AI tokens Bittensor, Near Protocol risk extending decline as futures funding rates shrink

- Bittensor's recovery remains elusive, held back by fading futures funding rates and strong headwinds.

- Near Protocol offers multiple sell signals, holding below the 50-day, 100-day and 200-day EMAs.

- NEAR futures funding rate suppressed near the mean line, indicating fewer traders are leveraging long positions.

Bittensor (TAO) and Near Protocol (NEAR) recovery has become elusive on Tuesday, reflecting risk-off sentiment, particularly in the artificial intelligence (AI) sector, but also in the broader cryptocurrency market.

The downtrend in the prices of TAO and NEAR can partly be attributed to the announcement of reciprocal tariffs in the United States (US) and weak economic data.

Investors are on the edge, digesting the impact of the tariffs, which are expected to take effect this week.

However, the focus could shift to the progressive regulatory developments in the US, following the GENIUS Act on stablecoins, and the CLARITY, as well as the Anti-CBDC Act, which the US Senate is expected to discuss before proceeding to President Donald Trump for signing into law.

"Despite the sell-off, the release of the US Digital Asset working group's report signaled a bullish long-term stance, advocating for crypto innovation and regulatory clarity, reinforcing momentum from the GENIUS and CLARITY Acts," a K33 report highlights.

Technical outlook: Bittensor, Near Protocol downtrend persists

Bittensor, the leading AI token by market capitalization of $3.3 billion, is extending intraday losses to trade at around $338 at the time of writing on Tuesday. The token also holds below key moving averages, underscoring the prevailing bearish structure. These include the 50-day Exponential Moving Average (EMA) at $378, the 100-day EMA at $373 and the 200-day EMA at $347.

Sell signals from the Moving Average Convergence Divergence (MACD) and the SuperTrend indicators reinforce the bearish outlook. Investors may continue de-risking with the blue MACD line holding below the red signal line and the SuperTrend line above the price of TAO.

