Bitcoin Price Forecast: BTC reclaims above $111,500 as Fed rate cut optimism, fresh corporate buys boost sentiment

- Bitcoin price extends its gains on Monday after recovering nearly 3% in the previous week.

- Market participants increase bets that the Federal Reserve could lower rates three times by year-end, lifting risk appetite.

- Metaplanet adds 136 BTC to its treasury, while El Salvador purchases 21 BTC to mark the fourth anniversary of its Bitcoin law.

Bitcoin (BTC) trades in green above $111,800 on Monday, supported by growing optimism over potential Federal Reserve (Fed) interest rate cuts and renewed institutional demand. Corporations such as Metaplanet and government entities in countries like El Salvador added BTC to their reserves, boosting market sentiment for the largest cryptocurrency by market capitalization.

Risk-on sentiment boosts after macroeconomic data

Bitcoin price extends its gains, trading above $111,900 during the early European trading session on Monday, after recovering almost 3% last week. This recovery came as the US Nonfarm Payrolls report released on Friday showed that the economy added just 22,000 jobs in August, missing market expectations by a big margin.

Moreover, revisions to earlier prints revealed that the economy lost 13,000 jobs in June, marking the first monthly decline since December 2020 and indicating deteriorating labor market conditions in the US. Furthermore, the US Unemployment Rate edged higher to 4.3% from 4.2% in August, as anticipated, while the Labor Force Participation Rate ticked up to 62.3% from 62.2%. Finally, annual wage inflation, as measured by the change in the Average Hourly Earnings, declined to the 3.7% YoY rate in August from 3.9% in the previous month.

These macroeconomic data releases last week led market participants to believe that the Fed might lower borrowing costs three times by the end of this year, which boosts risk-on sentiment, supporting a recovery in riskier assets, such as BTC.

Institutional demand supports Bitcoin recovery

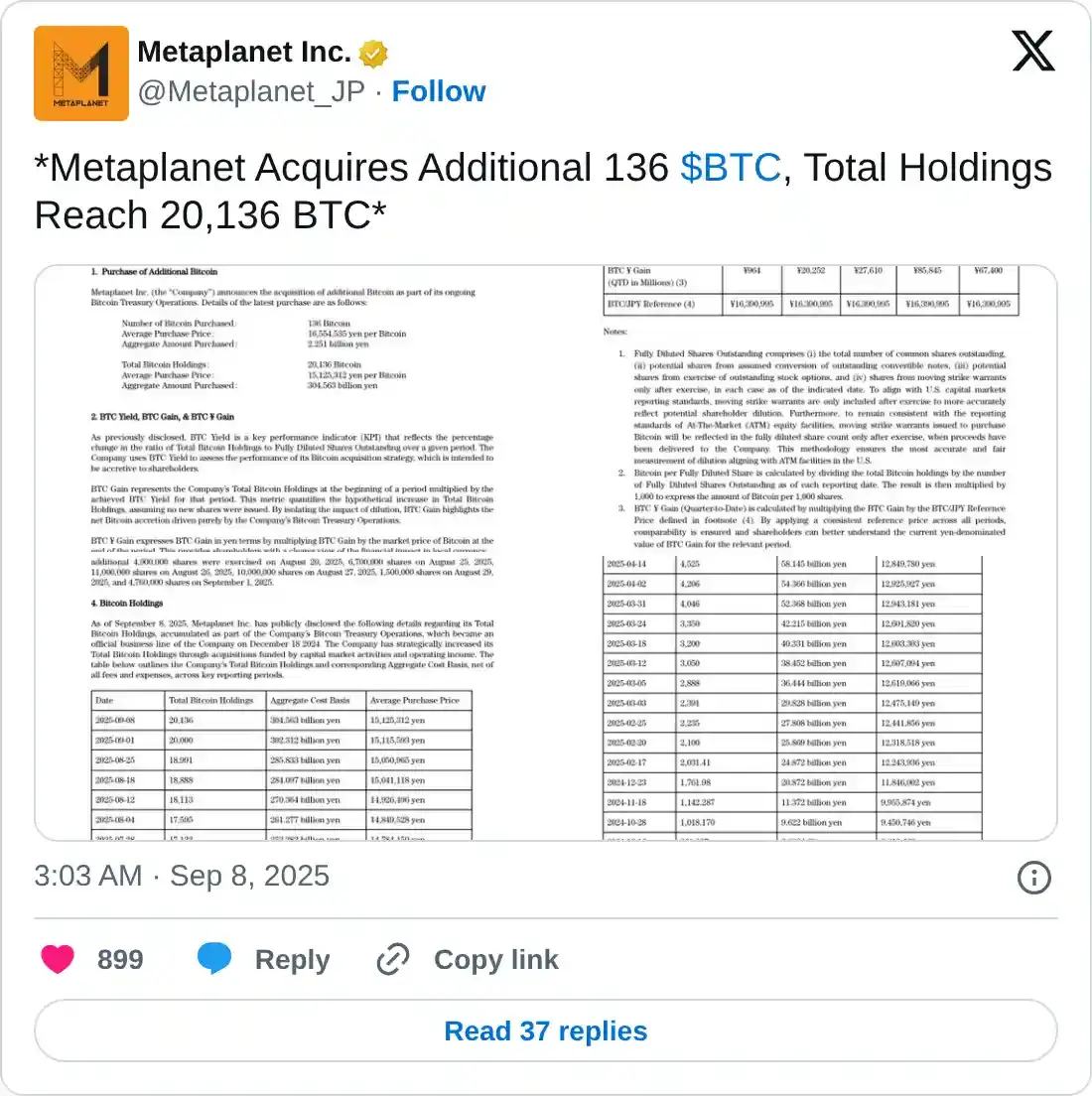

Japanese investment firm Metaplanet purchased an additional 136 BTC, bringing the firm’s total holdings to 20,136 BTC on Monday.

