Week Ahead: Crypto market outlook could set to change after stale weekend

- Crypto markets are likely to see a spike in volatility this week after a silent weekend.

- The failed attempts from bulls and bears suggest that BTC could continue to move sideways.

- The US CPI could induce a short-lived volatility spike if the Fed's decision veers off the expected course.

Not many interesting developments occurred over the weekend, but this week could see a spike in volatility. Why? Despite the sell signals on Bitcoin’s weekly chart, the bears have failed to knock the price lower. This failed attempt at a correction could become costly for short sellers in the near future.

Also read: Bitcoin Weekly Forecast: Short-term holders add 1.12 million BTC, what does this mean?

BTC/USDT 1-week chart

Macroeconomics’ influence on crypto wanes

Macroeconomic events had a major impact on the crypto markets in 2021 and 2022, and since 2023, this effect has waned. A major event like the US Consumer Price Index (CPI) coming up on Wednesday at 12:30 GMT would have had short-term implications on Bitcoin price, but considering the recent activity, crypto markets will likely remain unaffected.

Also read: US Dollar strength could be one of the reasons why Bitcoin could crash more

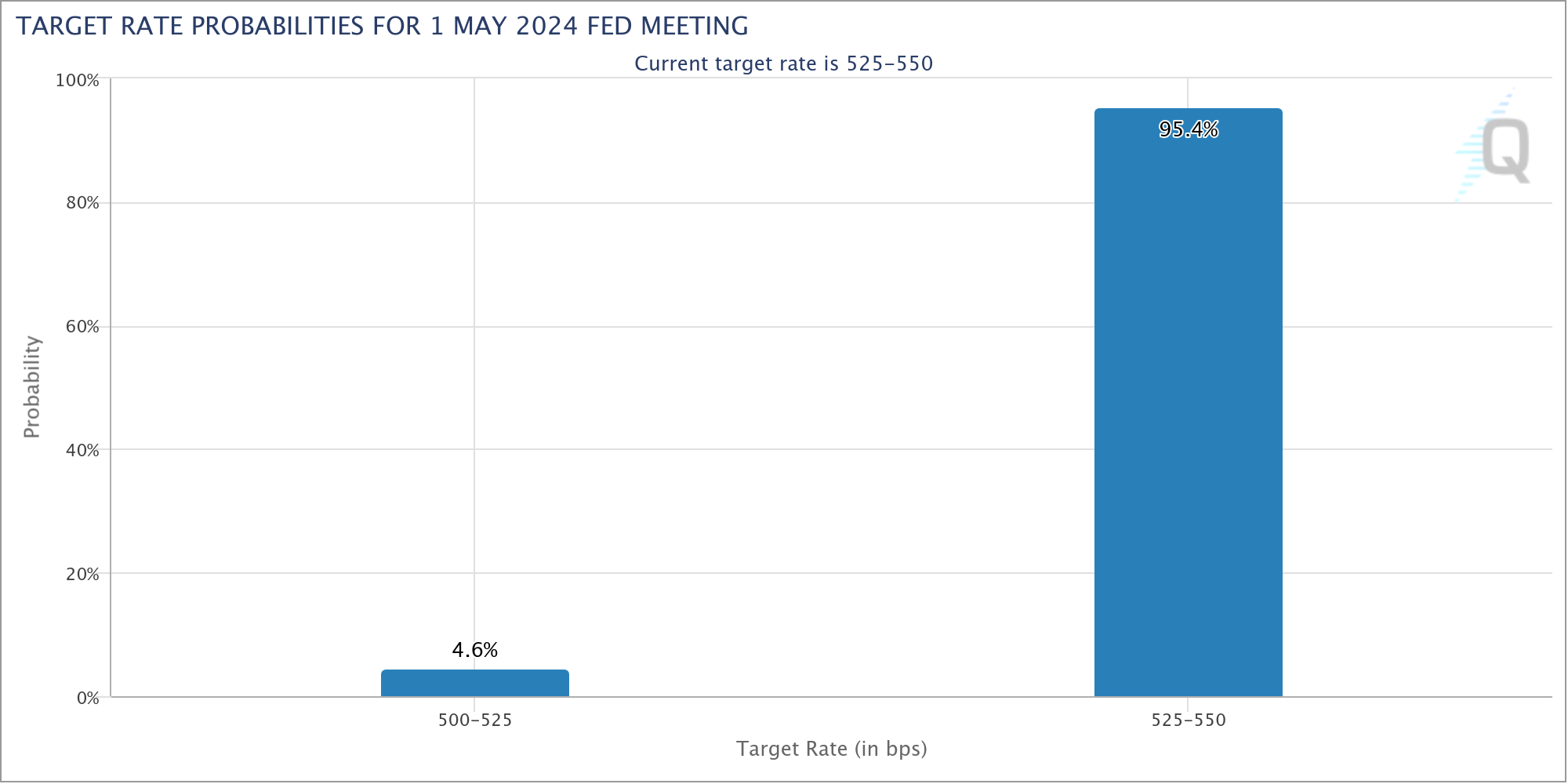

Regardless, the CME Group FedWatch Tool shows that there is a 95.4% odds that the interest rates will remain unchanged at the current 5.25% to 5.50% range in the Fed’s May meeting.

CME FedWatch Tool

Crypto events this week

Tuesday, April 9:

- Mina Protocol (MINA) Devnet Upgrade

Wednesday, April 10:

- US CPI

- SUI Base camp

- Binance Coin (BNB) Pawnee Hard Fork

- Stark “Influence” game pre-release

Friday, April 12:

- Aptos (APT) $400 million unlock

Top 3 Reads

Bitcoin price tags $69K as BlackRock enhances Wall Street’s presence in BTC market

Ethereum Layer 2 chains see nearly 32 million transactions per week after Dencun upgrade

XRP price ranges below $0.60 despite Ripple stablecoin launch announcement