XPL Price Reclaims $1 After 14% Rise, Yet Far From Full Recovery

Plasma (XPL) has reclaimed the $1 mark after a strong 14% surge in the past 24 hours, signaling the potential beginning of a sustained recovery phase.

The altcoin’s sharp rebound reflects renewed optimism from both investors and the broader market. With improving sentiment and favorable technical conditions, XPL may be gearing up for a continued rally in the days ahead.

Plasma Investors See An Opportunity

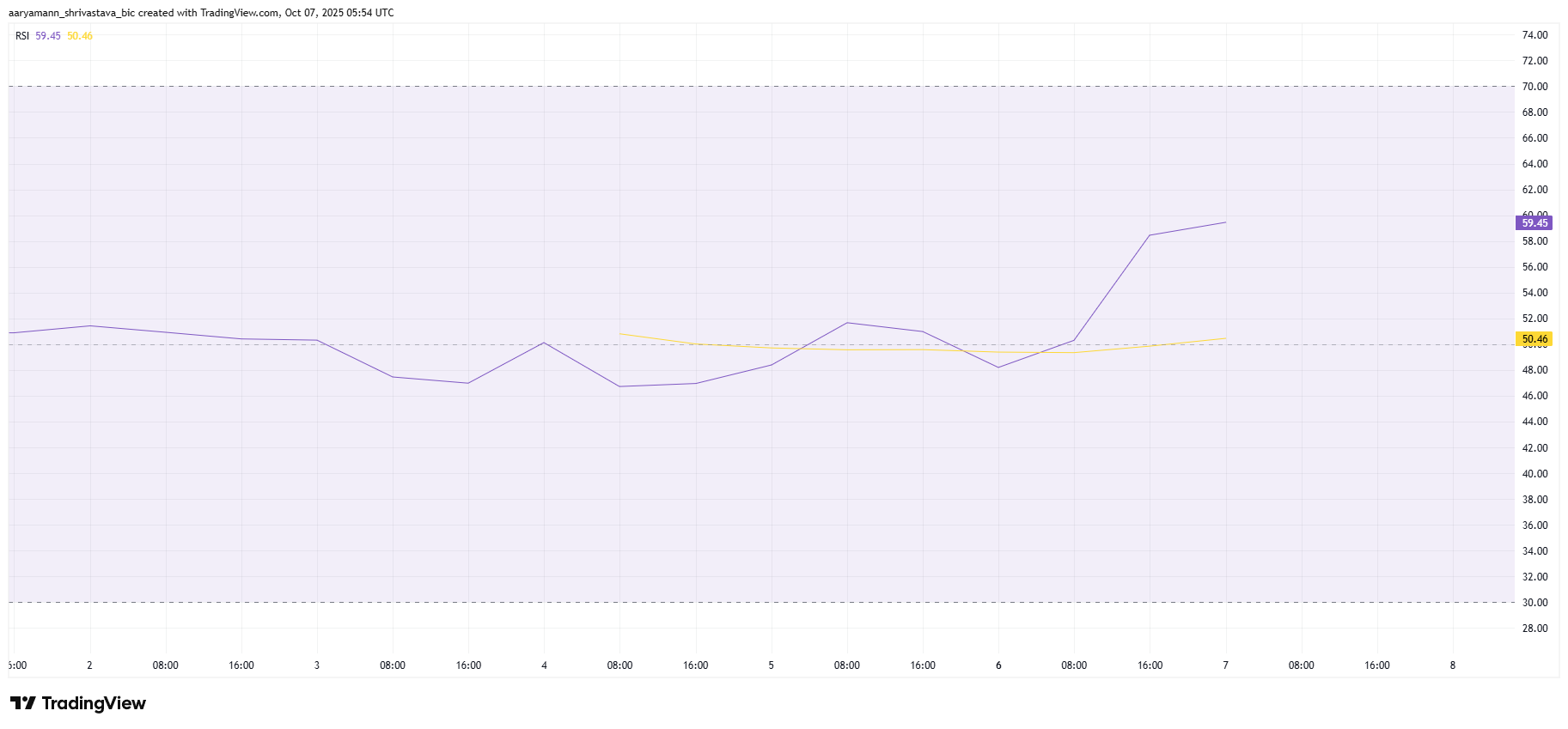

Plasma’s momentum is supported by improving technical indicators that suggest the market is primed for further upside. The Relative Strength Index (RSI) indicates that XPL is entering bullish territory, highlighting growing buying pressure. This shift marks a notable change from last week’s consolidation phase, suggesting that traders are regaining confidence in the asset.

