Upbit Will Be Listing a New Altcoin Today

Upbit, South Korea’s largest cryptocurrency exchange, has announced today the listing of Story (IP), the native token of the Story Protocol.

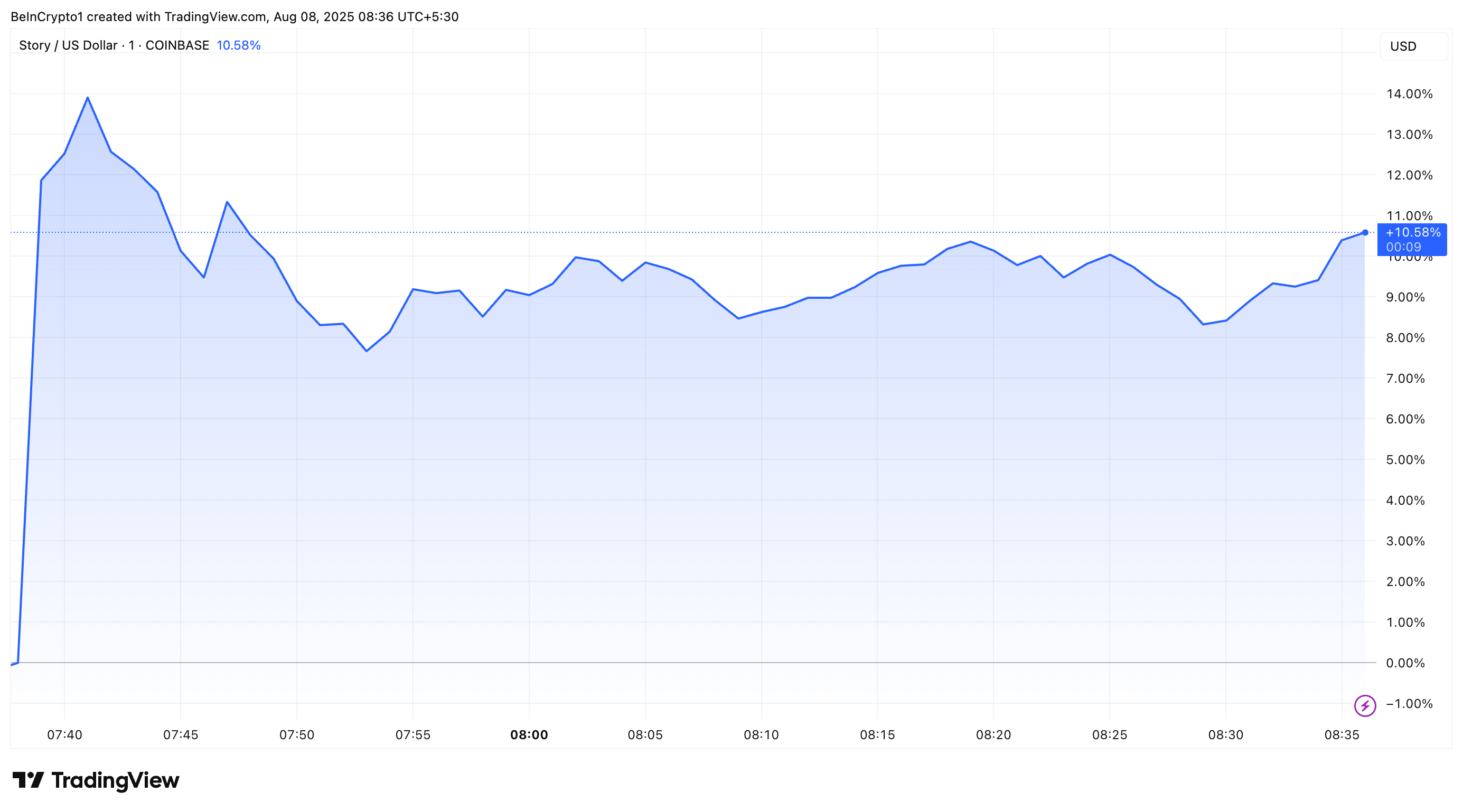

The announcement has sparked a significant double-digit surge in the token’s price. It also made IP the top trending coin on CoinGecko.

Story (IP) Secures Upbit Listing

For context, Story Protocol is a layer 1 blockchain that simplifies intellectual property management by enabling on-chain registration and enforcement of usage terms. It creates a transparent, decentralized IP repository where users can easily transact and monetize IP.

According to Upbit’s official notice, IP will be available for trading against three assets: Korean Won (KRW), Bitcoin (BTC), and Tether (USDT). The asset will go live to trade at 13:00 Korean Standard Time (KST).

The exchange notified users that deposits and withdrawals, facilitated exclusively through the IP-Story network, will open within 90 minutes of the announcement. Upbit emphasized the importance of verifying the network before depositing, as transactions via unsupported networks will not be processed.

Furthermore, to maintain market stability, Upbit has introduced temporary trading restrictions. It will cap buy orders for the first five minutes and block sell orders below 10% of the previous day’s closing price during the same period. Lastly, the exchange will only allow limit orders for the first two hours of trading.

“To comply with the Travel Rule, if assets are deposited into Upbit from an exchange not included in the list of virtual asset business operators for deposit/withdrawal, they cannot be processed, and returns may take a long time,” the notice read.

The listing has driven remarkable market activity. IP experienced a 16.13% rise. The token’s price increased from around $6.2 to $7.2.

The altcoin shed some of its gains to trade at a press time value of $6.8, up 10.58% since the announcement. In the past 24 hours, IP’s value has grown by 15.9%, making it the second-highest top gainer on CoinGecko.

Story (IP) Price Rise After Upbit Listing. Source: TradingView

Story (IP) Price Rise After Upbit Listing. Source: TradingView

Moreover, trading activity also surged. IP’s trading volume pumped 346.7%, reaching $169 million. This indicated heightened investor interest.

The latest rise is part of a broader uptrend. IP has been undergoing a bullish rally. Over the past month, the token’s value has soared by 127.9%, outperforming the broader crypto market, which has seen a 15.9% rise.

The token has also gained substantial institutional interest. On July 31, asset manager Grayscale launched a Story Trust. The Grayscale Story Trust offers investors regulated exposure to IP.

“By transforming intellectual property and real-world data into fully programmable on-chain assets, Story is laying the foundational infrastructure for the global intellectual property economy, which has been reported to be worth as much as $80 trillion,” Grayscale noted.

Thus, all the factors are quite positive for the IP token. As the broader bull run continues, its performance in the crypto market will be worth watching.