Ethereum Price Forecast: ETH breaks $4,500 following steady accumulation and declining selling pressure

Ethereum price today: $4,650

- Ethereum investors have accumulated over 1.7 million ETH in the past few weeks, around the $4,300-$4,400 range, amid a contraction in selling pressure.

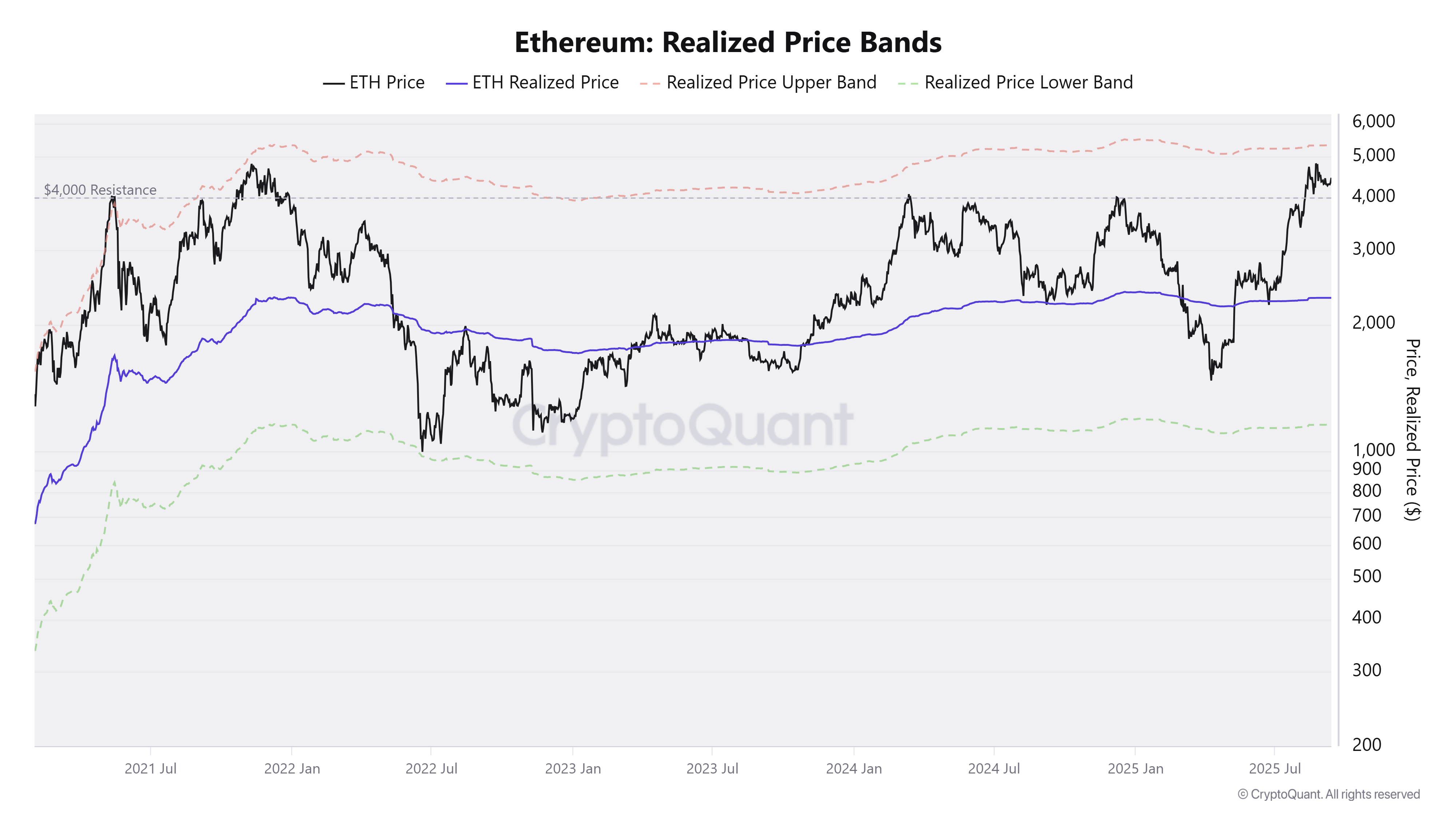

- Despite experiencing one of its strongest cycles, ETH has to clear the upper band realized price to stage another bullish run.

- ETH has broken above the $4,500 key resistance and is now eyeing a move toward its all-time high.

Ethereum (ETH) trades around $4,600 on Friday following strong accumulation from investors and declining selling pressure over the past few weeks.

Investors accumulate ETH as exchange inflows contract

Ethereum has been seeing strong accumulation around the $4,300-$4,400 range in the past few weeks. During this period, accumulation addresses — wallets with no record of selling activity — have purchased over 1.7 million ETH within this range, according to a Thursday note by a CryptoQuant analyst.

The analyst also noted that a majority of recent ETH activity has been dominated by withdrawals or outflows from exchanges, which have largely been processed at an average cost basis of $4,300, making it a potential strong support zone to withstand price declines.

"There is now a high sensitivity to maintaining the $4,300-$4,400 range. The accumulation of 1.7 million ETH at this level establishes it as a zone of significant interest and potential support," the analyst wrote.

While accumulation builds, selling activity has been contracting since ETH moved near the $5,000 level, as evidenced by declining exchange inflows. The seven-day moving average (MA) of ETH exchange inflows has declined by over 60% from nearly a three-year high in mid-August to 733,109 on Friday.

