Ethereum Long-Term Holders Sell Heavily: Is Price About To Suffer?

Ethereum’s recovery rally has stalled over the past few days, with ETH trading sideways as selling pressure mounts.

The hesitation stems from long-term holders (LTHs) moving to secure profits, a trend historically tied to major price reversals. While this behavior is not new, its reappearance threatens further downside.

Key Ethereum Holders Sell

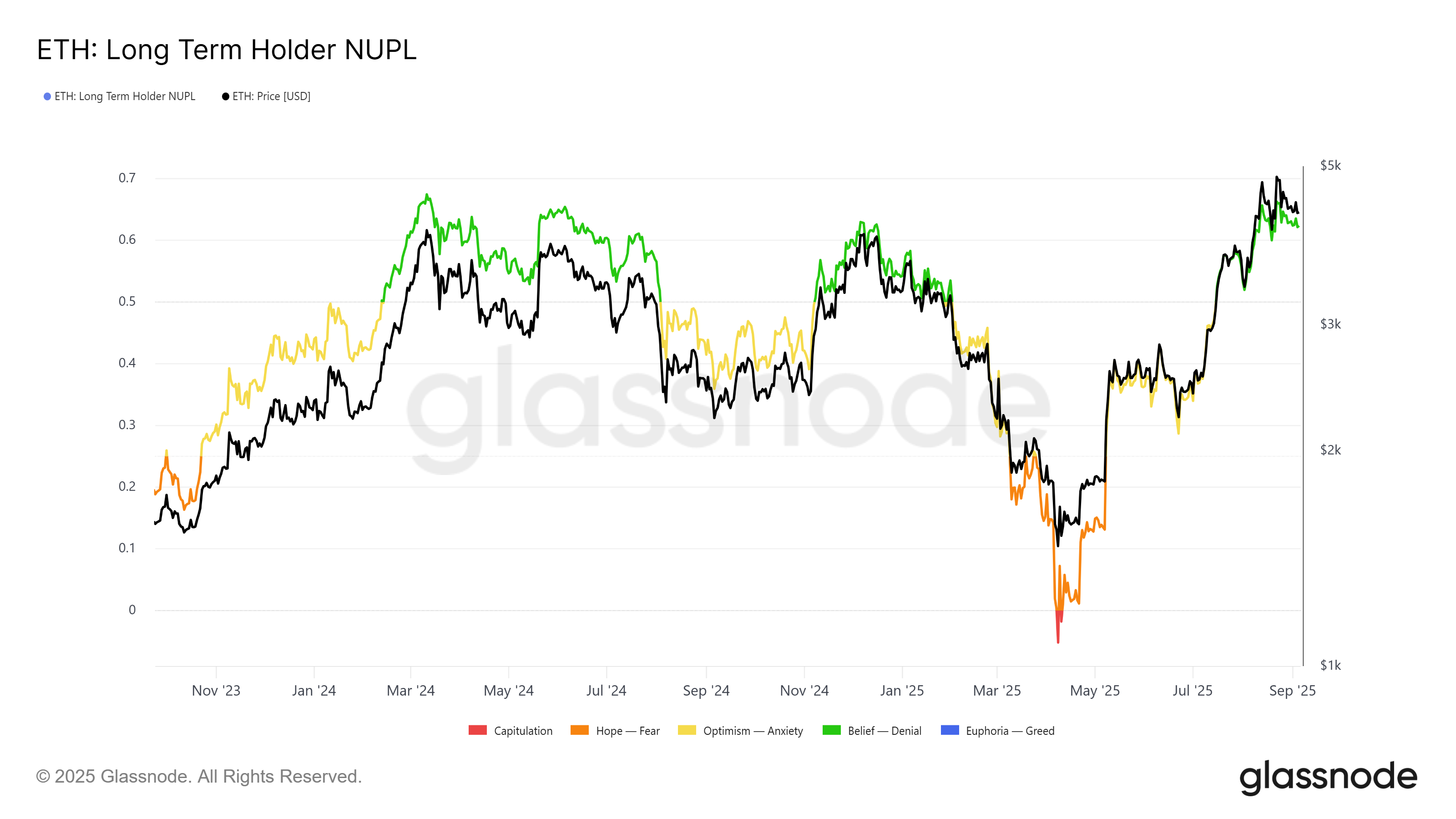

The LTH Net Unrealized Profit and Loss (NUPL) metric reveals that each time the indicator crosses the 0.65 mark, Ethereum’s price struggles.

This is because profit levels reach a saturation point where seasoned investors prefer to sell rather than hold, resulting in price stagnation or corrections.