TAO/USDT daily chart

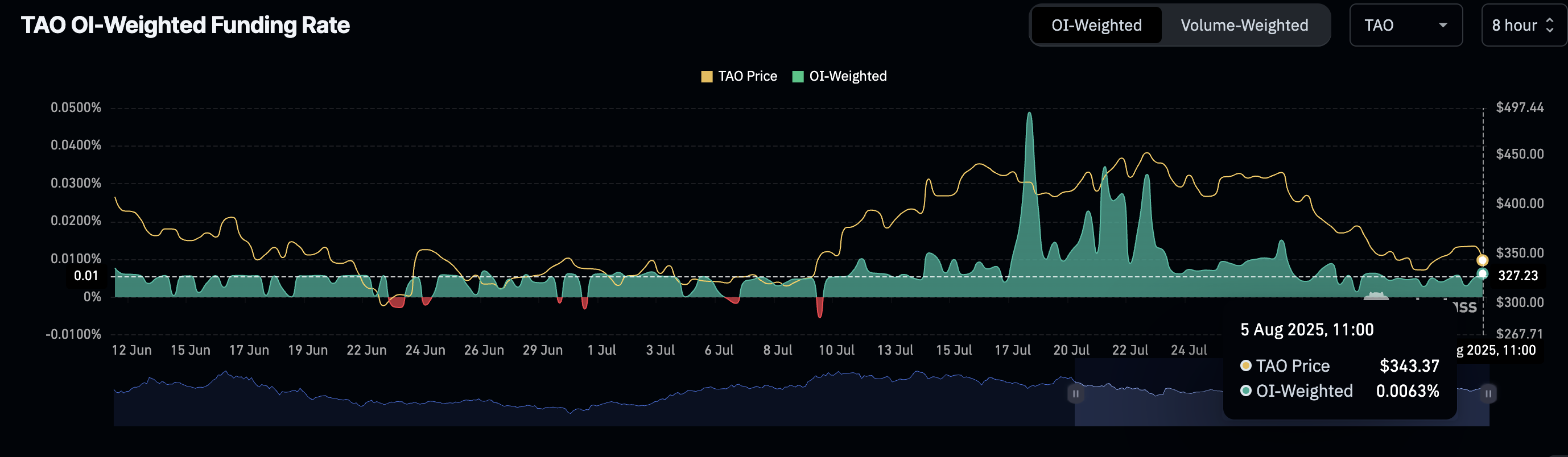

Key areas of interest for traders are tentative support levels at $328 and $300. The downtrend in TAO could persist amid a significant drop in the futures weighted funding rate from a July peak of 0.0489% to 0.0063% at the time of writing.

Low funding rates signal a lack of conviction in the future of the token as fewer traders bet on increases in the TAO price.

Bittensor Futures Weighted Sentiment | Source: CoinGlass

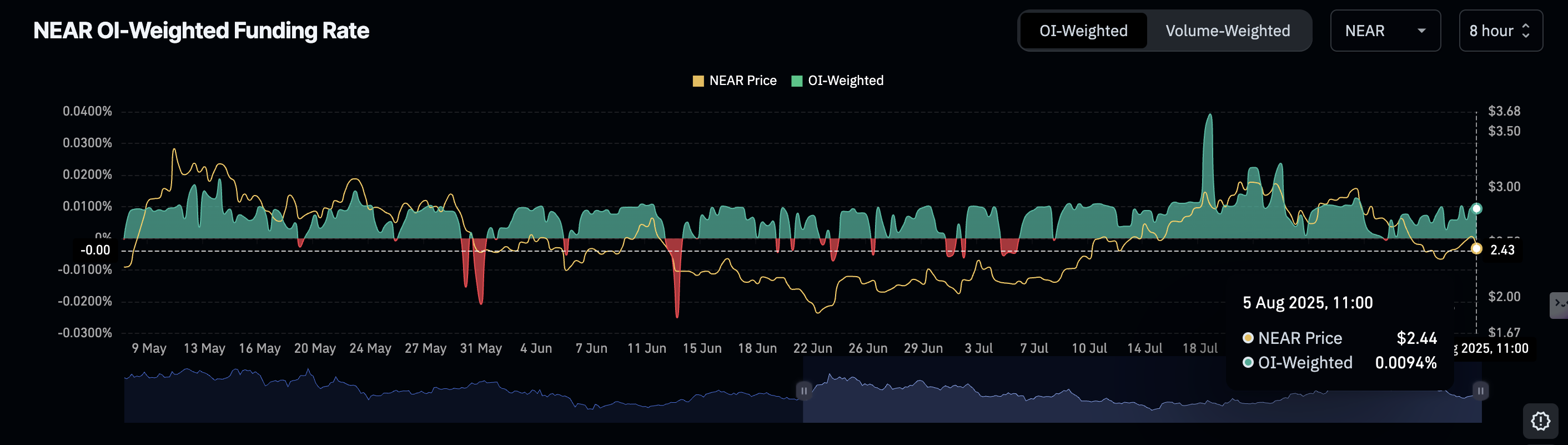

As for Near Protocol, the futures weighted funding rate has plunged into the negative to average at -0.0170% at the time of writing. If the trend persists, overhead pressure could accelerate the decline toward support at around $2.30, tested on Sunday.

NEAR Futures Weighted Sentiment | Source: CoinGlass

Near Protocol price has lost support at $2.55, highlighted by the 50-day EMA. The decline may extend in upcoming sessions due to the presence of two sell signals from the SuperTrend and the MACD indicators.

NEAR/USDT daily chart

Traders will look for NEAR's reaction to support at $2.30 if volatility spikes, keeping sellers in control. Still, the uptrend could resume above the 50-day EMA and the 100-day EMA at $2.60 if sentiment improves in the broader cryptocurrency market. Other key targets are the 200-day EMA at $2.98 and May's peak resistance at $3.38.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.