What To Expect From Pi Coin In October 2025?

Pi Coin faced one of the harshest sell-offs in recent weeks, with its price crashing nearly 48% in a single day. This decline hit the altcoin harder than most other tokens, forming a new all-time low (ATL).

A recovery from this point is possible, but it depends heavily on investor participation and renewed market confidence.

Pi Coin Is Showing Weak Signs

Technical indicators show that Pi Coin recently entered the oversold zone. The Relative Strength Index (RSI) fell below 30.0, reflecting excessive selling pressure. While the RSI has started to recover, it must climb past 50.0 to confirm a meaningful shift toward bullish momentum in October.

Historically, Pi Coin has often reversed near the start of the month when the RSI bounced from oversold conditions. If this pattern holds, October could present a similar opportunity for recovery. Investors will be watching closely to see whether the altcoin can repeat this behavior and trigger renewed demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Pi Coin RSI. Source: TradingView

Pi Coin RSI. Source: TradingView

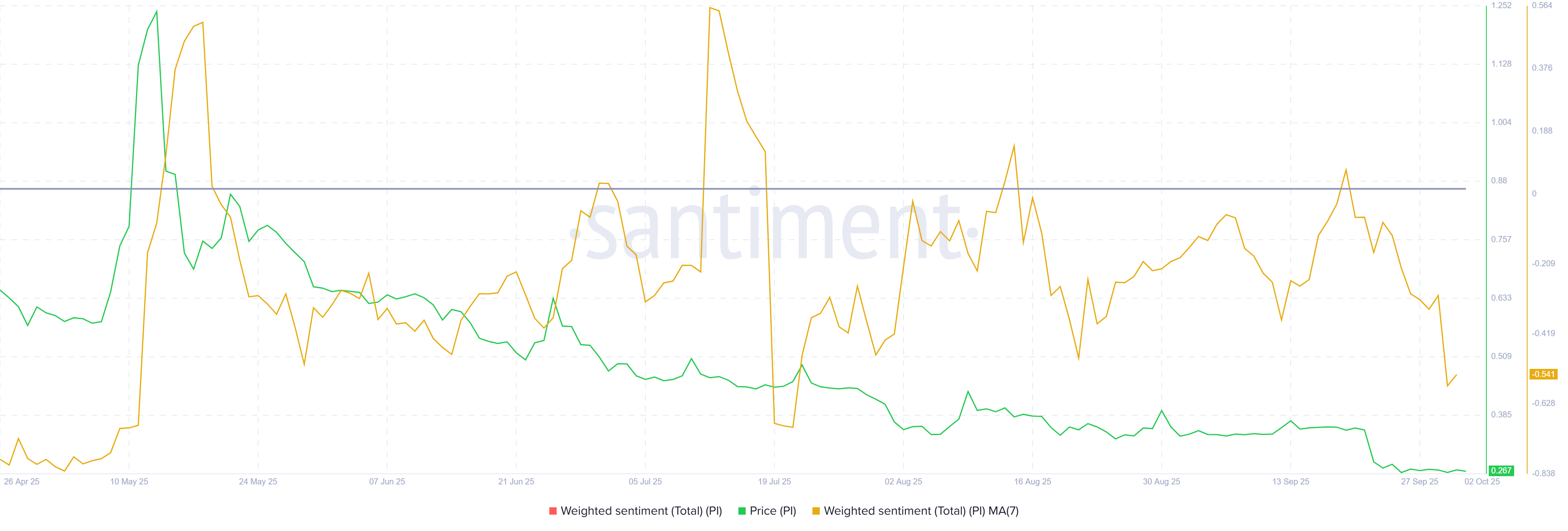

Investor sentiment around Pi Coin is currently sitting at a two-and-a-half-month low. Traders have not shown strong optimism in the past, and the recent crash has worsened the outlook. With weaker support from the community, Pi Coin faces an uphill battle to generate momentum without fresh buying pressure.

The absence of investor confidence could slow the pace of any rebound. While technical signals suggest a potential turnaround, sentiment-driven rallies require committed participation. Unless traders re-engage, Pi Coin may struggle to recover from its recent downturn and stabilize at higher levels.

Pi Coin Weighted Sentiment. Source: Santiment

Pi Coin Weighted Sentiment. Source: Santiment

PI Price May Have A Volatile October

Pi Coin experienced a volatile August, followed by an even more turbulent September. The near 48% single-day drop dragged the token down to a new ATL of $0.184. This marked a severe setback for the project and testing investor patience.

In October, often referred to as “Uptober” for its bullish seasonal trend, Pi Coin could attempt a recovery. A 35% rise would help the altcoin reclaim strength, with price targets set at $0.286 and $0.340. A rally past these levels could push Pi Coin to $0.360, effectively erasing the recent crash.

Pi Coin Price Analysis. Source: TradingView

Pi Coin Price Analysis. Source: TradingView

If declines continue, however, Pi Coin risks slipping below the $0.256 support. A deeper fall could send the price toward $0.200, invalidating the bullish outlook. This would signal further weakness for the altcoin as investor hesitation lingers.