Tom Lee’s Relentless ETH Buying Puts BMNR Stock on a Possible 55% Breakout Path

The BMNR price has started heating up again. It is up more than 5% in the past 24 hours and almost 10% in the last five days, outperforming Ethereum’s 8% weekly gain. The surge comes just as BitMine Chairman Tom Lee reportedly swept another $150 million worth of ETH off exchanges.

With Ethereum strengthening after the Fusaka upgrade and BMNR tracking the ETH price more closely, traders are now asking whether this crypto momentum can trigger a much larger stock price breakout.

ETH Spree and Rising Correlation Give BMNR Stock a Strong Tailwind

Arkham intelligence identified two fresh wallets withdrawing $92 million in ETH from Kraken and another $58 million from BitGo, mirroring earlier BitMine purchase signatures. Tom Lee has consistently positioned BitMine as an ETH-centric treasury company, and this aggressive buying shows that strategy has not slowed at all.

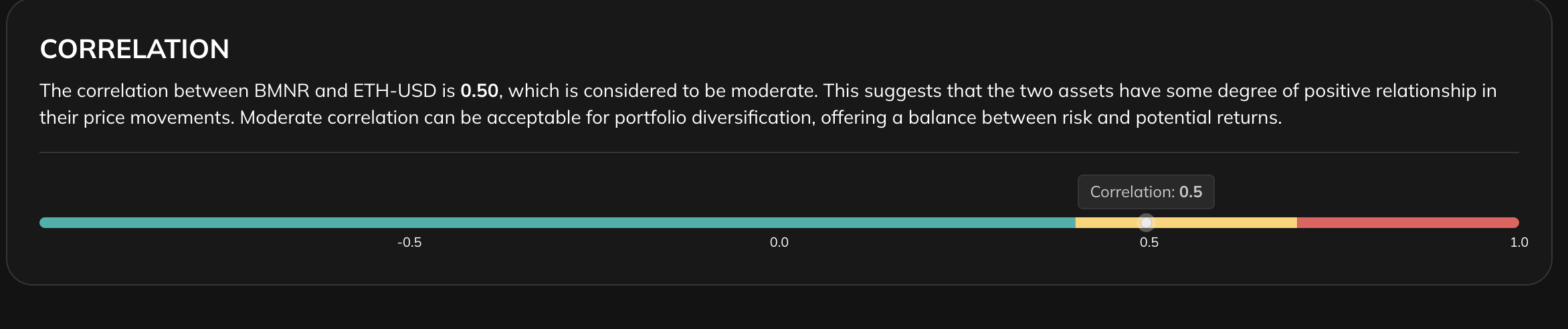

BMNR’s link to Ethereum is tightening as well. The stock’s correlation with ETH climbed from 0.47 to 0.50, meaning BMNR reacts more directly to Ethereum’s moves. If ETH continues rising after the Fusaka upgrade, BMNR tends to follow — and when Tom Lee is buying during the same window, the effect becomes even stronger.

BMNR-ETH Correlation: Portfolio Slab

BMNR-ETH Correlation: Portfolio Slab

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here

Together, Lee’s accumulation and BMNR’s rising correlation create a setup where the stock behaves like a leveraged Ethereum proxy, driven by ETH cycles and treasury positioning.

Two Key Divergences Point to Strength Building Beneath the Surface

The daily chart is showing early signs of accumulation.

Money flow, mostly from large wallets — captured by the Chaikin Money Flow (CMF) indicator — has started rising even while BMNR’s price pulled back.

Between November 28 and December 3, the stock made a lower high, but CMF made a higher high. This hints at a clear bullish divergence. This often signals that deeper pockets are buying dips more aggressively than retail participants. CMF still needs to cross above the zero line to confirm a full shift in momentum. Yet, the underlying demand is picking up.

Big Money Backs BMNR: TradingView

Big Money Backs BMNR: TradingView

Volume tells the same story.

The On-Balance Volume (OBV) indicator has been climbing while the BMNR price lagged, hinting at accumulation hiding beneath the surface.

OBV now needs to break above its descending trendline to validate the trend. Once it does, volume strength aligns with money-flow strength — a classic pre-breakout structure.

Volume Support: TradingView

Volume Support: TradingView

In combination, these divergences show BMNR’s strongest buyers stepping in early, building a foundation that often appears before major technical reversals.