External factors are also contributing to this trend. The ongoing US Government Shutdown and Bitcoin’s fresh all-time high this week have strengthened the overall crypto market’s bullish tone. As liquidity flows into digital assets, smaller altcoins like XPL benefit from renewed investor appetite, which could sustain its upward trajectory.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XPL RSI. Source: TradingView

XPL RSI. Source: TradingView

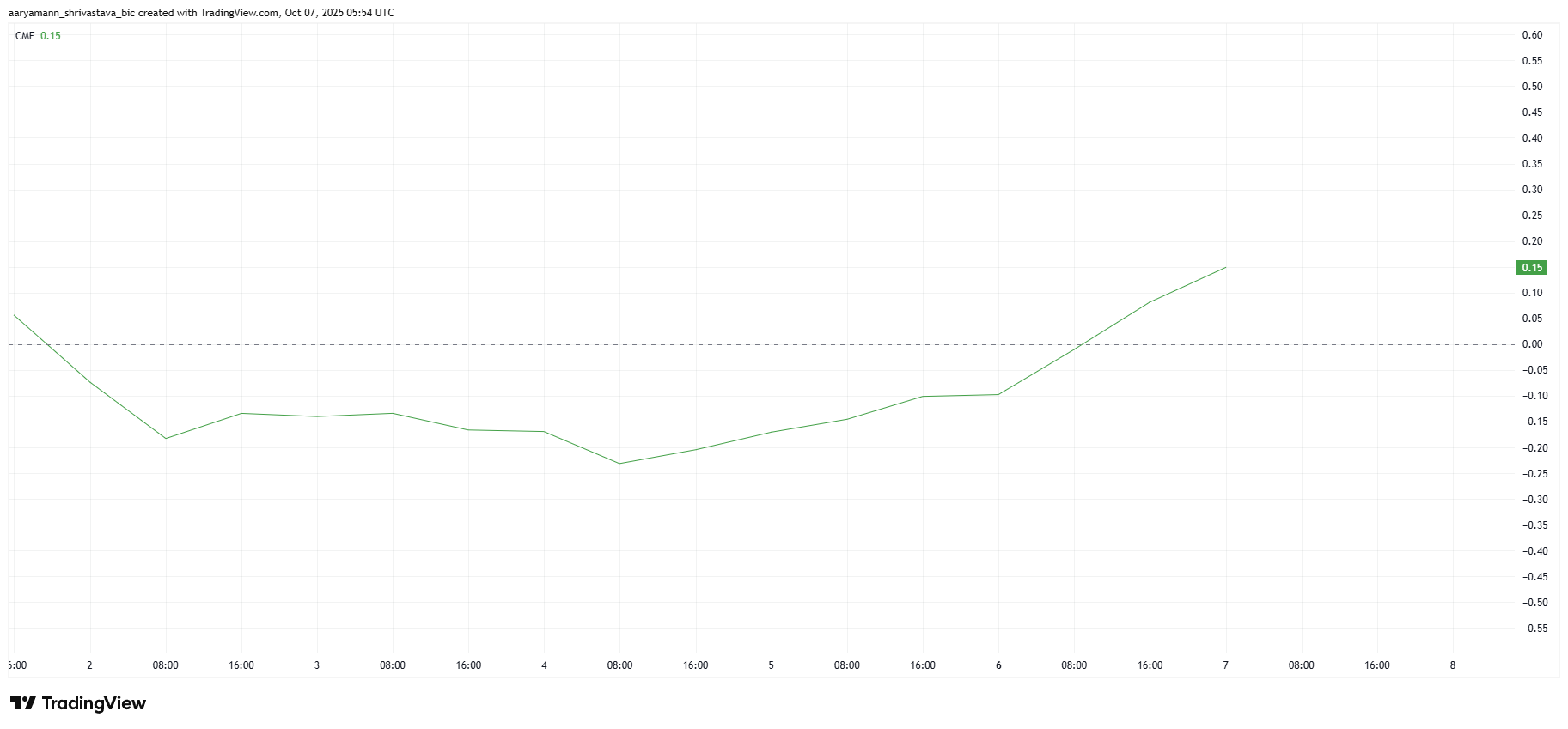

On the macro side, the Chaikin Money Flow (CMF) shows a sharp uptick, reflecting a surge in capital inflows into Plasma. This trend confirms that investors are allocating more funds toward XPL, potentially to capitalize on its relatively low price before a larger rally.

Such strong inflows often precede extended upward movements, as they signal growing conviction and market confidence. The willingness of investors to hold positions despite recent volatility underscores their long-term belief in Plasma’s value proposition.

