Dogecoin soars nearly 20% after Coinbase announces listing of DOGE derivatives

- CFTC approves Coinbase Derivatives Exchange application for Dogecoin, Litecoin, and Bitcoin Cash futures.

- Securities claims for these cryptocurrencies will be hard to establish since they are all based on Bitcoin.

- Crypto assets trade in the green on dovish Federal Reserve remarks.

Dogecoin (DOGE) went up nearly 20% on Thursday after experiencing a correction in the last three days. Gains for the largest meme coin came after Coinbase Derivatives LLC announced it would be listing futures products for it, Bitcoin Cash (BCH), and Litecoin (LTC).

DOGE futures trading to begin on Coinbase Derivatives

Dogecoin (DOGE) became one of the most trending topics on X (formerly Twitter) after Coinbase Derivatives LLC announced that it would open trading for the meme coin.

Coinbase had quietly filed certifications with the US Commodity and Futures Trading Commission (CFTC) for a Dogecoin futures product since March 7, but no one noticed, as one X user pointed out. The news started making rounds in the crypto community after Coinbase announced the CFTC approved certification on Wednesday.

Coinbase Derivatives LLC has said that trading for the Dogecoin futures product will go live on April 1, and users can currently test it in their integration environment.

Read more: XRP price hits new 2024 peak alongside Coinbase filing that reveals contradictory SEC stance on digital assets

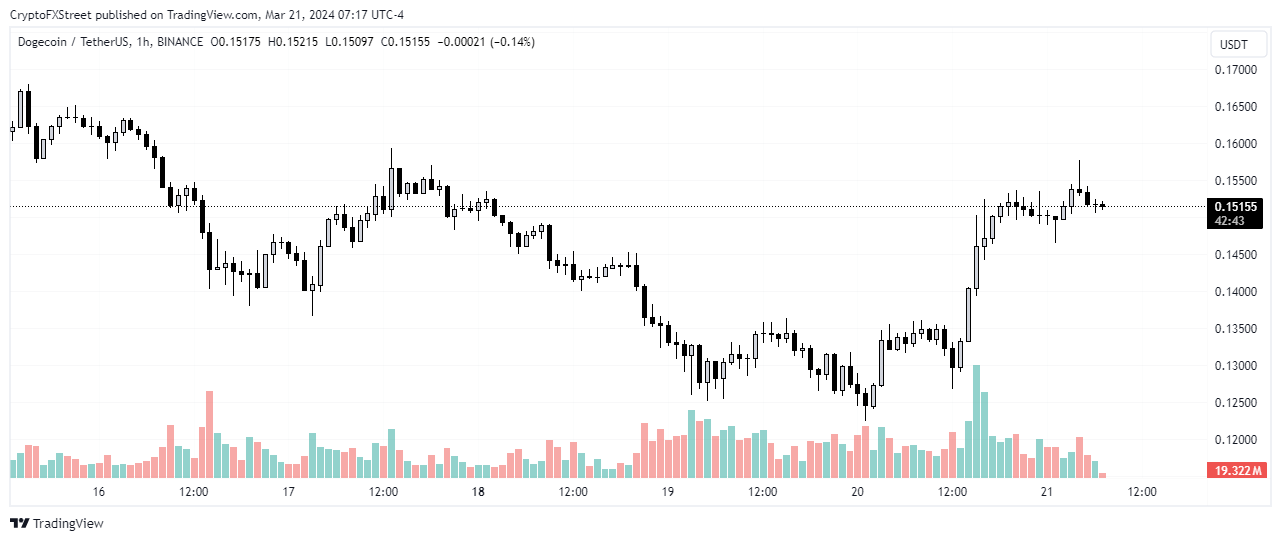

Following the news, the price of Dogecoin recorded nearly 20% in gains after a downward trend that saw it shed 23% of its value. With the Coinbase futures listing, DOGE may be set to trade higher.

DOGE/USDT 1-hour chart

DOGE had seen a massive rise last week following other meme coins, pushed by speculations that Tesla could accept payments in DOGE before the wider market slump.

Apart from Dogecoin, Bitcoin Cash and Litecoin had their fair share of price gains as they will also be listed on Coinbase Derivatives LLC. BCH recorded an 18% increase, while LTC spiked by almost 6% in the last 24 hours.

DOGE ETF on the way?

A notable insight from the CFTC's approval of these cryptocurrencies for futures trading is that the Commission acknowledges that they are commodities. One reason for the approval may be the similarity Dogecoin, Bitcoin Cash, and Litecoin share with Bitcoin—they are all forks of the original Bitcoin protocol.

Following the launch of spot Bitcoin ETFs in the US, many other cryptocurrencies are also gearing up for a potential debut in the US. Many Dogecoin proponents have expressed their hopes on X that a Dogecoin ETF is imminent as it would be hard for the Security and Exchange Commission (SEC) to argue that DOGE is a security, considering the CFTC now sees it as a commodity.

Also read: Meme coin season ends abruptly, whales transfer large volumes of Shiba Inu, Dogecoin and PEPE to exchanges

While the rise in these coins may largely be attributed to the Coinbase announcement, the general crypto market gain also plays a factor. After Federal Reserve officials signaled that they still expect to cut interest rates by three times this year, the entire cryptocurrency market recorded gains. Bitcoin and Ethereum prices, which have been on a downward trend since last week, increased about 10%.