BNB Price Train Steams Toward $1,000 as Buyers Fuel the Rally

Despite the broader market showing signs of fatigue, the BNB price train is still on track. Over the past 24 hours, Binance Coin has slipped 1.5%, now trading at $877. Given its relentless performance, this pullback, however, looks more like a scheduled pause than a derailment.

In the past month alone, BNB has gained 15%, while three-month returns sit at 30%, and the yearly swing is an impressive 51%. At just 2% below its all-time high of $899, the token is still within striking distance of a breakout that could carry it into four-digit territory for the first time.

Spot Demand Builds Through HODL Waves

Supporting this steady climb is the expansion across multiple HODL wave cohorts: a metric that tracks the percentage of circulating supply held across different holding periods.

BNB Sees Buyers Piling In: Glassnode

BNB Sees Buyers Piling In: Glassnode

Between July 24 and August 23, three key cohorts all grew their holdings: one-year to two-year wallets rose from 6.55% to 7.52%, three-month to six-month holdings surged from 1.62% to 7.30%, and one-month to three-month wallets ticked slightly higher from 2.29% to 2.306%.

These increases confirm that both long-term and mid-term investors are buying into strength rather than waiting for dips, adding fresh fuel to the BNB price train.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Futures Open Interest Keeps Momentum Alive

It isn’t just spot markets that are feeding the rally. BNB futures open interest has been climbing steadily alongside prices, hitting a three-month peak of $1.27 billion on August 22. The current levels are still around the same zone.

BNB Price And Futures Open Interest: Glassnode

BNB Price And Futures Open Interest: Glassnode

Rising open interest means leveraged traders are piling in, amplifying the potential for both upward surges and sudden squeezes. If momentum favors the bulls, short liquidations could accelerate the move past $899 and unlock higher price discovery levels.

On the flip side, a sudden long squeeze could trigger volatility and pullback, but the current alignment of spot and derivatives suggests the bias remains upward.

Futures open interest measures the total number of outstanding futures contracts that have not been settled, showing how much capital is tied to derivatives.

BNB Price Action: $898 Is the Gateway to Four Digits

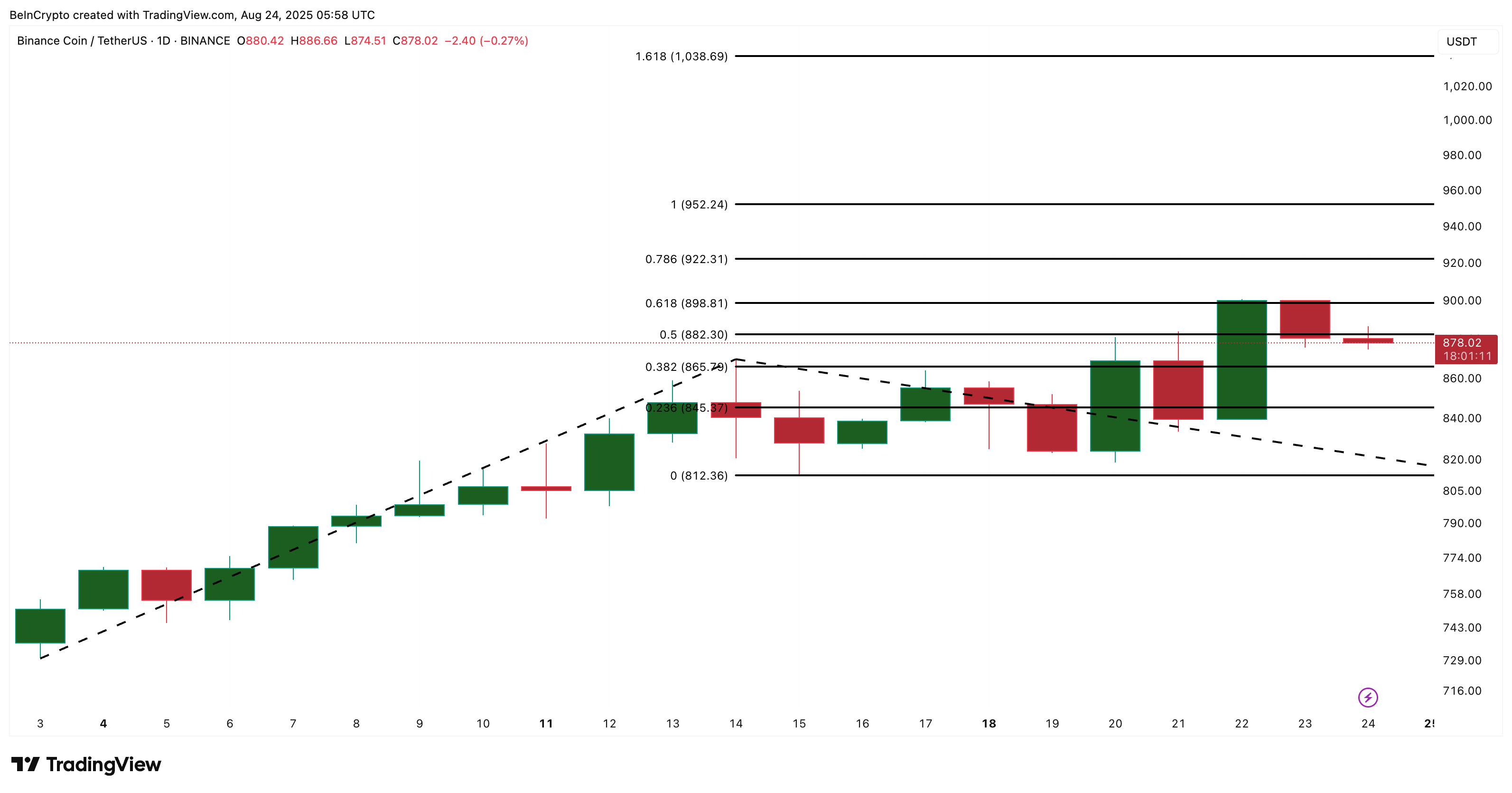

BNB is testing critical resistance zones that could define its next move. The token recently pulled back from $898, which aligns with the 0.618 Fibonacci extension, often seen as the strongest barrier in an uptrend. The BNB price is currently trading a notch under another key resistance level of $882.

BNB Price Analysis: TradingView

BNB Price Analysis: TradingView

With $898–$899 marking its historical high and one of the toughest resistance zones, a decisive candle close above that level could open the tracks toward $922 and $952.

Once BNB breaks past $898 strongly and into price discovery, the first four-digit target stands at $1,038. If spot and derivatives momentum holds, this may only be the beginning of a longer rally, where $1,000 is less a destination and more a milestone on the journey.

However, if the BNB price breaks under $812, a key retracement zone, it would invalidate the bullish hypothesis in the short term. That would momentarily put a halt to the BNB price train.