Bulls Flock to BNB As Chinese Bank Mulls $600 Million Investment in the Binance Token

China Renaissance Holdings Ltd is seeking to raise roughly $600 million to establish a digital-asset treasury centered on BNB.

Meanwhile, based on the volume profile indicator, the BNB token could be primed for further upside, potentially culminating in a new all-time high (ATH).

China Renaissance and CZ’s YZi Labs Target $600 Million BNB Treasury

The Beijing-based investment bank recently saw the return of its once-detained founder, Bao Fan. According to people familiar with the matter, the initiative will involve YZi Labs (formerly Binance Labs), the family office of Binance co-founder Changpeng Zhao (CZ).

Together, China Renaissance and YZi Labs are expected to contribute $200 million to the venture, with the remainder sourced from institutional backers and public investors.

If finalized, the funds will be used to create a publicly listed vehicle in the US dedicated to acquiring and holding BNB. Such a strategy would mirror the crypto treasury model, which continues to redefine corporate balance sheet management.

China Renaissance had already hinted at its crypto ambitions in an August filing, disclosing plans to invest about $100 million directly in BNB.

BNB Eyes New All-Time High

Meanwhile, technical analysis suggests BNB may be poised for new highs soon, with bullish hands controlling the third-largest crypto by market cap metrics.

As of this writing, BNB was trading for $1,319, up almost 8% in the last 24 hours. While altcoin recently established a new peak at $1,375, late bulls could miss out on a potential leg-up.

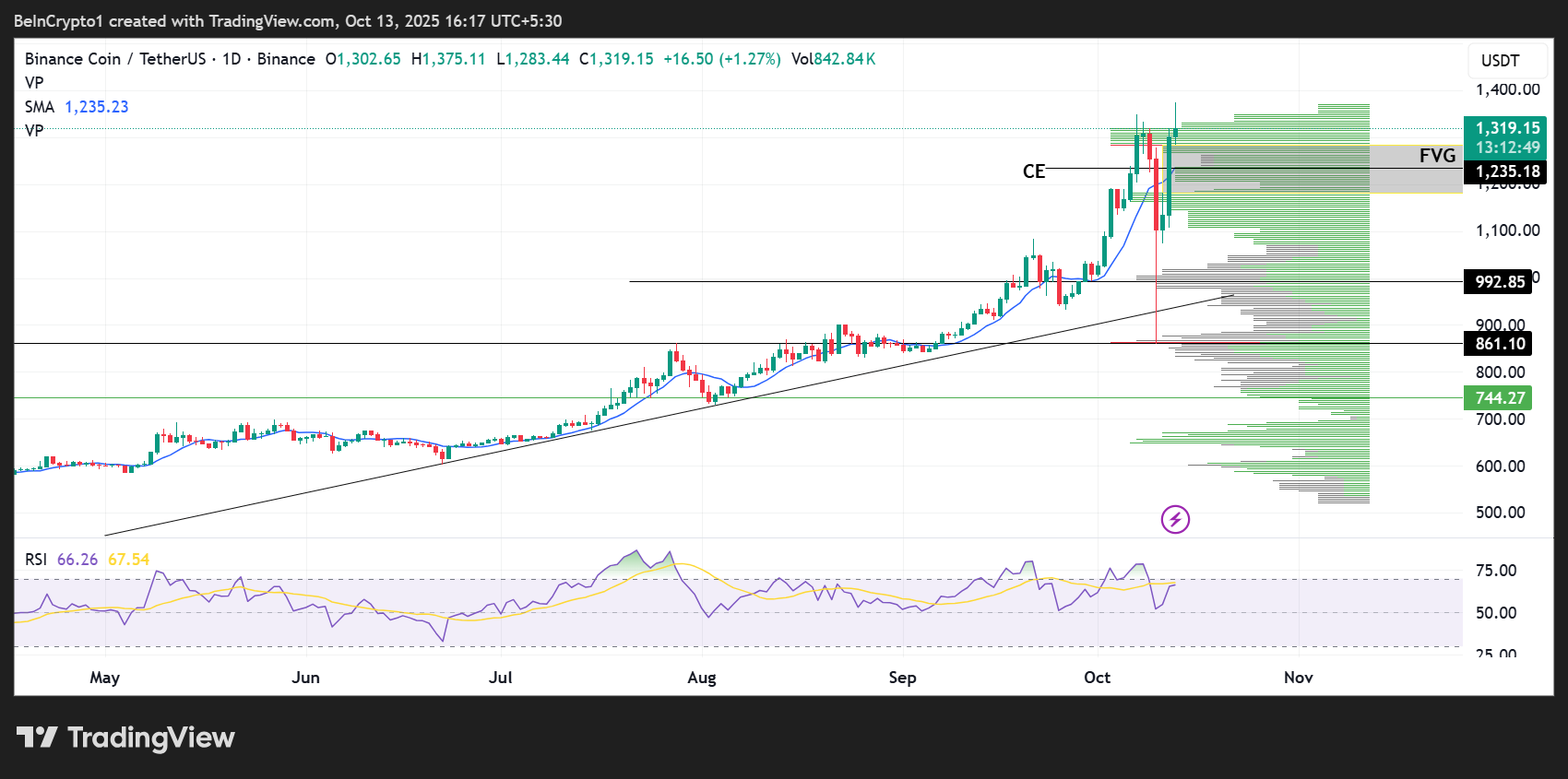

Based on the volume profiles, shown with green horizontal bars on the one-day timeframe, bulls currently control BNB and are actively interacting with the altcoin at current price levels.

The Simple Moving Average (SMA) provides initial support at $1,235, with the RSI indicator showing rising momentum. With the RSI position at 66, there is still more room to the upside before BNB can be considered overbought.

Based on this, increased buying momentum could see the BNB price clear its $1,375 peak to establish a new ATH soon.

BNB Price Performance. Source: TradingView

BNB Price Performance. Source: TradingView

However, the BNB price may also be poised for a correction before the next leg up. After a sudden rally on October 12, the price left an inefficiency or imbalance (FVG or fair value gap) that needs to be filled. This FVG extends between $1,182 and $1,283.

The FVG’s consequential encroachment (CE) midline at $1,235 is also vital, providing a support confluence with the SMA at $1,235.

Should the price fall below $1,235 decisively on the one-day timeframe, it could exacerbate the correction, potentially sending the BNB price as low as $1,100. In a dire case, the downtrend could extend to $992.85, almost 25% below current levels.

If push comes to shove, the correction could extrapolate towards the $861.10 support level, recollecting the sell-side liquidity (SSL) left on Friday when crypto markets flash-crashed.