Reddit-based tokens MOON and BRICKs rally ahead of oversubscribed Reddit's IPO

- Reddit's IPO, set for Thursday, has led MOON and BRICK tokens to post significant weekly gains.

- Reddit's IPO is four to five times oversubscribed, potentially driving growth for community tokens on its platform.

- MOON is set to go live on Arbitrum One on Thursday, potentially fueling growth for the token.

Reddit-related tokens r/CryptoCurrency Moons (MOON) and r/FortNiteBR Bricks (BRICK) are rallying sharply on Wednesday, ahead of Reddit's (RDDT.N) Initial Public Offering (IPO), which has been reported as oversubscribed.

Reddit's IPO ready to catapult MOON and BRICK

r/CryptoCurrency Moons is one of the trending coins in the crypto market, as Reddit's IPO is less than 24 hours away. Speculations about the IPO have made several rounds among investors on the thousands of online forums and communities on its platform.

These subreddits – which house several conversations around different topics, from memes to sports, politics, business, etc. – have boosted the popularity of the social media company over the years. One notable event on Reddit was when a group of investors collaborated on the “wallstreetbets” subreddit to pump the stock price of highly shorted game retailer GameStop (GME.N).

Initially, skeptics expressed concerns that the company may have a poor IPO due to fears of potential regulatory sanctions on its method of content moderation, which relies on community volunteers. They also added that Reddit has not been profitable since its launch in 2005, compared to other platforms like X (formerly Twitter) and Facebook, which have become social media giants.

Read more: Reddit-based tokens look set for a run as Reddit IPO looms

However, a report from Reuters suggests that the company's IPO is already "four to five times oversubscribed, making it more likely the social media platform will attain the $6.5 billion valuation it seeks."

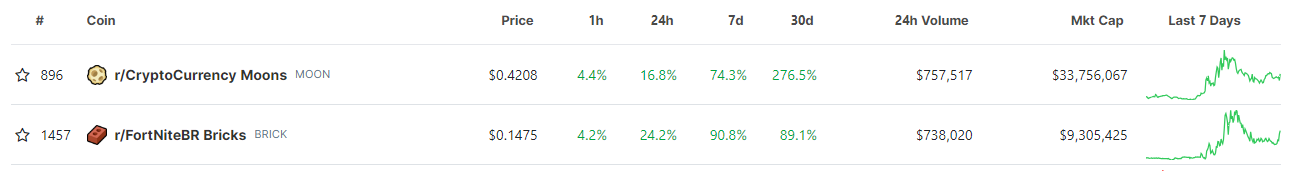

This explains why MOON and BRICK have shown bullish momentum for the past week. The tokens used for rewarding active users who contribute to the r/CryptoCurrency and r/Fortnite, respectively, have soared 16.8% and 24.2% in the past 24 hours as the IPO looms. This increase comes even amid the wider crypto market correction.

In a weekly timeframe, both tokens recorded significant gains, according to data from Coingecko.

Reddit points category

Celer powers MOON debut on Arbitrum One

Another potential reason for the rise may be the debut of MOON on Arbitrum One layer 2 on Thursday, after the interoperability protocol, Celer announced support for the community token earlier last month. The Celer bridge will allow users to move their MOON token from Arbitrum Nova to Arbitrum One.

Also read: Arbitrum price rally likely to extend as ARB TVL doubles in a year

Considering Arbitrum One boasts of a higher total value locked (TVL) of about $3.192 billion than Arbitrum Nova's $1.96 million, it will give MOON access to a broader range of applications in its rich DeFi ecosystem, as stated in a post by r/CryptoCurrency. The post further stated that the move would derisk any potential shutdown due to Nova's decreasing TVL and popularity.