Ethereum Price Forecast: Asia backers to join forces to launch $1 billion ETH treasury

- Asian crypto leaders are preparing to launch a $1 billion Ethereum treasury.

- The initiative has already attracted investment of up to $1 billion from institutional investors, including HongShan Capital Group and Avenir Capital.

- ETH is struggling to defend the support level near $3,800.

Ethereum (ETH) declined by 2% on Friday despite reports of key crypto investors in Asia collaborating in an effort to launch a $1 billion ETH treasury, according to Bloomberg.

Key Asia crypto backers set to launch $1 billion Ethereum treasury

Several crypto leaders in Asia have begun plans to enter the Ethereum treasury race, with Li Lin, founder of crypto exchange Huobi and chairman of investment firm Avenir Capital, joining forces with a group of investors in an effort to launch a $1 billion ETH treasury.

The cohort includes HashKey Group CEO and Chairman Xiao Feng, Fenbushi Capital co-founder Shen Bo and Meitu Inc. founder Cai Wensheng.

The initiative has already seen investors pledge about $1 billion, including a $500 million investment from institutional investors, including HongShan Capital Group (formerly Sequoia China) and $200 million from Lin's Avenir Capital, Bloomberg reported, citing people familiar with the matter.

An official announcement regarding the treasury's launch is expected within the next two to three weeks. However, Bloomberg reported that discussions are still underway, and the details of the plan may yet be revised.

The move adds to the list of digital asset treasuries focused on acquiring ETH as a reserve asset. Ethereum treasury companies currently hold 3.6 million ETH, led by BitMine Immersion (BMNR), with 1.7 million ETH. SharpLink Gaming follows behind with over 797,000 ETH worth roughly $3 billion.

With more firms pivoting to an Ethereum treasury, experts are predicting a bubble. BitMine Chairman Thomas Lee stated that the 'bubble has burst' in digital asset treasury companies, as many trade below net asset value.

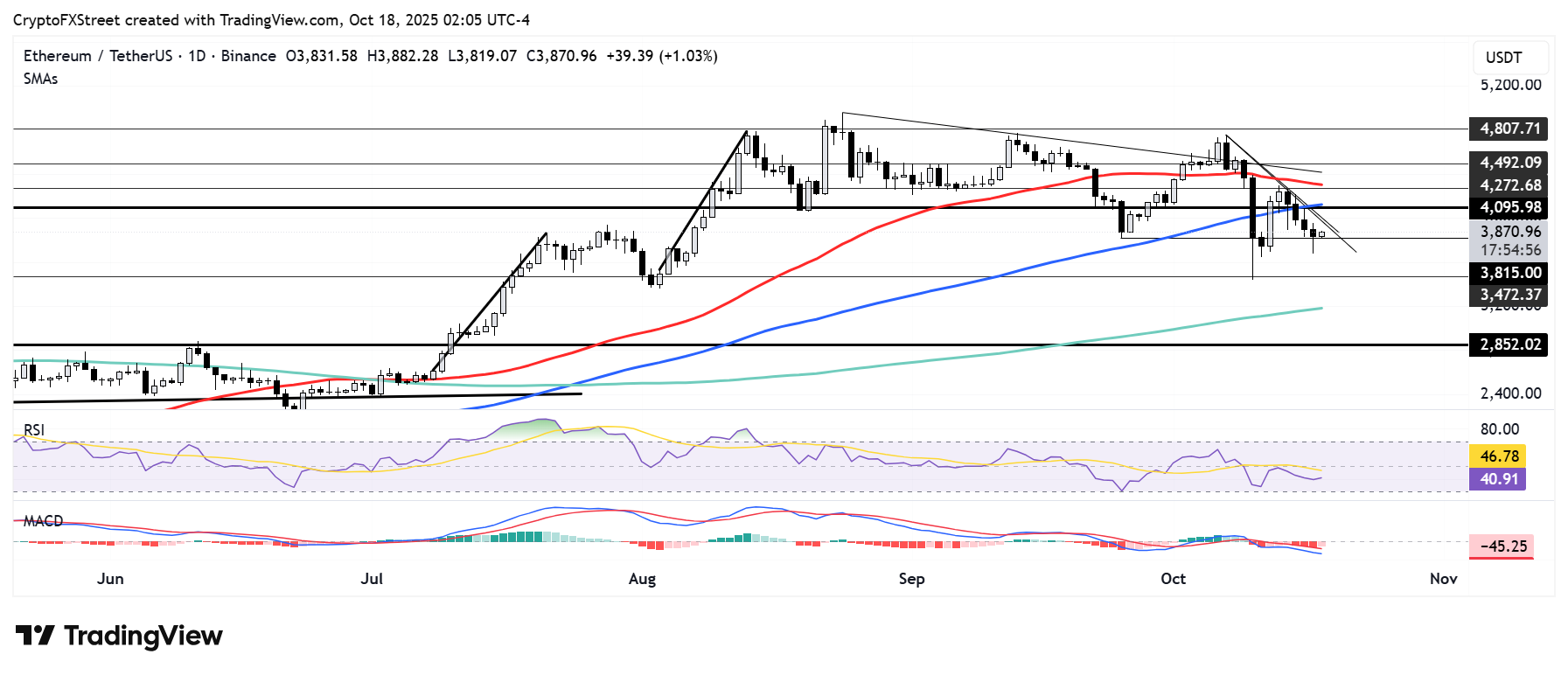

Ethereum Price Forecast: ETH tests $3,800 support

Ethereum experienced $215.9 million in futures liquidations over the past 24 hours, spearheaded by $146.1 million in long liquidations.

ETH briefly declined below the key support at $3,815, but bulls quickly recovered the level. However, the top altcoin still faces pressure at the level with a descending trendline resistance standing above it.

ETH/USDT daily chart

A failure to hold $3,800 could send ETH toward the support just below $3,500.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are below their neutral levels, indicating a dominant bearish momentum.