MicroStrategy Buys $50 Million In Bitcoin Despite Market Turbulence

Strategy has added more Bitcoin to its balance sheet, continuing its accumulation strategy despite recent market volatility. The company now holds 641,692 BTC, valued at approximately $47.5 billion.

The move reaffirms long-term confidence in Bitcoin’s growth potential, but also raises doubts about sustainability.

Strategy Buys 487 BTC

Strategy (formerly MicroStrategy) continues to strengthen its position as the world’s largest corporate Bitcoin holder.

The company announced the purchase of an additional 487 BTC for approximately $49.9 million, at an average price of $102,557 per coin. With this latest acquisition, Strategy’s total Bitcoin holdings have climbed to 641,692 BTC.

Strategy’s average purchase price across all holdings stands at $74,079 per Bitcoin. This latest figure represents a 26.1% year-to-date BTC yield in 2025.

The company’s overall performance highlights its disciplined approach to Bitcoin accumulation.

However, its latest purchase has raised eyebrows, particularly given the broader volatility in Bitcoin’s performance.

Bitcoin Slips but Saylor Stays Bullish

Bitcoin recently slipped below the $100,000 mark in early November, sparking renewed debate about market volatility and the sustainability of corporate Bitcoin investment strategies.

While some investors viewed the recent correction as a warning sign, Strategy saw it as a buying opportunity.

The company’s latest purchase came just days after Michael Saylor set a $150,000 year-end target for Bitcoin, doubling down on the conviction that short-term volatility won’t derail the company’s long-term strategy.

On Friday, Strategy also raised $770 million through the issuance of its 10% Series A STRE preferred stock, targeting institutional investors seeking stable returns. The funds raised are being used to support further Bitcoin purchases and general corporate operations.

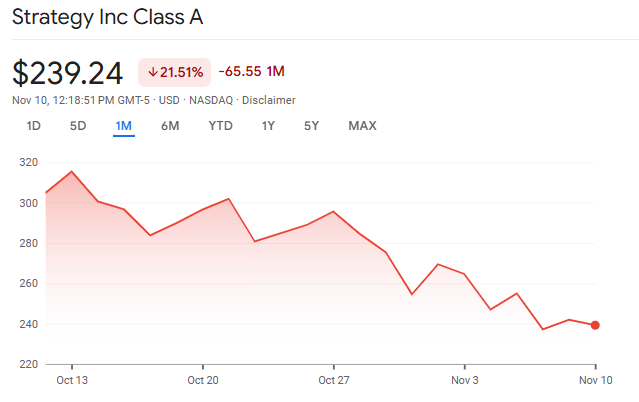

MicroStrategy Share Prices Over The Past Month. Source: Google Finance

MicroStrategy Share Prices Over The Past Month. Source: Google Finance

Still, Strategy’s latest actions come amid heightened uncertainty, with both Bitcoin and MSTR shares facing steep declines. The company’s stock has dropped more than 27% in the past month, closely tracking Bitcoin’s retreat from record highs.

Critics contend that the company’s fortunes are too closely tied to Bitcoin’s price, while supporters view its approach as a strong expression of long-term confidence and value preservation.

Whether Strategy’s bold conviction pays off will depend on Bitcoin’s recovery trajectory and investor sentiment in the months ahead.