- All Exchanges-1757712984626-1757712984626.png)

ETH Exchange Inflows. Source: CryptoQuant

"Investors are sending lower amounts of ETH to exchanges, supporting price stability and suggesting confidence in further upside," CryptoQuant analysts stated in a weekly report on Thursday.

However, the analysts also highlighted a strong resistance or selling pressure around Ethereum's Realized Price Upper Band at $5,200. This follows ETH's correction near the upper band after hitting a new all-time high of $4,956 on August 24.

ETH Realized Price. Source: CryptoQuant

ETH is likely to continue consolidation or experience a further correction if it fails to break above the Realized Price Upper Band, the report states.

On a broader note, CryptoQuant analysts have highlighted how Ethereum is experiencing one of its strongest cycles, underscored by rapid institutional and corporate accumulation, rising whale demand, increased staking participation, and an expansion of smart contract activity.

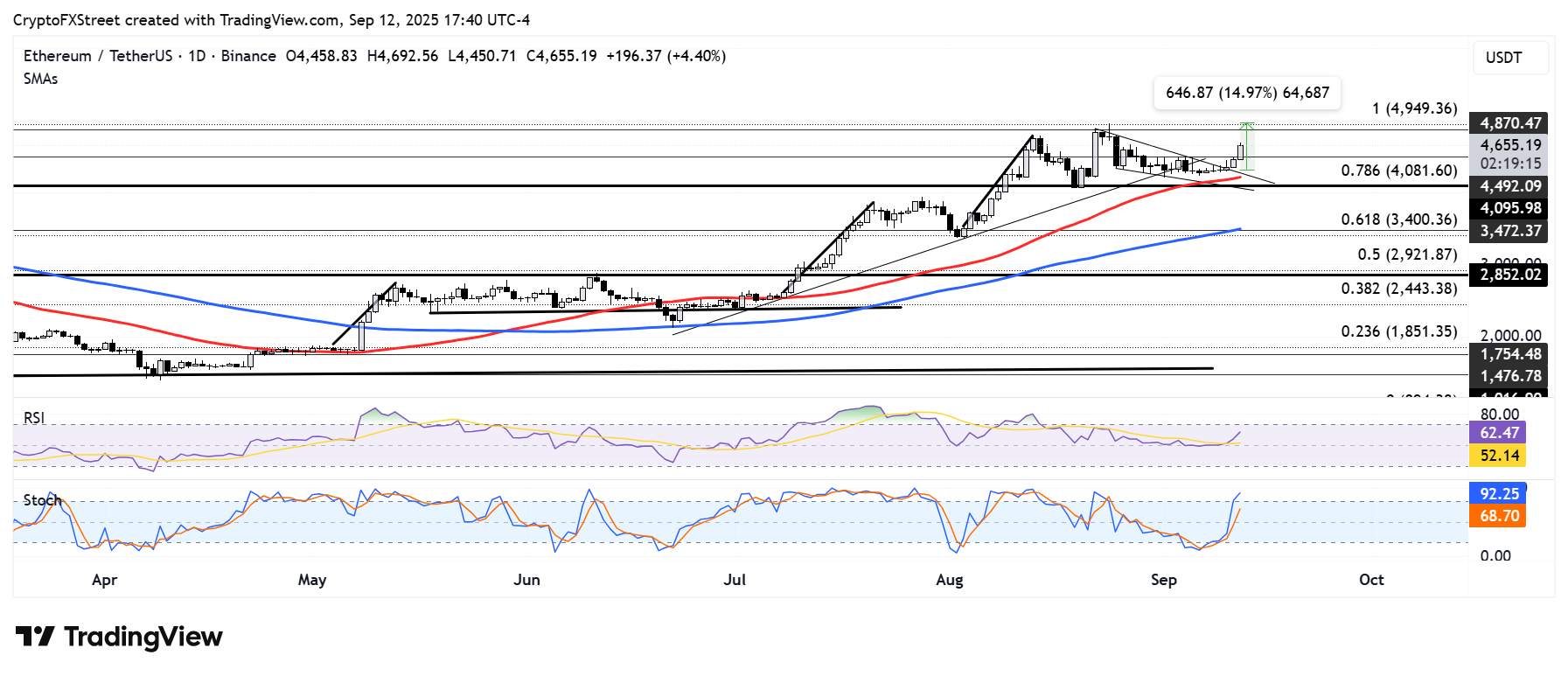

Ethereum Price Forecast: ETH breaks $4,500 resistance, eyes move toward all-time high

Ethereum experienced $104.7 million in futures liquidations over the past 24 hours, comprising $11.8 million and $92.9 million in long and short liquidations.

ETH has broken above the $4,500 level for the first time in September — a level that has served as a critical resistance over the past two weeks.

The move comes after ETH saw a breakout from a falling wedge pattern on Wednesday, priming it for a potential rally toward its all-time high resistance. The target is obtained by measuring the height of the falling wedge and projecting it upward from a potential breakout point.

ETH/USDT daily chart

On the downside, ETH is supported by the 50-day Simple Moving Average (SMA) and the upper boundary trendline of the falling wedge. Further down, the $4,000 psychological level serves as a critical support.

The Relative Strength Index (RSI) is above its neutral level after crossing its moving average line. Meanwhile, the Stochastic Oscillator (Stoch) is in its overbought region, indicating a dominant bullish momentum but with potential for a short-term pullback.