Ripple expands RLUSD stablecoin into Africa through new partnerships

- RLUSD stablecoin is now available to institutions in Africa via three new partnerships.

- Humanitarian use cases emerge as RLUSD underpins extreme weather relief pilot projects by Mercy Corps Ventures in Kenya.

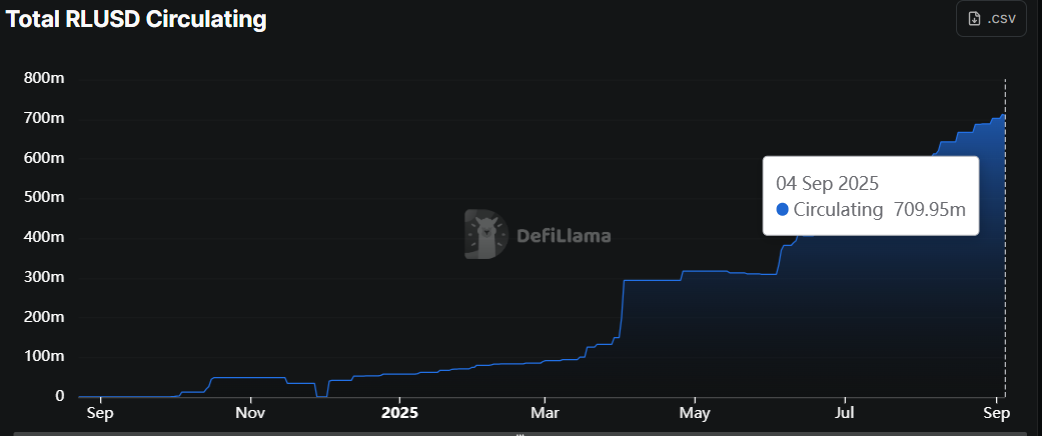

- DeFiLlama’s on-chain data shows that the RLUSD supply continues to expand, currently standing at 709.95 million.

Ripple (XRP) is extending the reach of its RLUSD stablecoin into Africa through new institutional partnerships, marking a major step in its global expansion strategy. Beyond financial access, RLUSD is also being deployed in humanitarian pilot projects in Kenya. On-chain data shows a rising stablecoin with a market capitalization exceeding $700 million.

Ripple’s growing stablecoin activity

Ripple announced on Thursday that it is making its enterprise-grade, USD-backed stablecoin, Ripple USD (RLUSD), available to institutions in Africa through three new partnerships with Chipper Cash, VALR, and Yellow Card.

“RLUSD has quickly become established in enterprise financial use cases, from payments to tokenization to collateral in both crypto and traditional trading markets. We’re seeing demand for RLUSD from our customers and other key institutional players globally and are excited to now begin distribution in Africa through our local partners,” said Jack McDonald, SVP of Stablecoins at Ripple.

In addition to its availability in Africa through new partnerships, Ripple’s RLUSD stablecoin is also being applied in humanitarian use cases, underpinning extreme weather relief pilot projects in Kenya by Mercy Corps Ventures, including blockchain-powered drought and rainfall insurance solutions.

Ripple has continued to collaborate with top-tier partners worldwide to make RLUSD globally accessible through Bitso, Bitstamp, Bullish, CoinMENA, Independent Reserve, Gemini, Kraken, LMAX, Mercado Bitcoin, and Uphold.

Since its launch in late 2024, RLUSD has experienced strong global adoption, with DefiLama data showing that stablecoin market capitalization reached $709.95 million as of Thursday.

Despite Ripple’s stablecoin showing growth, Artemis data show that RLUSD still has a long way to catch up, with monthly transaction volume rising to $193.9 million in August from $119.6 million in July, yet remaining well below the activity levels of established stablecoins on networks like Ethereum (ETH) and Tron (TRX).

-1756970192904-1756970192905.jpeg)

Monthly stablecoin transaction volume chart by chain. Source: Artemis Terminal

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.