Cryptocurrency entrepreneur Justin Sun claims innocence amid WLFI pump and dump allegations against him

- The WLFI team freezes cryptocurrency entrepreneur Justin Sun’s holdings, alleging a pump and dump.

- Justin Sun defends with test transfers and addresses dispersion claims.

- A timeline analysis by the Nansen AI agent suggests the transfer followed the dump.

The US President Donald Trump’s World Liberty Financial (WLFI) team blacklisted cryptocurrency entrepreneur Justin Sun’s wallet address as the token faces a massive supply dump, resulting in a 14% drop on Friday. Sun demands that the team unlock the tokens as the Nansen AI agent highlights the 50 million WLFI transfer succeeded the sell-off wave.

Justin Sun gets blacklisted for a 50 million WLFI sale

The WLFI token edges lower by 1% at press time on Friday, following the 14% drop from the previous day. This sudden downfall raised alarms of a potential price manipulation.

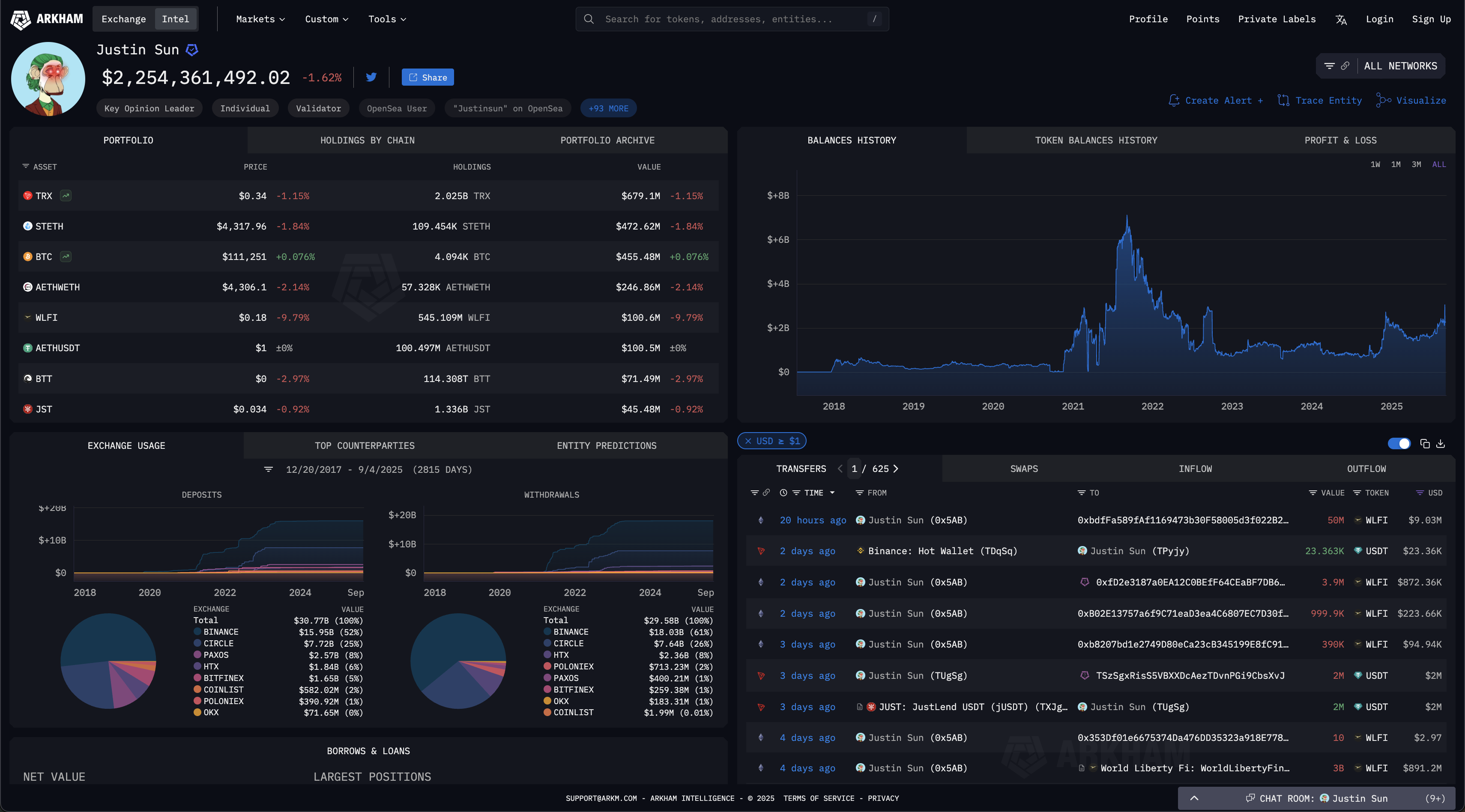

The WLFI team zeroed in on a 50 million WLFI transferred from Justin Sun’s address, then worth $9.03 million. At present, the Arkham Intelligence data shows the wallet left with 545.1 million WLFI tokens worth $100.6 million.

