Ripple Price Forecast: XRP uptrend shows strong buy-side momentum as open interest rebounds

- XRP bulls target a break above $3.00, reflecting strong market sentiment.

- A steady increase in the futures Open Interest indicates increasing demand for XRP from retail investors.

- XRP exchange reserves surge, indicating investors’ readiness to sell as the price increases.

Ripple (XRP) is positioned above $3.00 on Friday, as bulls push to extend the uptrend, aiming for the record high of $3.66 reached on July 18. The uptick in the XRP price over the past week reflects bullish sentiment in the broader cryptocurrency market, which has seen the Altcoin Season Index rise to 78, indicating the beginning of the long-awaited altcoin season.

XRP holds $3.00 as retail demand soars

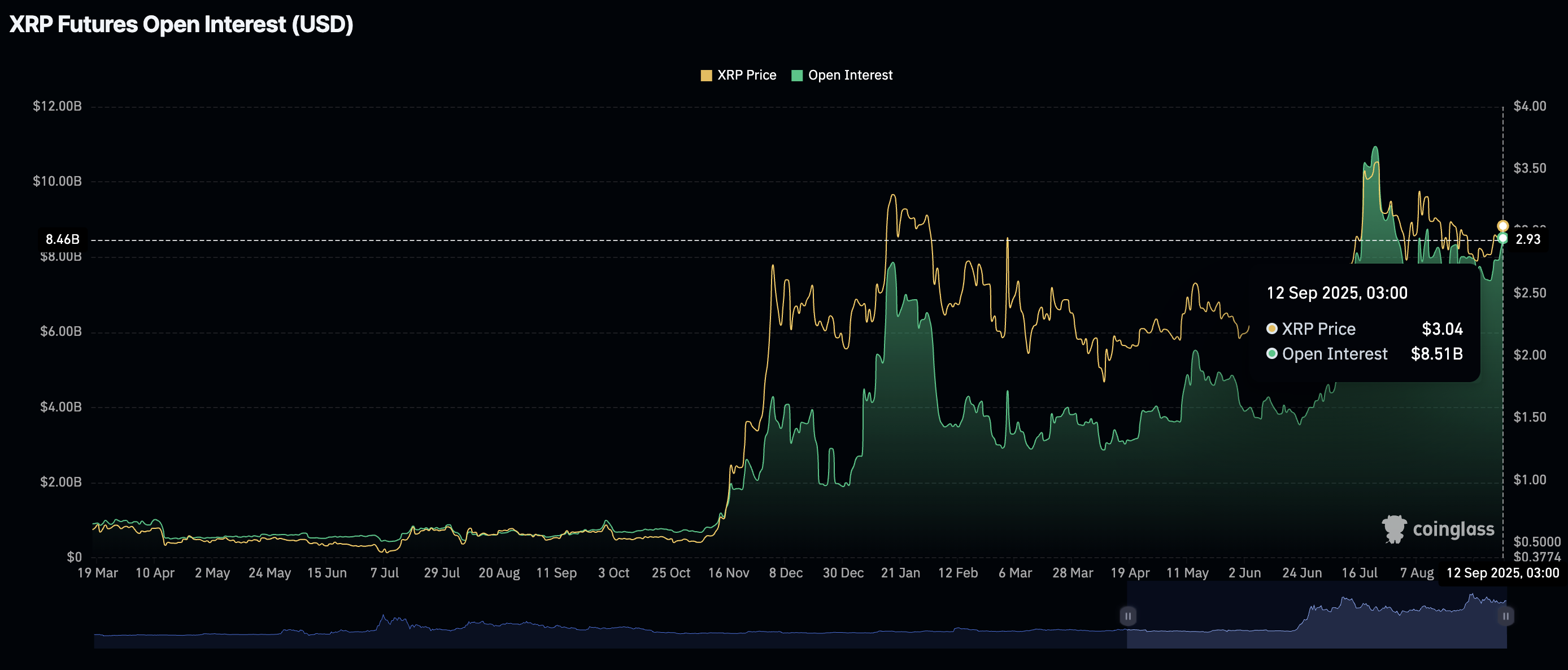

Interest in XRP has been rising this week, evidenced by the futures Open Interest (OI) averaging at $8.51 billion, up from $7.37 billion recorded last Sunday. Although the OI, referring to the notional value of outstanding futures contracts, stands below the July peak of $10.94 billion, a steady increase suggests that risk-on sentiment is growing as traders pile into long positions.

XRP Futures Open Interest | Source: CoinGlass

The futures-weighted funding rate is also rising steadily, averaging 0.0107% on Friday, which reinforces the positive market sentiment. This solid increase in OI, as shown in the chart below, implies that more traders are leveraging long positions in XRP, anticipating short-term price increases.

XRP Futures Weighted Funding Rate | Source: CoinGlass

Despite the surge in retail demand, investors should pay attention to the growth in XRP’s exchange reserves. According to CryptoQuant’s data, the balance of XRP on the Binance exchange currently stands at 3.66 billion coins, representing a 23% increase from approximately 2.8 billion tokens on August 31.

A persistent increase in exchange reserves often signals potential selling pressure, as traders deposit XRP on exchange platforms to either trade or liquidate their holdings. The immediate impact of higher exchange reserves is an increase in the available supply, which could push prices lower if demand fails to match it.

Notably, the correction is unlikely to be immediate; hence, this is an on-chain metric worth monitoring, especially for risk-averse traders.

XRP Exchange Reserves | Source: CryptoQuant

Technical outlook: What’s next as XRP holds critical $3.00 support

XRP is trading above $3.00 at the time of writing on Friday. A minor pullback from the intraday high of $3.07 suggests that profit-taking is underway. However, a buy signal from the Moving Average Convergence Divergence (MACD) has been maintained since Monday, supporting the bullish outlook for a breakout toward the next key resistance at $3.35, which was last tested in mid-August.

XRP/USDT daily chart

A closer look at the Relative Strength Index (RSI), which is currently at 55 and moving sideways, indicates a cooling of bullish momentum. If the RSI declines below the midline, XRP could extend the pullback below the $3.00 short-term support.

Traders should keep an eye on the 50-day Exponential Moving Average (EMA) at $2.92, which could serve as the first key level of support. If instability rocks the XRP market, the 100-day EMA at $2.79 and the 200-day EMA at $2.54 could come in handy to absorb potential sell-side pressure.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.