Currently, Ethereum reflects the same behavior as its past cycles. With LTHs realizing substantial profits, the sell-off is undermining ETH’s upward trajectory. Buyers hesitate to absorb the selling pressure, leaving ETH vulnerable to extended consolidation.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum LTH-NUPL. Source: Glassnode

Ethereum LTH-NUPL. Source: Glassnode

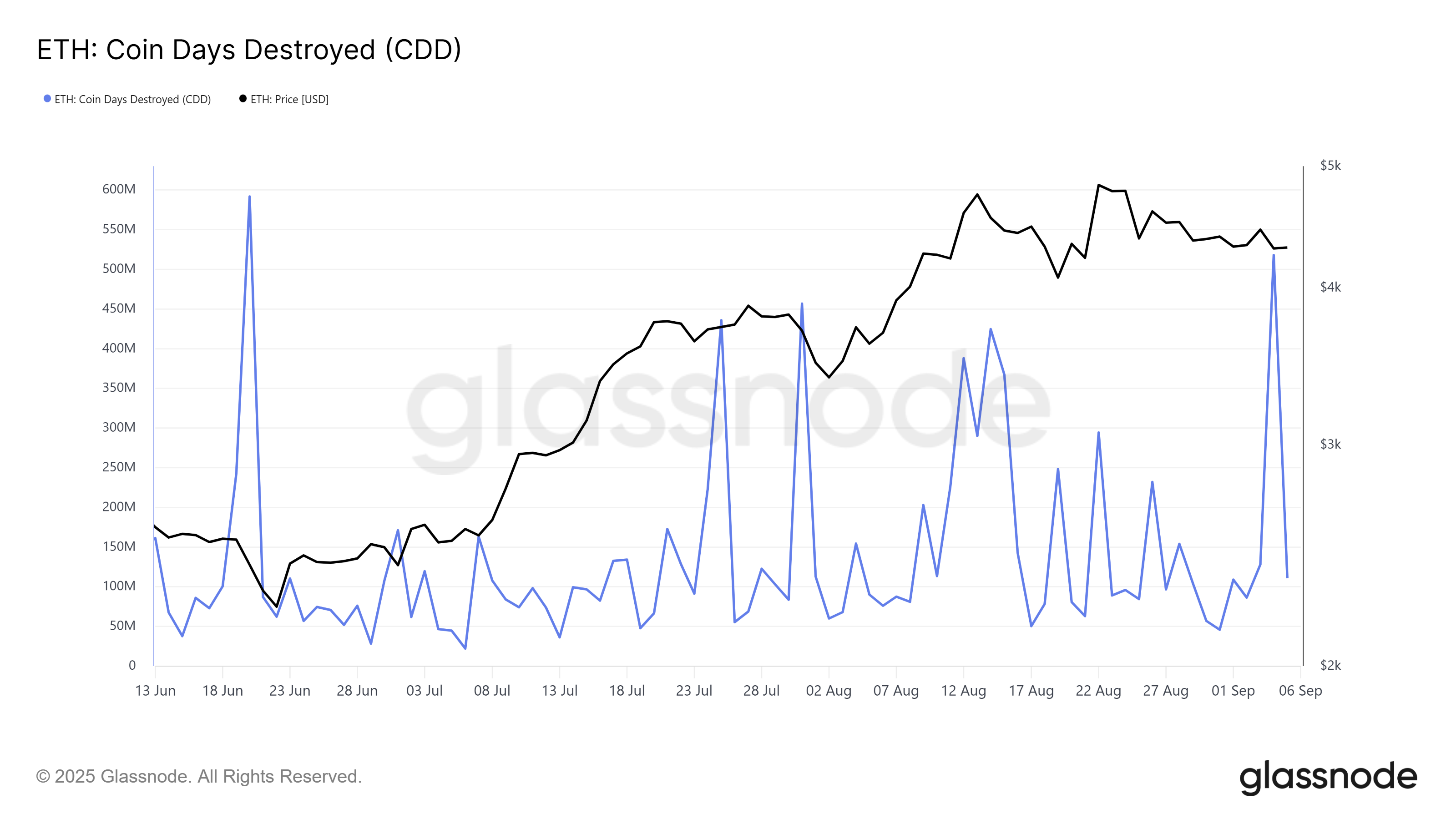

The Coin Days Destroyed (CDD) metric supports this trend, showing LTHs are actively liquidating holdings. In the past 24 hours, CDD registered its sharpest spike in two months, highlighting increased selling.

Such activity often signals further downside risk. LTH selling at elevated levels indicates a lack of confidence in immediate recovery. Unless offset by strong inflows from other investor groups, ETH’s macro momentum suggests a cooling period.

