Worldcoin (WLD) Jumps 25% as Smart Money and Futures Traders Bet Big

Sam-Altman linked WLD has emerged as today’s standout performer, soaring 25% in the past 24 hours.

The token has been trending upward since September 5, driven by the project’s recent launch of its anonymized multi-party computation (APMC) initiative. Currently trading at a two-month high of $1.26, WLD’s growth is supported by strong market signals that suggest the rally could continue.

Worldcoin Rally Gains Traction

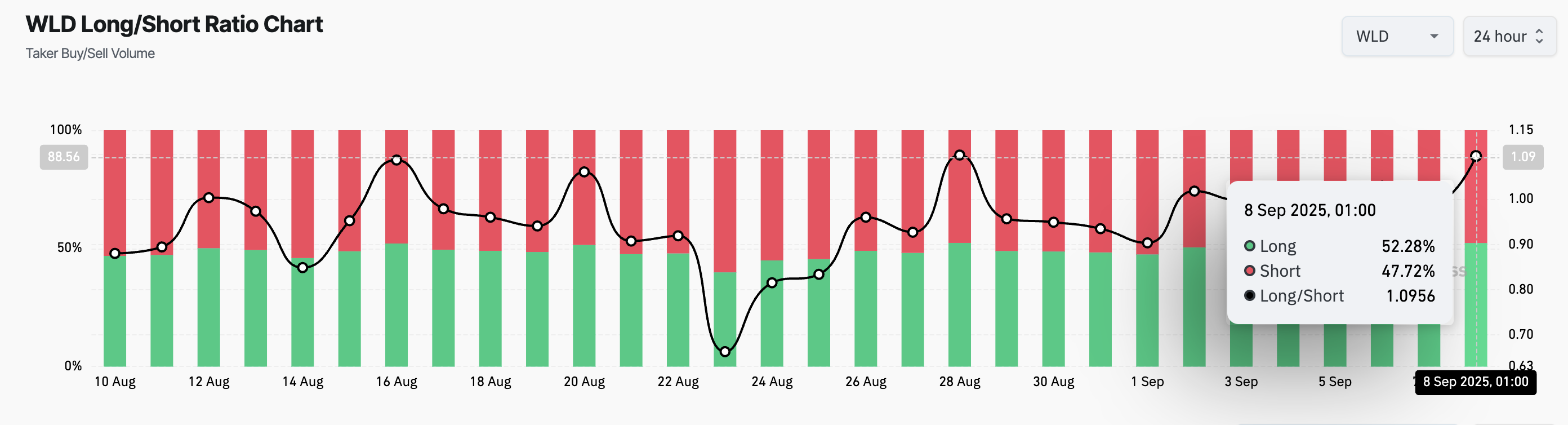

WLD futures market participants display bullish conviction, as evidenced by the token’s spiking long/short ratio. The metric stands at 1.09 at press time.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

WLD Long/Short Ratio. Source: Coinglass

WLD Long/Short Ratio. Source: Coinglass

The long/short ratio measures the number of traders holding long positions compared to those holding shorts. A reading above 1 indicates that more traders are betting on price appreciation rather than decline. Conversely, a ratio below one indicates that most traders are positioning for a price drop.

WLD’s climbing ratio signals heightened optimism across derivatives markets and confirms that many traders expect the rally to continue.

