Bitcoin Price Forecast: BTC stabilizes around $108,000 as ETF inflows return amid cautious sentiment

- Bitcoin price steadies around $108,000 on Wednesday after facing rejection from the 50-day EMA the previous day.

- Mixed investor sentiment keeps traders cautious, limiting the upside potential in riskier assets like Bitcoin.

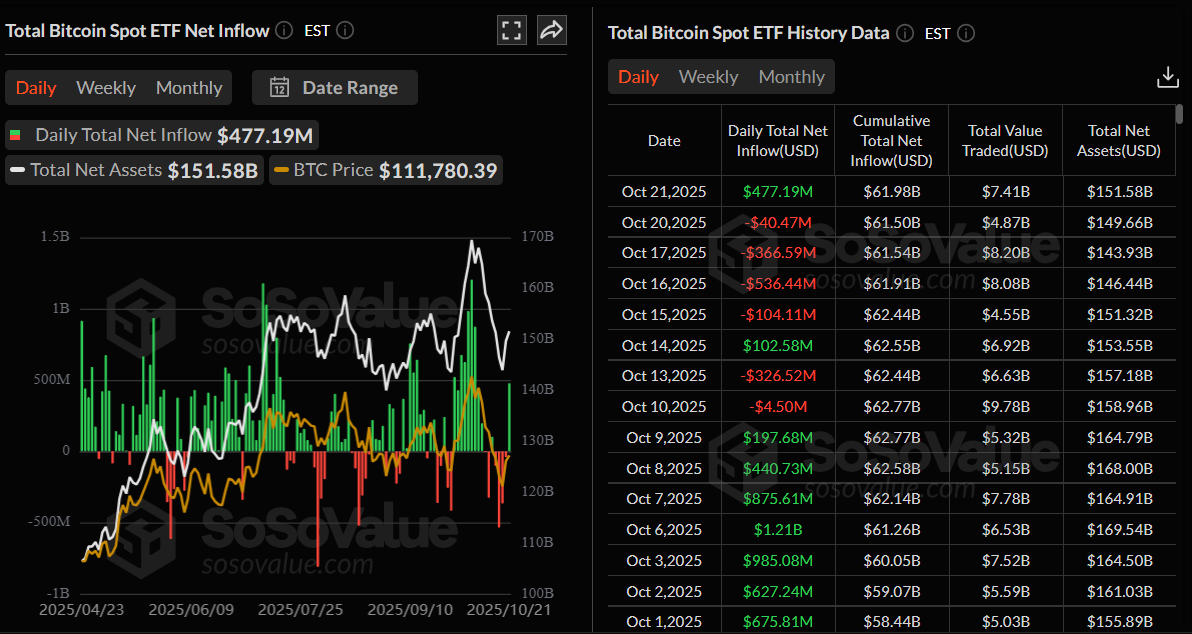

- US-listed spot Bitcoin ETFs record an inflow of $477 million on Tuesday, breaking the streak of outflows since October 15.

Bitcoin (BTC) price steadies around $108,000 at the time of writing on Wednesday after being rejected from a key resistance level the previous day. Investor sentiment remains cautious, limiting significant upward momentum in riskier assets such as BTC. Meanwhile, US-listed spot Bitcoin Exchange Traded Funds (ETFs) recorded an inflow of over $477 million on Tuesday, breaking a streak of outflows and providing some support for the BTC price.

Mixed sentiment among Bitcoin traders

On Monday, US President Donald Trump expressed confidence that an upcoming meeting with Chinese President Xi Jinping, on the sidelines of the Asia Pacific Economic Cooperation summit in South Korea later this month, would yield a “good deal” on trade. However, he also conceded that the highly anticipated talks may not happen. Moreover, US Treasury Secretary Scott Bessent is set to meet with his Chinese counterparts to discuss a de-escalation of trade tensions

Easing US-China trade tensions provided mild support to riskier assets like Bitcoin, which briefly reclaimed the $114,000 level before closing Tuesday’s session with a 2% decline.

On the geopolitical front, Trump said on Tuesday he did not want a "wasted meeting" after a plan to have face-to-face talks with his Russian counterpart, Vladimir Putin, about the war in Ukraine was put on hold, according to the BBC report.

The report further highlighted that key differences between US and Russian proposals for peace became increasingly clear this week, seemingly dashing the chances of a summit.

These mixed signs on the geopolitical front and the ongoing shutdown of the US government are making investors more cautious, keeping a lid on riskier assets such as Bitcoin.

Wenny Cai, Co-Founder and COO at SynFutures, told FXStreet in an exclusive interview that "the sharp intraday swings seen across Bitcoin, Ethereum, and major altcoins reflect a cautious market sentiment, which is unsurprising following the massive liquidation earlier this month."

Cai continued after Tuesday's brief recovery that traders are back to reacting to macro cues like rising bond yields, geopolitical uncertainty, and thin liquidity. In this kind of environment, even small changes in risk appetite trigger outsized moves.

Mild inflow in the institutional demand

On the institutional front, there is a mild demand for Bitcoin. According to SoSoValue data, Bitcoin spot ETFs recorded an inflow of $477.19 million on Tuesday, breaking the streak of outflow since October 15. If these inflows continue and intensify, BTC price could recover.

Total Bitcoin Spot ETF net inflow daily chart. Source: SoSoValue

Bealls Inc. became the first national retailer to accept digital currencies

Bealls Inc., a privately held retail corporation operating across the United States, announced on Monday a partnership with digital payments platform Flexa to enable cryptocurrency payments across more than 660 stores nationwide. With this integration, Bealls becomes the first national retailer to accept digital assets from over a dozen blockchains, including BTC, ETH, stablecoins and meme tokens.

This news is bullish for the overall crypto market in the long term as it signals growing mainstream adoption, validates the utility of cryptocurrencies in everyday transactions, and indicates wider acceptance. Moreover, it could also encourage other large retailers to integrate crypto payments, which could increase demand and usage across multiple blockchain networks.

Bitcoin Price Forecast: BTC faces rejection from the 50-day EMA

Bitcoin faced rejection from the 50-day Exponential Moving Average (EMA) at $113,606 on Tuesday, closing at $108,297 and losing 2% on the day. At the time of writing on Wednesday, BTC stabilizes and trades at around $108,000.

If BTC continues its correction, it could decline toward the 61.8% Fibonacci retracement (drawn from the April low of $74,508 to the record high of $126,199) at $106,453. A successful close below this level could extend additional losses toward the October 10 low of $102,000.

The Relative Strength Index (RSI) on the daily chart reads 40, below the neutral level of 50, indicating that bearish momentum is gaining traction. Additionally, the Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover last week, which remains in effect, further supporting the bearish view.

BTC/USDT daily chart

On the other hand, if BTC recovers and closes above the ascending trendline, it could extend the recovery toward the 50-day Exponential Moving Average (EMA) at $113,608.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.