Ethereum CDD. Source: Glassnode

Ethereum CDD. Source: Glassnode

ETH Price To Remain Stagnant

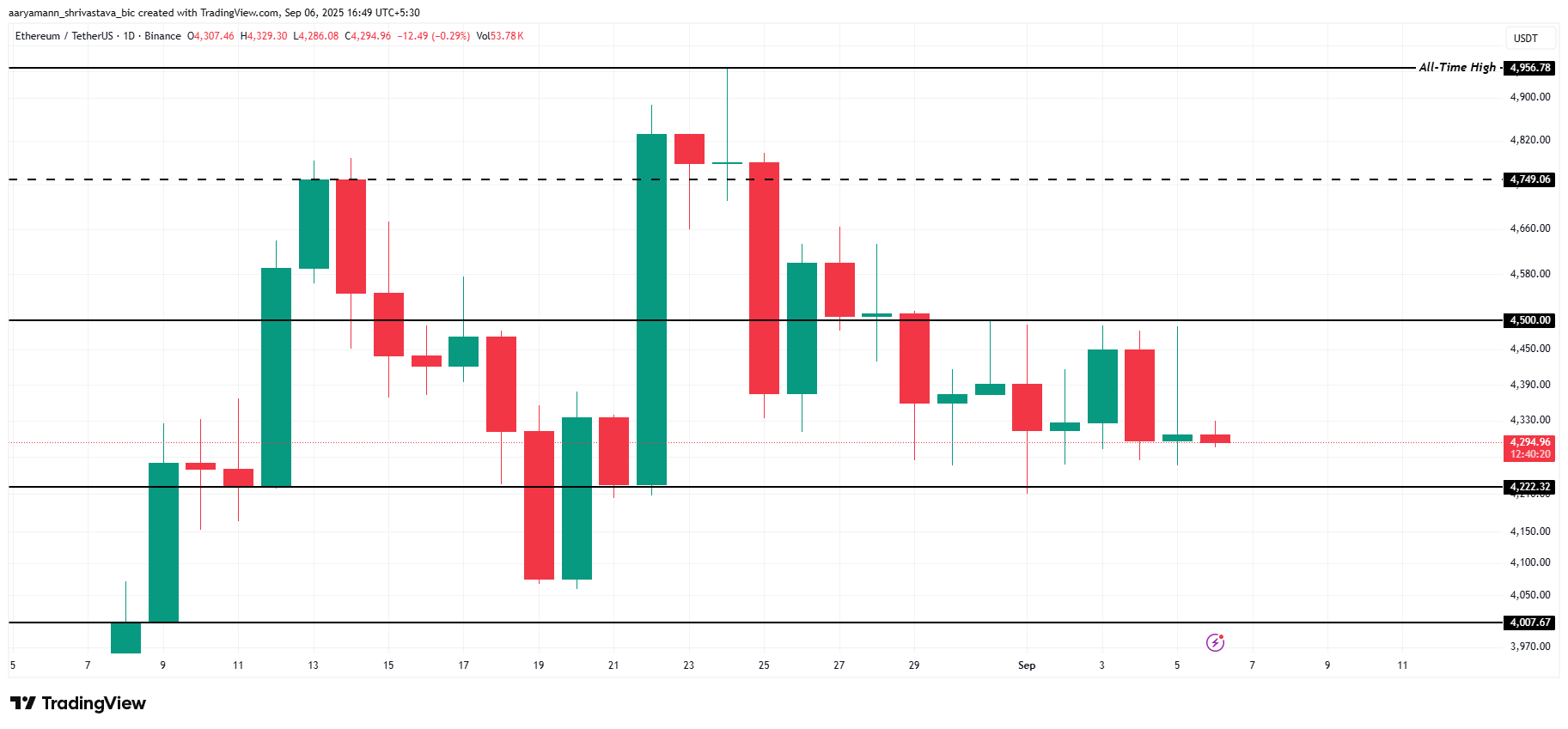

Ethereum’s price is currently at $4,294, holding above the $4,222 support level. The challenge remains ETH’s repeated failure to breach $4,500 over the past few days, a ceiling that now acts as a critical resistance barrier for the altcoin king.

This suggests ETH may remain rangebound in the near term. With LTHs booking profits, upside potential is capped, leaving ETH oscillating between $4,222 and $4,500 until market conditions improve or demand absorbs the ongoing sell pressure.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

If other investors step in to buy ETH offloaded by LTHs, recovery could still materialize. A successful breach and flip of $4,500 into support would open the path for ETH to retest $4,749.

This would mark a potential resumption of its broader bullish trajectory.