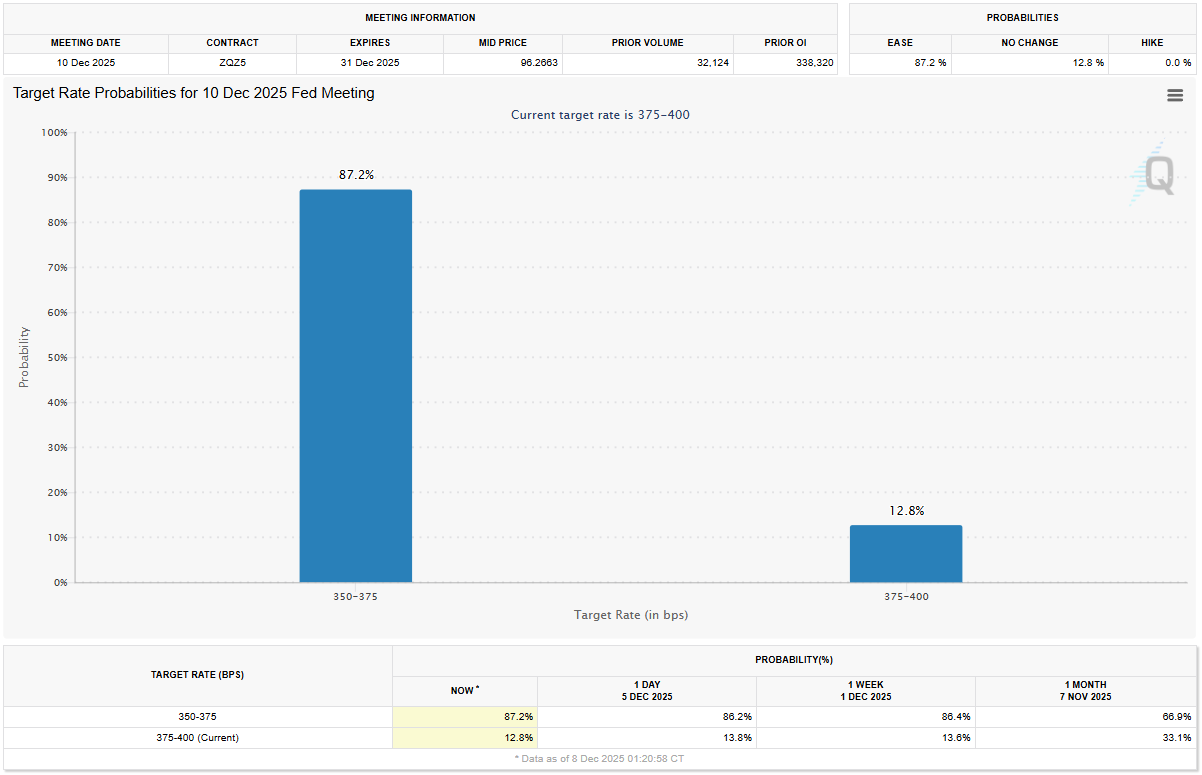

At the moment, the probability of a rate cut is sitting at 87.2% while a 12.8% chance of no interest rate slash exists. If the former occurs, cryptocurrencies could rise as Lower rates typically drive capital into risk assets like crypto. However, a hawkish surprise could suppress demand, especially with Bitcoin down 20% over 90 days.

US Interest Rate Cut Probability. Source: CME Group

US Interest Rate Cut Probability. Source: CME Group

Thus, ahead of the meeting, BeInCrypto has analysed three such altcoins that could benefit from the Fed’s rate cut.

Fartcoin (FARTCOIN)

FARTCOIN has emerged as a strong performer this week, gaining 32% in seven days despite bearish market conditions. The altcoin is trading at $0.404 and continues to show resilience as broader sentiment attempts to stabilize.

The RSI indicates healthy bullish momentum, with the indicator positioned above the neutral line. This trend could support a continued climb, allowing FARTCOIN to break $0.417 and potentially reach $0.470 if buyers remain active and market cues hold steady.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

FARTCOIN Price Analysis. Source: TradingView

FARTCOIN Price Analysis. Source: TradingView

If the anticipated rate cut fails to lift sentiment, FARTCOIN may struggle to extend its rally. A loss of momentum could push the price below $0.358. This could risk a decline toward $0.320 or even $0.280, which would invalidate the bullish outlook.

