ETNs, not ETFs, send Bitcoin price back above 70K as LSE plans to launch BTC and ETH markets

- Bitcoin price has reclaimed above $70,000 amid ETN-related news.

- London Stock Exchange is expected to launch BTC and Ethereum exchange-traded notes market.

- Exposure to different assets and strategies while providing some unique benefits and considerations is the allure of ETNs over ETFs.

Bitcoin (BTC) price is back above $70,000, levels last tested on March 15 as the pioneer cryptocurrency slumped toward the March 19 $61,555 bottom.

While market recovery commenced over the weekend, reports from the United Kingdom’s London Stock Exchange (LSE) has sent a shock wave across the market.

Also Read: Bitcoin price tags $70K as BlackRock and Fidelity inflows contend against Grayscale outflows

Bitcoin and Ethereum ETNs to trade on LSE soon

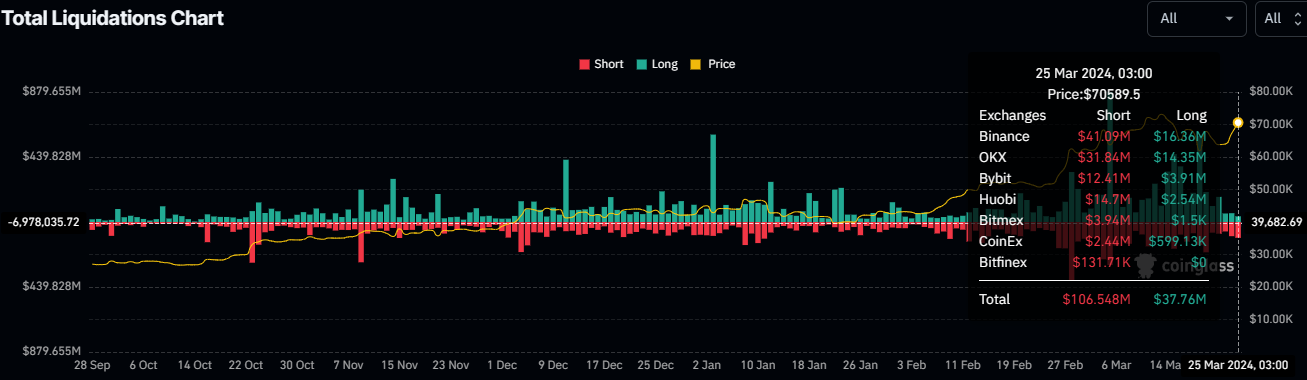

Bitcoin price shattered the $70,000 threshold on Monday, causing almost $145 million in total liquidations across the market, composed of $106 million in short positions and almost $38 million in longs.

Total liquidations

It came following reports that the United Kingdom’s main stock exchange, the London Stock Exchange, has issued a market notice, committing to launch cryptocurrency ETNs by May 28, 2024.

Specifically, the ETNs will back Bitcoin and Ethereum assets and comes after an initial announcement indicating plans to accept applications for Bitcoin and Ethereum ETNs.

The London Stock Exchange (LSE) began accepting applications for listing cryptocurrency ETNs on BTC and ETH in the second quarter of 2024. (Reuters)

— Crypto Figur (@Crypto_Figur) March 11, 2024

- the UK regulator has allowed it. pic.twitter.com/EEmSUA4md1

Based on the latest notice, applications can be made starting on April 8 but are subject to approval by the country’s Financial Conduct Authority (FCA).

The development points to traditional financial institutions seeing the value in cryptocurrencies and starting to embrace them. The LSE, a market worth over $3 trillion, is coming into the BTC space.

At the time of writing, Bitcoin price is trading for $70,602, up nearly 7% on the day.

BTC/USDT 1-day chart

Difference between ETFs and ETNs

ETNs are unsecured debt securities that financial institutions issue in an effort to track the performance of a specific market index, commodity, currency or other asset. They are different from exchange-traded funds (ETFs), as ETNs do not represent an ownership stake in a pool of underlying assets (BTC or ETH in this case).

ETN investors receive a return based on the performance of the index or asset the ETN is designed to track. Another distinguishing factor is that ETNs carry credit risk associated with the issuing institution.

London Stock Exchange listing crypto ETNs but what is a ETN?

— MartyParty (@martypartymusic) March 25, 2024

An ETN, or Exchange-Traded Note, is a type of debt security issued by a financial institution, such as a bank. It is similar to an ETF (Exchange-Traded Fund) in that it tracks an underlying index, asset, or strategy,…

Among the perks of investing in ETNs include the tax advantages they offer to long-term investors. Other important factors to know about investing in ETFs and ETNs:

- ETFs are typically easier to understand than ETNs

- ETNs are subject to the credit risk of the issuer

- ETFs do not have this credit risk, because they hold underlying assets that are separate from the issuer.

- ETFs are generally more tax-efficient than ETNs.

- ETFs are typically more liquid than ETNs as they trade on stock exchanges throughout the day, meaning investors can buy and sell shares easily.

- ETNs may have lower trading volumes, likely impacting liquidity.

- ETFs often provide diversification benefits by holding a basket of securities. This helps reduce risk.

- ETFs generally have lower fees than ETNs.

It is important to be aware of the issuer's credit rating and financial stability, as the value of an ETN is tied to the creditworthiness of the issuing institution. Notably, the crypto ETN will be exclusively available to professional investors.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.