Ethereum Price Lags Below $4,000—Support Levels To Watch

The Ethereum price has been one of the best performers in the cryptocurrency market in the third quarter, reaching a new all-time high at the end of August. However, the second-largest cryptocurrency has struggled to build on this record-setting momentum in September.

With September and the third quarter of 2025 almost done, the Ethereum price appears to be struggling to reclaim the psychological $4,000 support level. Below are the critical support levels to watch for should a deeper correction occur, according to the latest on-chain data.

Is $3,500 The Next Stop For ETH Price?

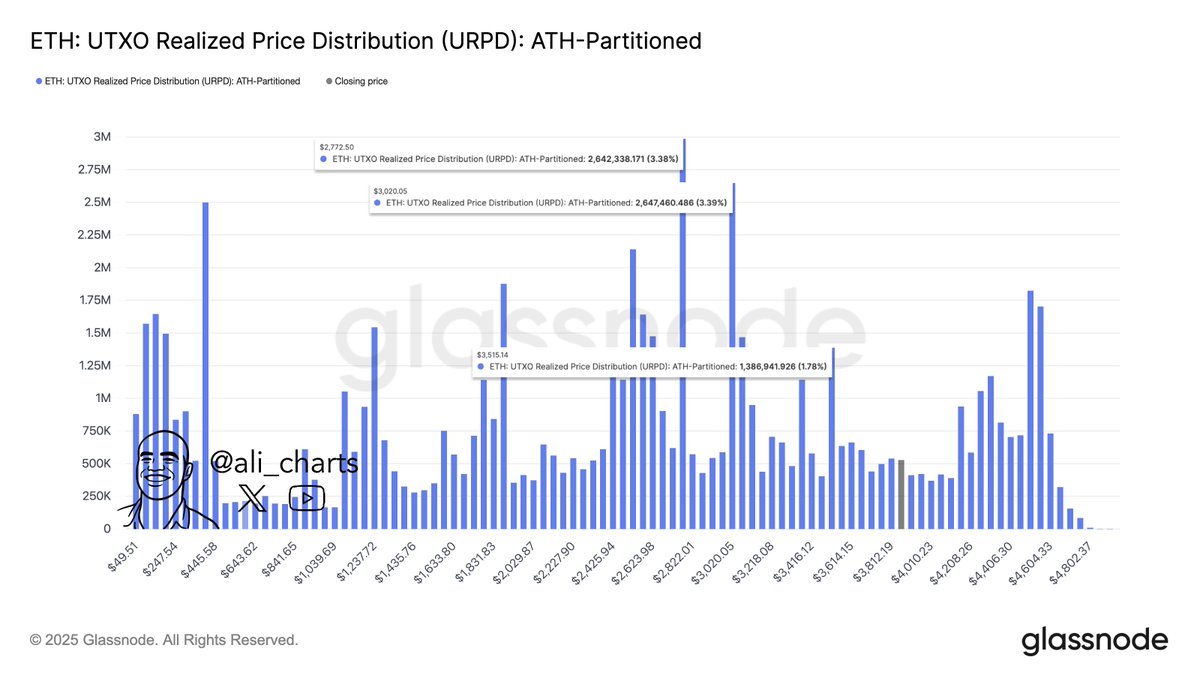

In a September 27 post on the X platform, popular crypto analyst Ali Martinez identified three major support levels to watch if the Ethereum price further declines over the next few weeks. This on-chain observation revolves around the UTXO Realized Price Distribution (URPD) metric, which estimates the amount of a specific cryptocurrency acquired at a certain price level.

This indicator looks at a price level’s capacity to act as an on-chain support or resistance zone, which typically depends on the number of investors with their cost basis at the given level. An investor’s cost basis refers to the original price at which they bought a crypto asset (Ether, in this scenario).

Based on the cost basis theory, major support zones are often around price levels—with significant buying activity—below the current spot value. Having purchased their assets at these prices, several investors tend to double down and purchase more assets when the price returns to their cost basis, thereby keeping the prices afloat.

According to data highlighted by Martinez, the next major support levels for the Ethereum price lie around $3,515, $3,020, and $2,772. As observed in the chart below, if the price of ETH doesn’t have a sustained close above $4,000, its next immediate support cushion is around $,3,515, where nearly 1.39 billion coins were purchased.

In a case where the “king of altcoins” fails to stop bleeding, the UTXO Realized Price Distribution metric shows that the next major support is at $3,020, where almost 2.65 billion coins were bought. Now, the last significant support for the Ethereum price lies around $2,772, which is the cost basis of more than 2.64 billion Ether tokens.

Ethereum Price At A Glance

As of this writing, the price of ETH stands at around $3,994, reflecting no significant movement in the past 24 hours. While the largest altcoin by market cap seems to be hanging on to the major $4,000 level, its performance over the past week is still quite worrying. According to data from CoinGecko, the Ethereum price is down by more than 10% in the last seven days.

Featured image from Shutterstock, chart from TradingView