Forex Today: Gold rises to record-high as USD struggles to rebound after dismal jobs data

Here is what you need to know on Monday, September 8:

The US Dollar (USD) finds it difficult to stage a rebound to start the new week after suffering large losses on Friday. The European economic calendar will feature Sentix Investor Confidence data for September and French MPs will debate a no confidence vote in Prime Minister François Bayrou later in the day.

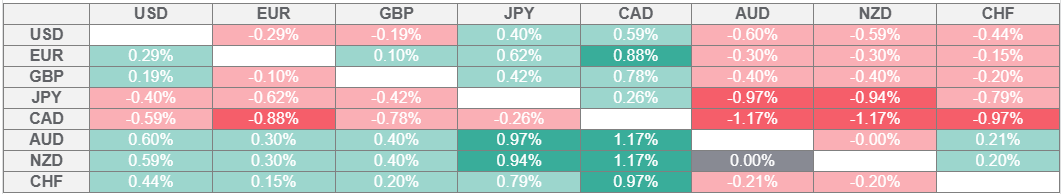

US Dollar Price Last 7 Days

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the weakest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Bureau of Labor Statistics (BLS) reported on Friday that Nonfarm Payrolls (NFP) rose by 22,000 in August. This reading followed the 79,000 increase (revised from 73,000) recorded in July and missed the market expectation of 75,000 by a wide margin. In this period, the Unemployment Rate edged higher to 4.3%, as anticipated. In its press release, the BLS noted that the change in total Nonfarm Payrolls employment for June was revised down by 27,000, from 14,000 to -13,000. With the immediate reaction, the USD Index turned south and lost more than 0.5% on the day. Early Monday, the index is marginally lower on the day below 97.70, while US stock index futures cling to modest gains. On Tuesday, the BLS will release the preliminary estimate of the upcoming annual benchmark revision to the establishment survey data.

The data from China showed earlier in the day that the trade surplus widened to $102.33 billion in August from $98.24 billion in July. On a yearly basis, Imports rose by 1.3% in August, while Exports grew by 4.4%. After closing decisively higher on Friday, AUD/USD holds its ground early Monday and climbs toward 0.6600.

EUR/USD reached its highest level since late July above 1.1750 on Friday following the US employment data. In the European morning on Monday, the pair stays relatively quiet and fluctuates above 1.1700. Earlier in the day, the data from Germany showed that Industrial Production expanded by 1.3% on a monthly basis in July, matching the market expectation.

GBP/USD holds steady above 1.3500 after rising more than 0.5% on Friday and closing the week with small gains.

Gold rose more than 1% on Friday and gained about 4% for the week, as the benchmark 10-year US Treasury bond yield slumped to its lowest level since April below 4.1% after the disappointing labor market report. XAU/USD preserves its bullish momentum early Monday and trades at a fresh record-high above $3,600.

USD/JPY opened with a bullish gap and rose toward 148.50 in the Asian session on Monday. With the USD failing to attract buyers, however, the pair reversed its direction and was last seen trading flat on the day near 147.50.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.