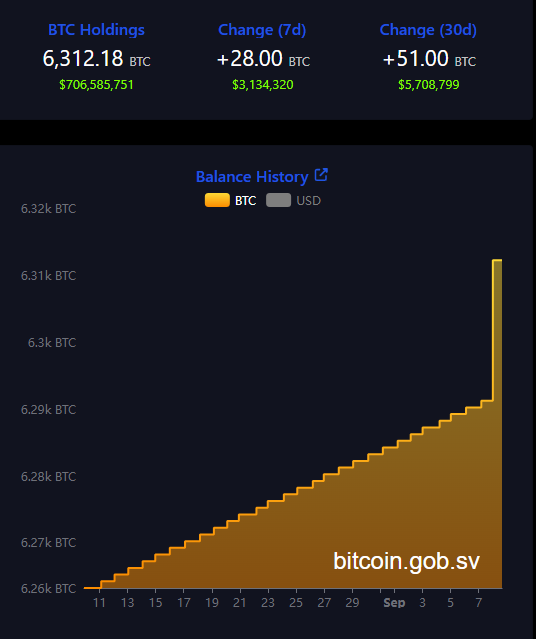

Similarly, on Sunday, El Salvador purchased 21 BTC in celebration of the fourth anniversary of its Bitcoin law. This announcement can be seen through El Salvador’s President Nayib Bukele’s post on X.

The country currently holds approximately 6,313 BTC in total, worth around $706.58 million at current market prices, as shown in the chart below.

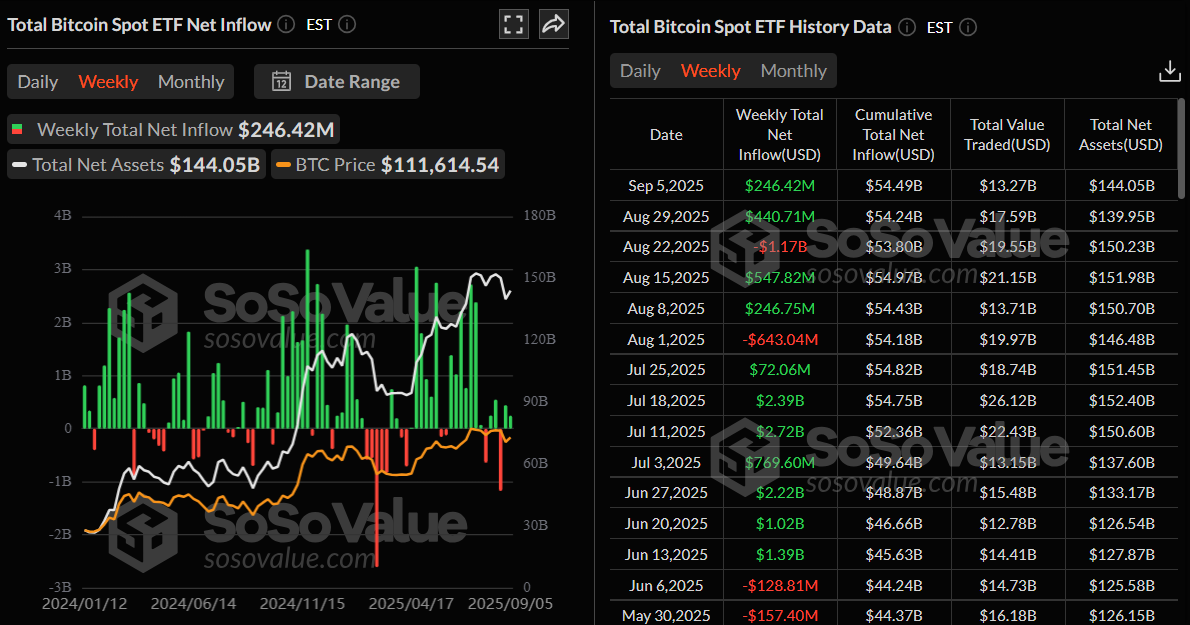

Additionally, the data below from SoSoValue shows that Bitcoin spot Exchange Traded Funds (ETFs) have recorded a total of $246.42 million in inflows last week, continuing its second consecutive week of positive flows. However, these weekly inflows are smaller compared to those seen during mid-July, when BTC rallied toward $120,000 mark for the first time.

Bitcoin Price Forecast: BTC bulls gaining control of momentum

Bitcoin price recovered nearly 3% last week after facing three consecutive weeks of pullbacks from its all-time high of $124,474. At the time of writing on Monday, it continues to recover, trading above $111,800.

If BTC continues its upward momentum, it could further extend the rally toward its daily resistance level at $116,000.

The Relative Strength Index (RSI) on the daily chart reads 48, and points upward toward its neutral level of 50, indicating that bearish momentum is fading. Moreover, the Moving Average Convergence Divergence (MACD) showed a bullish crossover on Saturday, giving a buy signal and indicating improving momentum, which supports the bullish view.

BTC/USDT daily chart

However, if BTC faces a correction, it could extend the decline toward its daily support level at $105,573.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.