Ethereum whales pushes its price up as Hong Kong approves spot ETH ETF

- Hong Kong has approved applications for a spot Bitcoin and Ethereum ETF.

- Whales have been accumulating ETH as they view recent crypto market dump as buying opportunity.

- Ethereum may not post significant gains in coming days despite price recovery.

Ethereum's (ETH) price slightly improved on Monday after Hong Kong approved applications for a spot Bitcoin and Ethereum ETF. Whales have also been accumulating ETH after the market dip over the weekend.

Daily digest market movers: Hong Kong ETH ETF approval, whale accumulation

Ethereum has seen a slight gain coming out of a bearish weekend. Here are your latest market movers for the number one altcoin:

- Hong Kong Securities & Futures Commission (SFC) approved applications for spot Bitcoin and Ethereum ETFs on Monday. The approval was confirmed by several applicants, including HashKey Capital, Harvest Global Investments, Bosera Capital and China Asset Management.

Unlike spot Bitcoin ETFs in the US, which are based on cash redemption, Hong Kong's spot Bitcoin and Ethereum ETFs will allow an in-kind redemption and subscription model. This means that investors can subscribe to and redeem their investments using the underlying asset.

In contrast, several analysts and crypto community members expect the US Securities & Exchange Commission (SEC) to deny applications for a spot Ethereum ETF in May.

- Hong Kong's ETH ETF approval coincides with increased whale activity surrounding Ethereum. Following the crypto market dip over the weekend, whales have been on a buying spree for the second-largest digital asset.

In the past few hours, eight whales who have previously profited from ETH returned to spend a combined 31.88 million in USDT and USDC to purchase 9,787 ETH on-chain on Monday, according to data from Spot On Chain. The purchase comes at an average price of $3,257.

Another whale wallet related to digital asset firm Matrixport withdrew 16,300 ETH from Binance, according to data from Lookonchain. The same wallet had withdrawn ETH in bulk from exchanges on several occasions since March 29, withdrawing a total of 67,286 ETH.

Other large whale withdrawals include:

This whale spent 70M $USDC to buy 23,790 $ETH at $2,942 from the bottom again after $ETH dropped.

— Lookonchain (@lookonchain) April 14, 2024

He has bought 85,931 $ETH($278.5M) from #Binance and #DEX in the past week, with an average buying price of $3,241.

He still holds $136M stablecoins and may buy more $ETH.… pic.twitter.com/d7yYdqEnDB

- Lookonchain also posted on X:

It seems that whales bought $ETH at the bottom!

— Lookonchain (@lookonchain) April 13, 2024

Whale"0x4359" withdrew 37,018 $ETH($120.7M) from #Binance 4 hrs ago and this whale has withdrawn 62,141 $ETH($202.6M) from #Binance in the past 5 days.https://t.co/41366OnM5Y

Fresh whale wallet"0xE347" withdrew 7,300 $ETH($23.8M)… pic.twitter.com/qEtTSYU3Us

- The market dip before Hong Kong's spot ETH ETF approval may have seemed like a good buying opportunity for these whales. Some of these withdrawals may have also gone into Ethereum liquid staking and restaking protocols as several of them have recorded impressive increases in the past 24 hours, according to data from DeFiLlama.

Technical analysis - ETH may not see a huge price increase

Ethereum began the new week with a strong start, showing recovery signs from the general crypto market dump over the weekend.

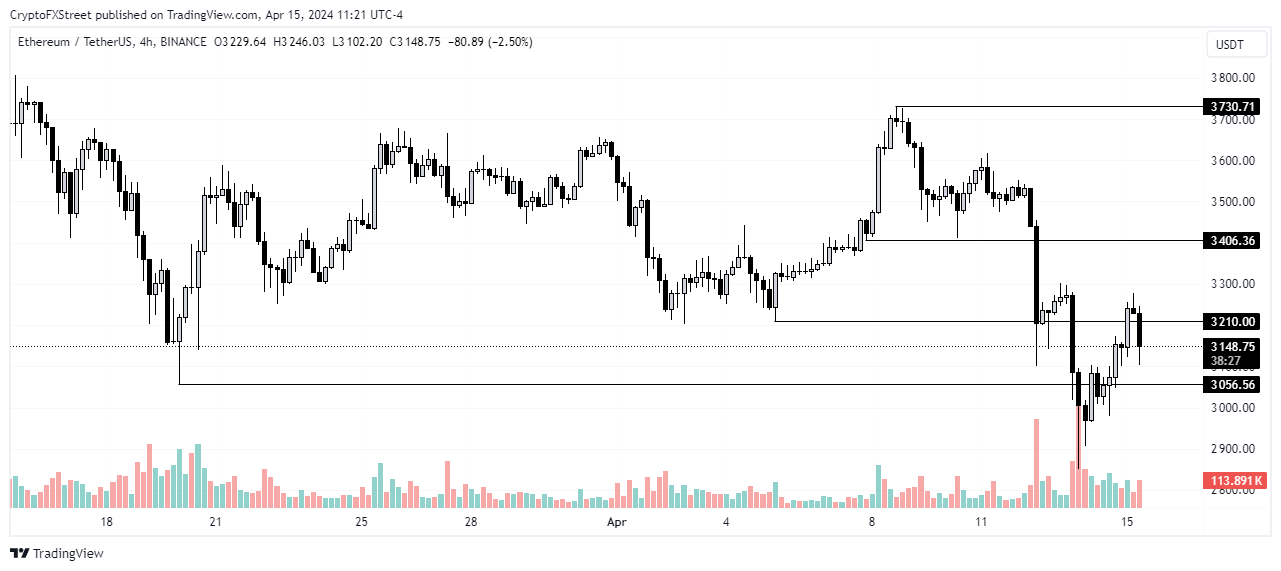

While recent whale activity has enabled its price to recover from the bottom of $2,850 recorded on Saturday, ETH may not see huge increases in the next few days. If whales maintain their buying activity, ETH could settle inside the range of $3,210 and $3,406 within the next few days in an attempt to fill the liquidity void formed on April 12.

ETH/USDT 4-hour chart

However, things could change quickly if the upcoming Bitcoin halving - less than four days away - causes a significant shift in the crypto market. A move below the $3,056 support of March 20 will indicate another bearish trend in ETH. If it breaks past the $3,406 resistance of April 7, ETH could target the $3,730 key level and eventually rally to $4,000.

ETH is currently trading at $3,134, up 3.1% at the time of writing on Monday.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.