Monero Price Forecast: XMR extends recovery as on-chain metrics turn bullish

- Monero continues its recovery on Monday after bouncing from a key support level last week.

- Metrics signal strengthening momentum, with weekly trading volume hitting a yearly high and funding rates turning positive.

- The technical outlook points to further upside potential, with XMR eyeing a move above the $350 mark.

Monero (XMR) price extends its recovery, trading above $314 at the time of writing on Monday, after finding support around a key level last week. On-chain and derivatives data support bullish sentiment as weekly trading volume hits a yearly high and funding rates turn positive. On the technical side, the daily chart points to further upside with bulls aiming for levels above $350.

XMR extends recovery as bullish momentum builds

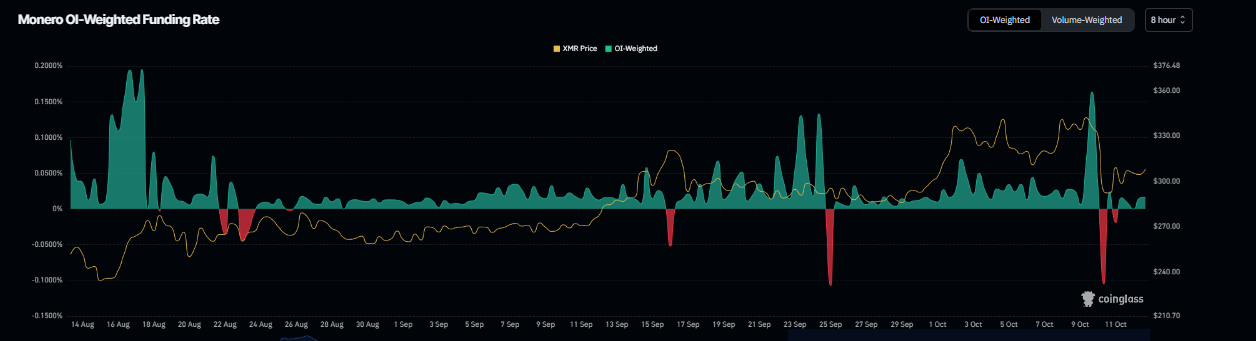

CoinGlass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of Monero will slide further is lower than that anticipating a price increase.

The metric has turned positive and reads 0.016% on Monday, indicating that longs are paying shorts. Historically, when the funding rates have flipped from negative to positive, the XMR price has rallied sharply.

Monero funding rate chart. Source: Coinglass

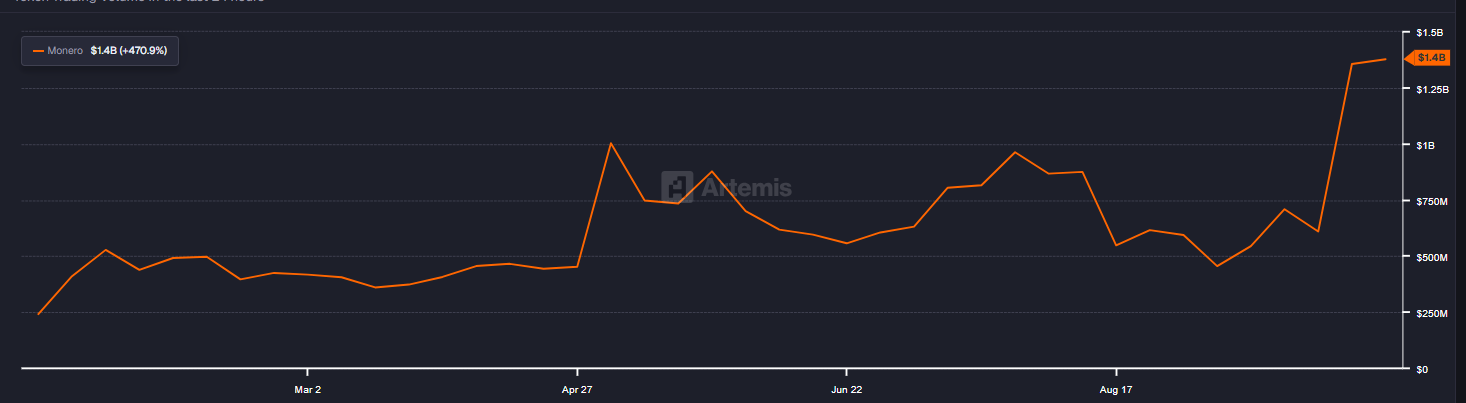

Artemis terminal data indicate that the XMR ecosystem’s weekly trading volume (the aggregate weekly trading volume generated by all exchange applications on the chain) reached a new yearly high of $1.4 billion last week and has been steadily rising since early September. This volume rise indicates a surge in traders’ interest and liquidity in the XMR chain, boosting its bullish outlook.

XMR weekly trading volume chart. Source: Artemis

Monero Price Forecast: XMR bulls aiming for $357 mark

Monero price faced rejection around the daily level of $348.30 and declined by over 14% on Friday. However, XMR retested its key daily support at $278.75 and rebounded slightly. XMR continued its recovery during the weekend by nearly 4%. At the time of writing on Monday, XMR extends its recovery by 3.3% trading above $314.

If XMR continues its recovery, it could extend the rally toward the July 14 high of $357.66.

The Relative Strength Index (RSI) on the daily chart reads 53, above its neutral level of 50, indicating bullish momentum is gaining traction.

XMR/USDT daily chart

On the contrary, if XMR faces a correction, it could extend the decline toward the 61.8% Fibonacci retracement level at $303.49 (drawn from the August low of $231 to the October 9 high of $348.3).