Polkadot backs Paraguay’s $6M innovation hub tokenization, parachains TVL rises

- DOT is preparing for a lift-off within a symmetrical triangle pattern.

- DeFiLlama data shows the total value held by parachains exceeds $300 million.

- Paraguay shifts focus to Polkadot to tokenize Assuncion Innovation Valley, backed by $6 million.

Polkadot (DOT) edges higher by 2% at press time on Thursday, underpinned by Paraguay’s investment to tokenize Assunción Innovation Valley, which is equipped with a hotel, university, and data center. The technical and on-chain outlook remains bullish as DOT rebounds within a triangle pattern, accompanied by the Total Value Locked (TVL) on parachains crossing $300 million.

Parachains TVL crosses $300 million as Paraguay’s innovation hub tokenized equity comes to Polkadot

Polkadot announced the tokenization of Paraguay’s innovation hub district, Assuncion Innovation Valley (AIV), on Tuesday, in partnership with Moonbeam, a parachain, and Better Use Blockchain (BuB), a tokenization platform on Moonbeam.

Parachains are custom, parallel chains built on the Polkadot network. The innovation hub will be tokenized into 130,000 equity shares, backed by $6 million. These equity tokens will enable holders to vote and profit from shares in accordance with Paraguayan regulations.

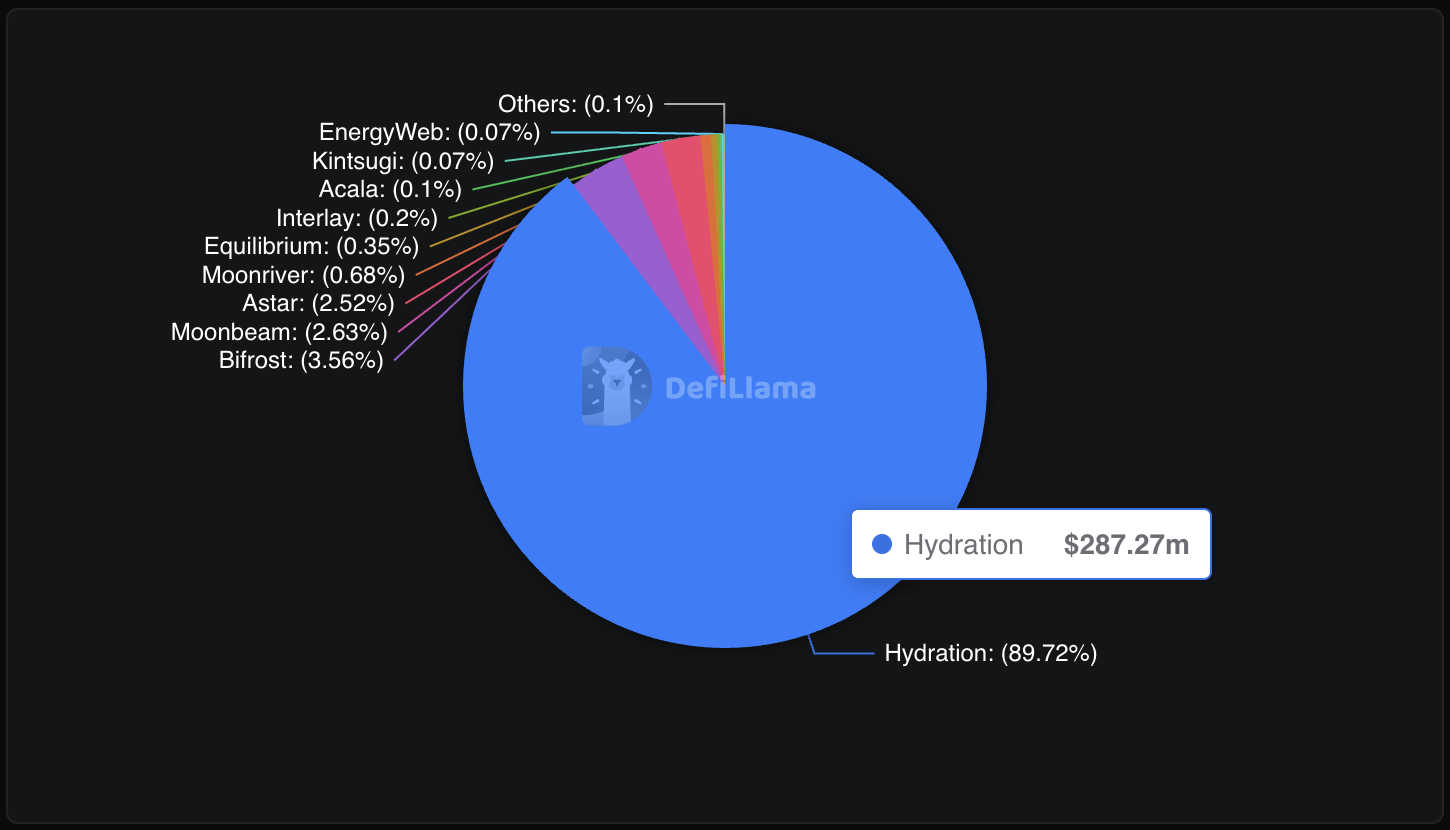

DeFiLlama data shows the Moonbeam TVL at $8.42 million, with Hydration leading among parachains, boasting a $287.27 million TVL, which accounts for a 89.72% share. This translates to the $320 million TVL of the parachains ecosystem.

Parachains TVL. Source: DeFiLlama

Polkadot within a triangle keeps the situation at balance

Polkadot rebounds within a symmetrical triangle pattern on the daily chart, challenging the 50-day Exponential Moving Average (EMA) at $3.928. The multi-chain blockchain token could target the 200-day EMA at $4.318, moving close to the triangle’s upper boundary trendline.

If DOT closes above this dynamic resistance, it could extend the rally to the $5.297 mark, aligning with the R2 pivot level.

The Relative Strength Index (RSI) is at 49 on the daily chart, hovering under the halfway line and pointing upwards. A potential rise in RSI above the neutral line would indicate a resurgence in bullish momentum, which could be a buy opportunity ahead of the pattern breakout.

DOT/USDT daily price chart.

Looking down, if DOT slips below the support trendline or the $3.689 low from Monday, it would mark a bearish outcome of the price pattern. This case could drop Polkadot to the $3.427 low from August 2.