Mantle Price Forecast: MNT holds steady uptrend amid Bybit integrations

- Mantle holds above $1.80, extending its upward move for the third consecutive day.

- VIP holder program and trading fees payment integrations on Bybit boost traders' sentiment.

- An increase in capital inflow in MNT derivatives suggests increased demand among traders.

Mantle (MNT) price advances higher for the third straight day, trading above $1.80 at press time on Wednesday. The announcement of the VIP holder program and trading fees discount over Bybit on Tuesday boosted the interest in MNT derivatives. Furthermore, the technical outlook suggests an extended rally, potentially reaching a new record high.

Bybit integrations spark optimism in MNT derivatives

Mantle announced two new integrations with the Bybit exchange on Tuesday, enabling MNT holders to receive 25% discounts on spot trading and 10% discounts on derivatives trading. Furthermore, the MNT tokens will be valued at 1.5 times, enabling Bybit users to achieve VIP status, which offers benefits such as reduced fees and higher deposit and withdrawal limits.

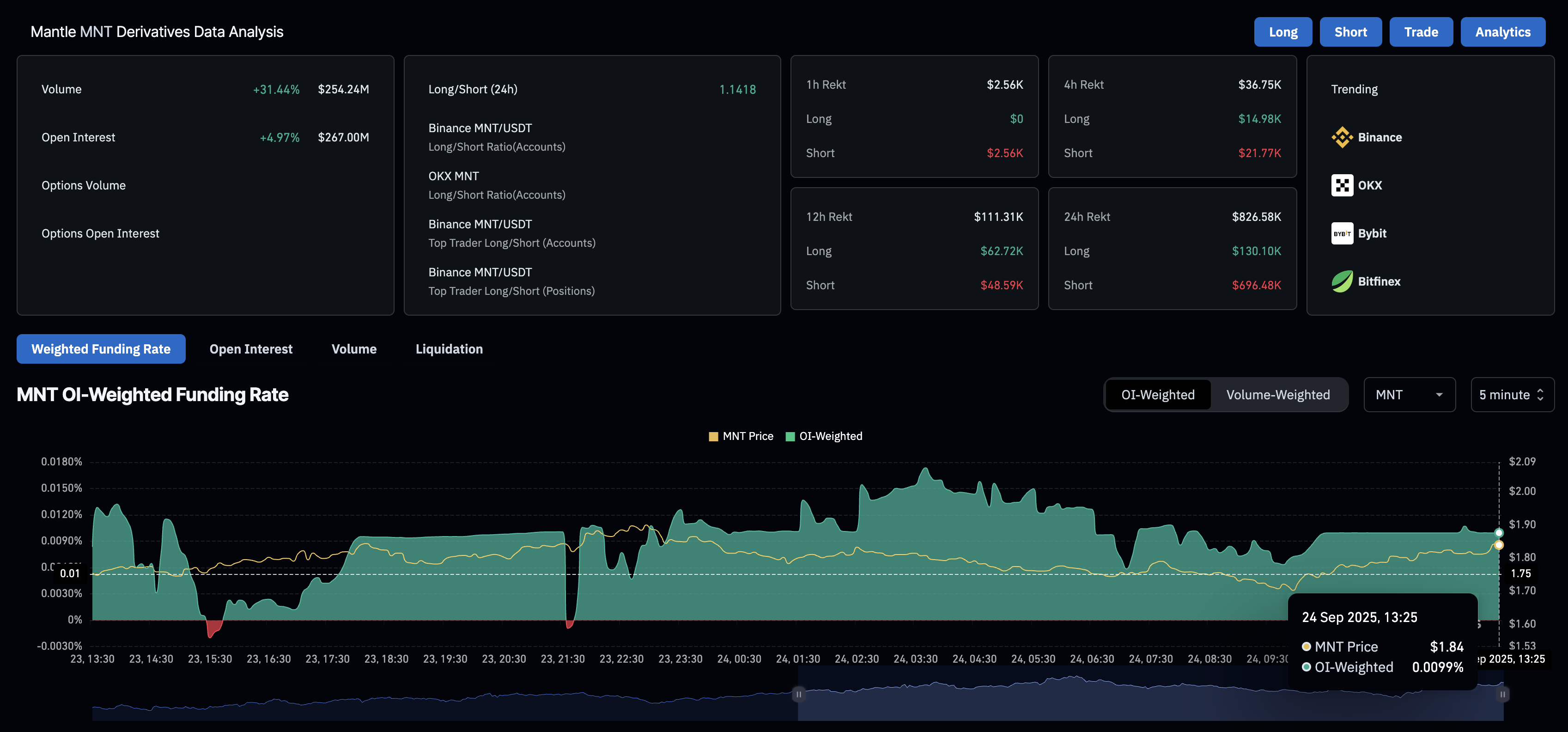

Following the new integrations, the CoinGlass data indicate that the MNT Open Interest (OI) has increased by 4.97% over the last 24 hours, now standing at $267.00 million. This significant capital increase locked in MNT derivatives points to risk-on sentiment among traders.

Validating the buying pressure, the OI-weighted funding rate remains stable at 0.0099% which bulls are paying to hold positions and offset the leverage-caused imbalance between spot and swap prices. Furthermore, the long-to-short ratio reads 1.1418, which indicates that there are more active long positions.

MNT derivatives data. Source: CoinGlass

Mantle stands on the verge of price discovery mode

Mantle appreciates over 4% at the time of writing on Wednesday, surpassing the R2 pivot level resistance at $1.80. A decisive close above this level could extend the MNT rally, potentially targeting the R3 resistance at $2.21 for a fresh record high.

The technical indicators on the daily chart suggest a bullish trend, supporting the upside potential in Mantle. The Moving Average Convergence Divergence (MACD) is sloping upward from its signal line, indicating a revival in bullish momentum and avoiding a bearish crossover. Furthermore, the Relative Strength Index (RSI) is at 67, inching closer to the overbought boundary, suggesting that the buying pressure is heightened with further space for recovery.

MNT/USDT daily price chart.

On the downside, if MNT flips below $1.80, it could retest the R1 pivot point resistance at $1.48.