Maple Finance Ends Staking, Launches Token Buybacks in RWA-Driven Overhaul

Maple Finance is advancing a new model for decentralized credit markets through its MIP-019 proposal. The proposal replaces staking with token buybacks and governance incentives.

The move comes amid a surge in real-world asset (RWA) adoption and rising institutional interest in on-chain lending. Maple curbs token inflation and links rewards to actual financial performance, strengthening its position in the evolving RWA-driven credit ecosystem.

Maple’s MIP-019: From Staking to Sustainable On-Chain Credit

Maple Finance, a decentralized credit marketplace, has approved the MIP-019 proposal. The proposal formally ends Maple’s staking program and introduces a buyback-based mechanism for its governance token, SYRUP. The change makes Maple’s tokenomics more sustainable and aligns the protocol more closely with traditional credit markets.

Moreover, protocol revenues will repurchase SYRUP tokens from the open market under the new framework. The old model distributed inflationary staking rewards. Maple’s governance forum states this transition “limits inflation, strengthens capital efficiency, and links value directly to protocol revenue.”

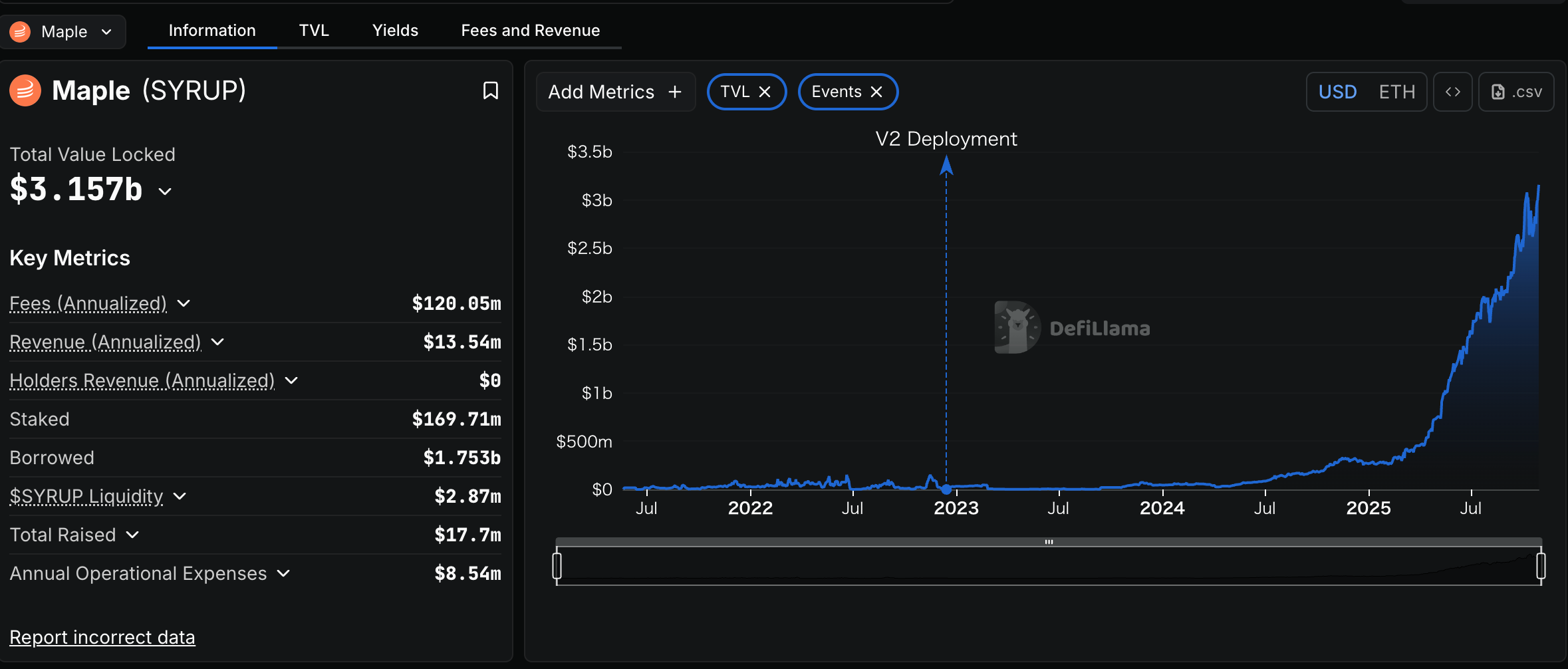

The market reacted swiftly. Maple’s total value locked (TVL) surged above $3.1 billion in late October, marking its highest level since 2022. Analysts attribute the spike to increased activity from institutional liquidity providers.

Maple’s total value locked (TVL): DefiLlama

Maple’s total value locked (TVL): DefiLlama

Meanwhile, these providers are entering the RWA sector. Maple has positioned itself as a bridge between DeFi and real-world financial assets.

Market Reaction and RWA Context

The MIP-019 proposal has drawn significant attention from on-chain analysts and key opinion leaders (KOLs). For instance, RWA-focused commentator @RWA_Guru described the change as “ultra-bullish.”

“Reduces inflation, caps supply growth, and introduces stronger governance incentives.” He highlighted how Maple’s move.

These factors are critical for sustainable DeFi credit markets.

“The token crushed a multi-month downtrend,” said @TokenTalk3x, noting the market momentum around SYRUP following the proposal’s approval.

The broader RWA sector has grown rapidly over the past year. Protocols such as Centrifuge, Ondo, and Clearpool capture institutional demand for tokenized credit instruments. Maple’s strategy reflects a growing recognition. DeFi’s future may depend on integrating with off-chain, yield-generating assets. The platform replaces staking emissions with buybacks funded by real yield.

Risks and Institutional Outlook

Analysts have welcomed MIP-019. However, they caution that Maple’s new model introduces dependencies on external credit conditions. A downturn in RWA yields could limit Maple’s buyback capacity. A contraction in institutional borrowing would have the same effect.

Nevertheless, market observers see the governance shift as part of a larger evolution. The industry is moving toward “on-chain credit infrastructure.” Many analysts believe DeFi protocols are maturing from speculative farming to genuine financial utility.

Consequently, Maple’s latest governance overhaul represents more than a tokenomics tweak. It signals DeFi’s continued convergence with traditional finance. The company anchors protocol value in real-world credit flows, positioning Maple at the center of the RWA-driven on-chain lending revolution.