A 55% Upside Target Could Shape the BMNR Price Path

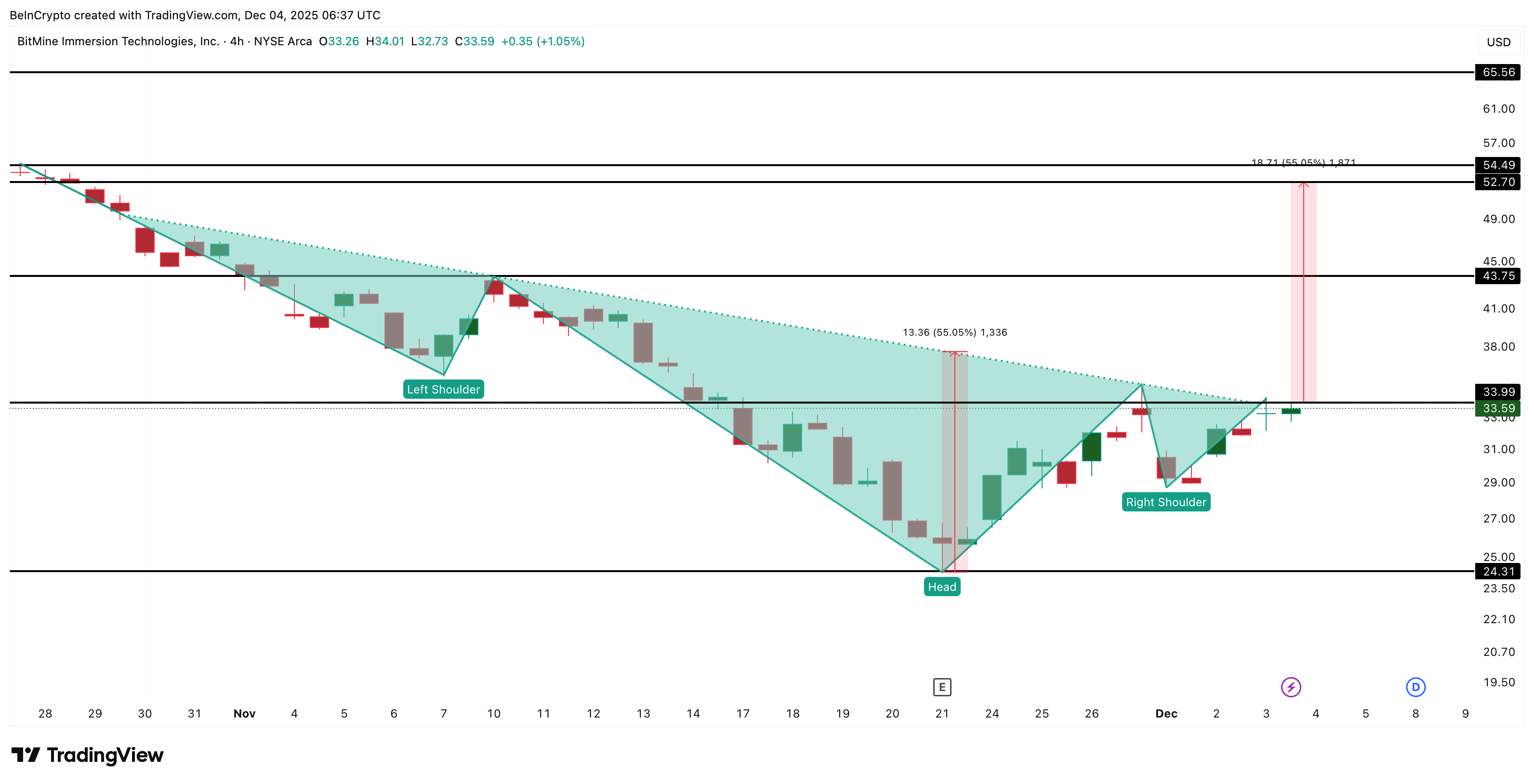

The 4-hour BMNR price chart presents the clearest structure: an inverse head and shoulders pattern developing. The neckline is sloping downward, which signals sellers still have some influence and that a breakout will require strong volume confirmation. That is where the OBV breakout becomes all the more necessary.

BMNR is currently trading near $33.59. A decisive move above the $33.99 zone would activate the pattern fully. Based on the measured move, the upside target sits near $52.70, representing a potential 55% rally if the breakout completes.

On the downside, $24.31 remains the key invalidation zone.

BMNR Price Analysis: TradingView

BMNR Price Analysis: TradingView

With Tom Lee supposedly buying $150 million in ETH, Ethereum gaining traction post-Fusaka, bullish divergences appearing on the daily chart, and a major reversal pattern forming on the 4-hour timeframe, the BMNR price is entering a rare moment where fundamentals and technicals align.