Justin Sun's wallet address data. Source: Arkham Intelligence

Following the trace, the team has blacklisted Sun’s wallet address and blocked his WLFI funds.

Sun has pushed back in an X post by urging the World Liberty Financial team to unlock the tokens underpinning his contribution as an early investor. While further cementing his trust and support for the project, the founder of Tron (TRX) also highlighted that "As one of the early investors, I joined together with everyone – we bought in the same way, and we all deserve the same rights.

In a separate post, the founder elaborated on the operations that triggered the panic, specifically mentioning a few general test deposits that were followed by the 50 million token transfer. Sun calls the final transfer an address dispersion and not a sale, which could have impacted the market price.

Nansen AI agent backs Tron founder

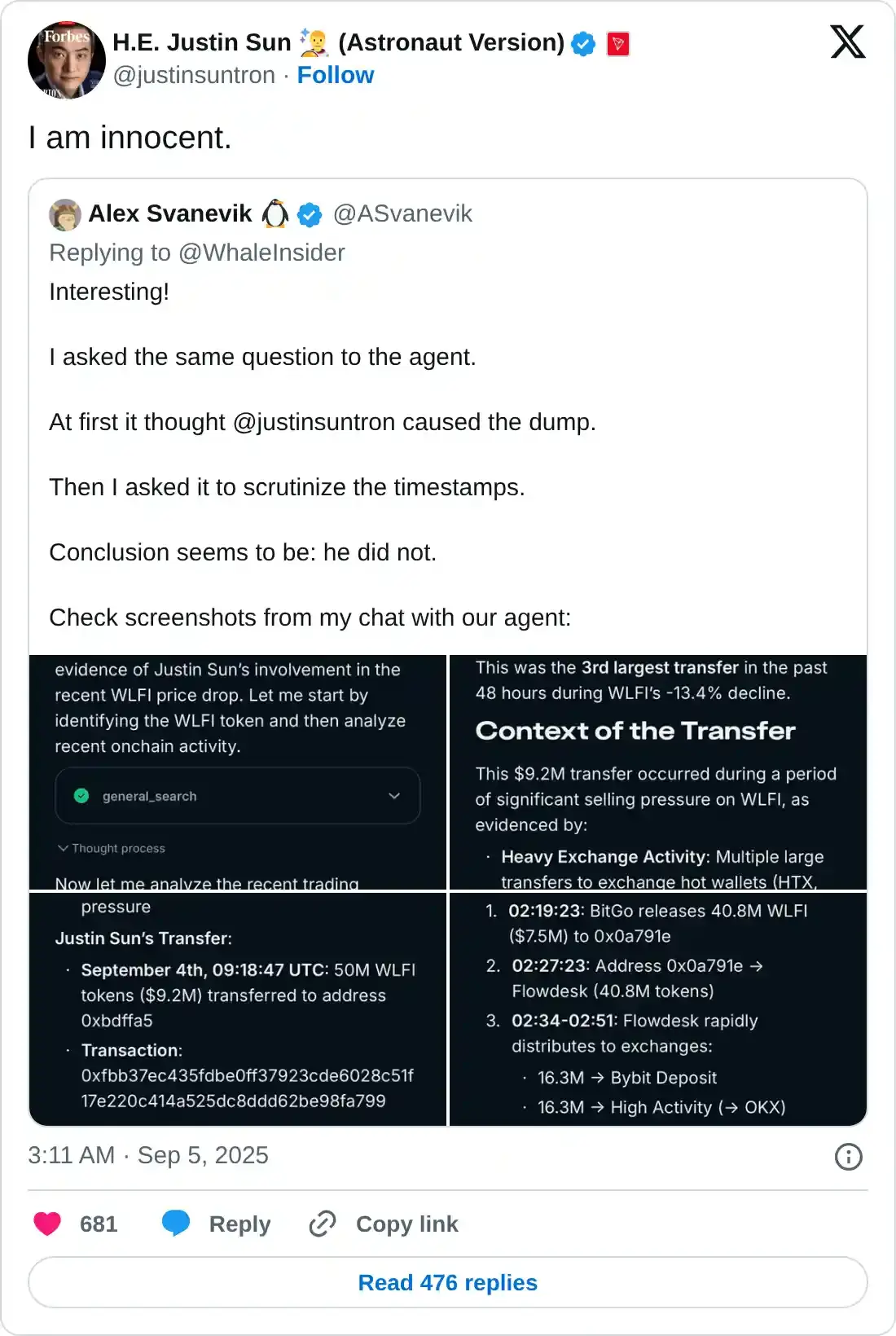

Alex Svanevik, the CEO of Nansen, a blockchain analytics platform, shared screenshots of the Nansen AI agents clearing Justin Sun from any direct role in the WLFI dump on Thursday.

The AI highlights massive exchange deposits as the key catalyst that occurred between 2:19 GMT and 2:51 GMT, while the 50 million WLFI transfer occurred at 9:18 GMT.

Justin Sun has reposted the same with the caption “I am innocent” to extend his plea. It is worth noting that he was the winner of the Trump Gala Dinner invite in late May, based on the Official TRUMP token holding of over $22 million.