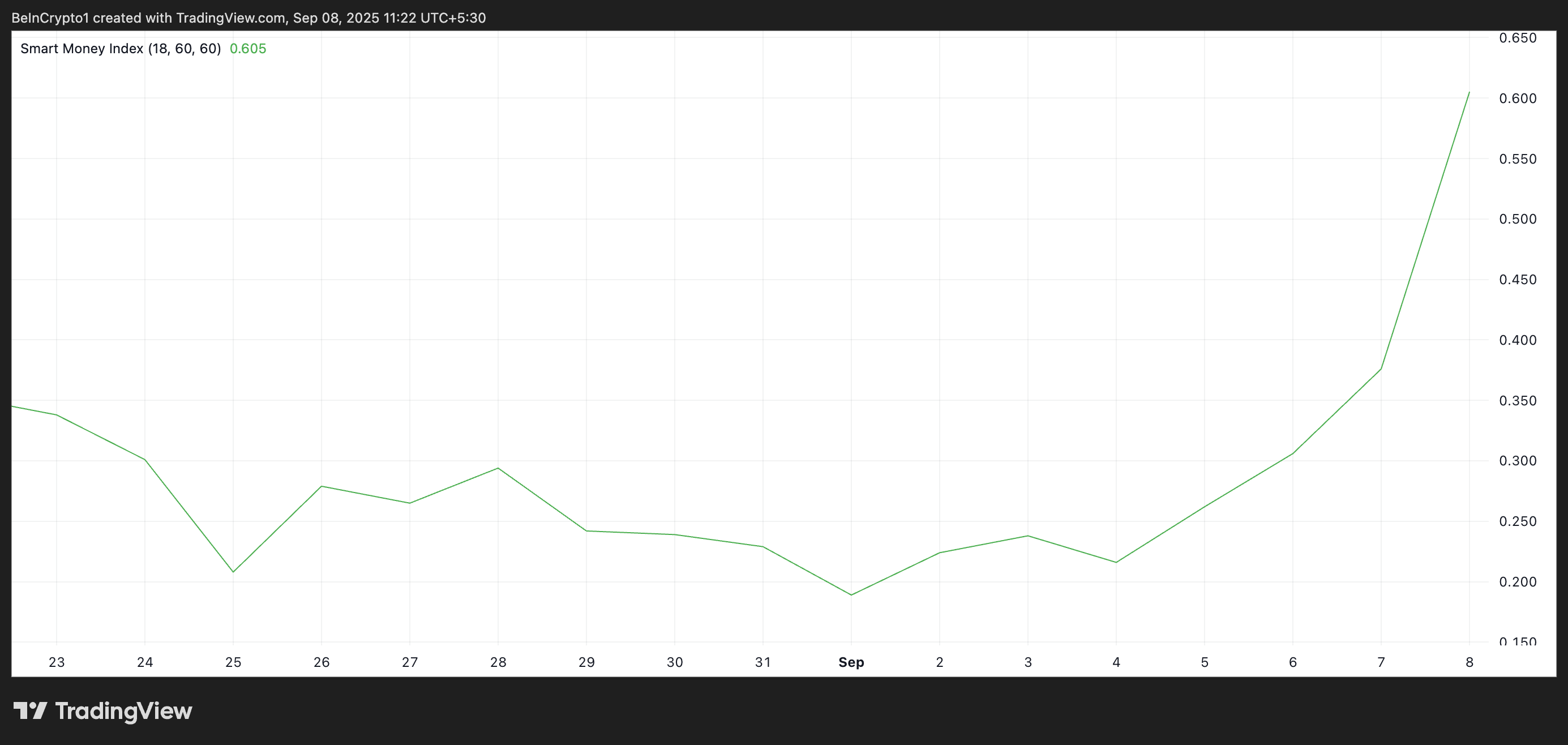

Moreover, on the daily chart, WLD’s Smart Money Index (SMI), which tracks participation from key institutional and influential investors, is also rising. At press time, this sits at a 48-day high of 0.605, indicating that capital from sophisticated market players is flowing into WLD, further strengthening the bullish outlook.

Worldcoin SMI. Source: TradingView

Worldcoin SMI. Source: TradingView

The SMI indicator refers to capital controlled by institutional investors or experienced traders who understand market trends and timing more deeply. It tracks the behavior of these investors by analyzing intraday price movements. Specifically, it measures selling in the morning (when retail traders dominate) versus buying in the afternoon (when institutions are more active).

A rising SMI like this signals that smart money is accumulating an asset. If this backing continues, it could help propel WLD to new price highs in the near term.

Can Bulls Defend $1.14 and Push Toward $1.64?

WLD rests significantly above the support floor formed at $1.14. If demand grows and this floor strengthens, WLD could break above the barrier at $1.34, opening the door for a rally toward $1.64.

Worldcoin Price Analysis. Source: TradingView

Worldcoin Price Analysis. Source: TradingView

On the other hand, if profit-taking starts, WLD could lose some of its recent gains and attempt to breach the $1.14 support. If successful, WLD’s price could plummet to $0.57.