Bitcoin Cash (BCH)

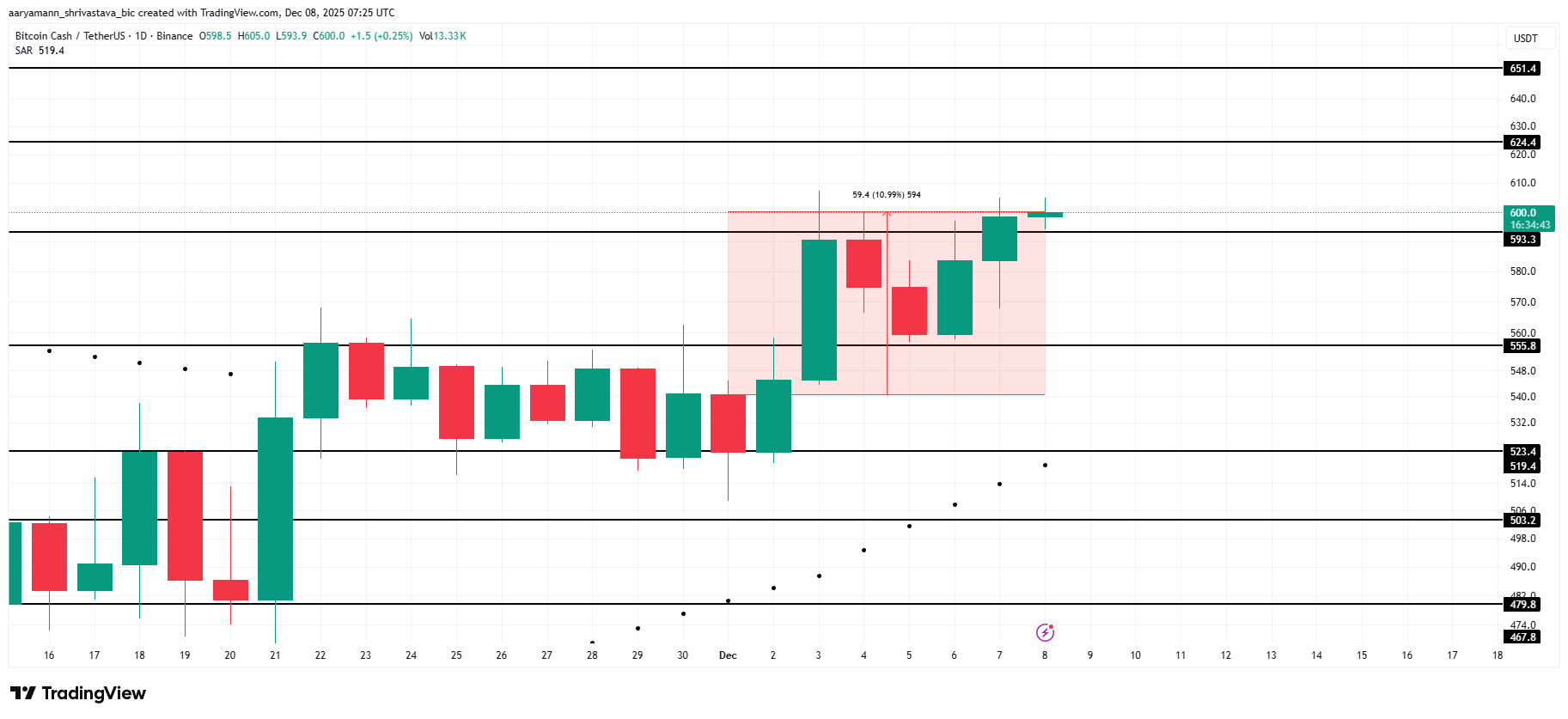

Bitcoin Cash is up nearly 11% this week, making it a key altcoin to monitor as markets prepare for potential rate-cut reactions. As a Bitcoin namesake, BCH often mirrors BTC’s momentum, meaning a BTC rally could extend directly into BCH’s price action.

The Parabolic SAR confirms an active uptrend, signaling sustained bullish momentum. If this strength continues, BCH could push toward $624. This is only possible, provided it successfully flips $593 into a stable support level. Securing this range is essential for extending recovery.

BCH Price Analysis. Source: TradingView

BCH Price Analysis. Source: TradingView

If investors shift to profit-taking, BCH may face a sharp reversal. Losing the $593 support could send the altcoin down to $555 or lower. This would invalidate the bullish outlook and expose BCH to deeper corrective pressure.

Double Zero (2Z)

2Z price has surged 21%, pushing the altcoin into the top 100 crypto assets. It is trading at $0.1382, sitting just below the $0.1433 resistance. Holding this range is key as momentum builds across the broader market.

The MACD signals strengthening bullish momentum, which could intensify if the rate cut fuels additional upside. A successful move above $0.1433 may open the path toward $0.1581, supported by improving technical and market conditions.

2Z Price Analysis. Source: TradingView

2Z Price Analysis. Source: TradingView

If uncertainty takes over or investors sell into strength, 2Z could face a reversal. A drop to $0.1296 or even $0.1199 would invalidate the bullish outlook and expose the altcoin to deeper corrective pressure.