XPL CMF. Source: TradingView

XPL CMF. Source: TradingView

XPL Price Awaits A Surge

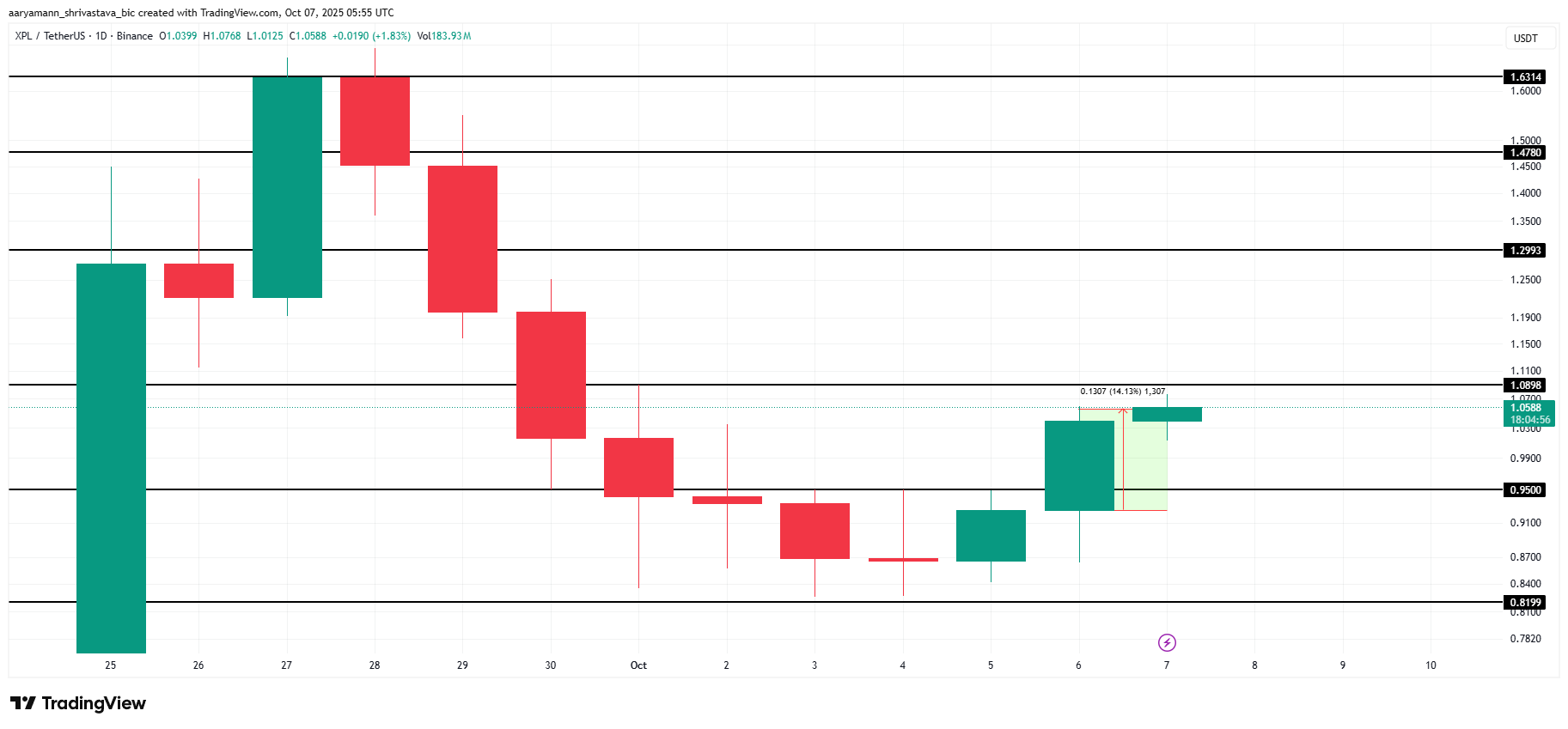

At the time of writing, XPL trades at $1.05, slightly below the key resistance level of $1.08. The altcoin’s 14% surge in a single day demonstrates strong bullish momentum, and holding above $1.00 would further reinforce investor confidence.

If market conditions remain steady, XPL could break above $1.08 and rally toward $1.29 or higher. Sustained buying activity and supportive macro trends would likely fuel this climb, potentially extending the recovery further.

XPL Price Analysis. Source: TradingView

XPL Price Analysis. Source: TradingView

However, if investor sentiment weakens or external conditions shift, XPL could retrace. A drop below $0.95 might expose the altcoin to further losses. This could potentially pull XPL down to $0.81 and invalidating the current bullish outlook.