How Hyperliquid Is Quietly Beating Robinhood at Its Own Game

Once a little-known player in 2023, Hyperliquid is now reshaping the DeFi industry in 2025, outpacing Robinhood in trading volume and challenging the dominance of centralized exchanges.

With an aggressive growth strategy and unique approach to liquidity, this decentralized exchange (DEX) is no longer flying under the radar.

Centralized Exchanges Beware: Hyperliquid Is Catching Up Fast

While many still believe that decentralized exchanges (DEXs) can’t scale like centralized exchanges (CEXs), Hyperliquid (HYPE) is forcing the entire industry to rethink. This DEX now leads the perpetual futures trading segment, outperforming many big names.

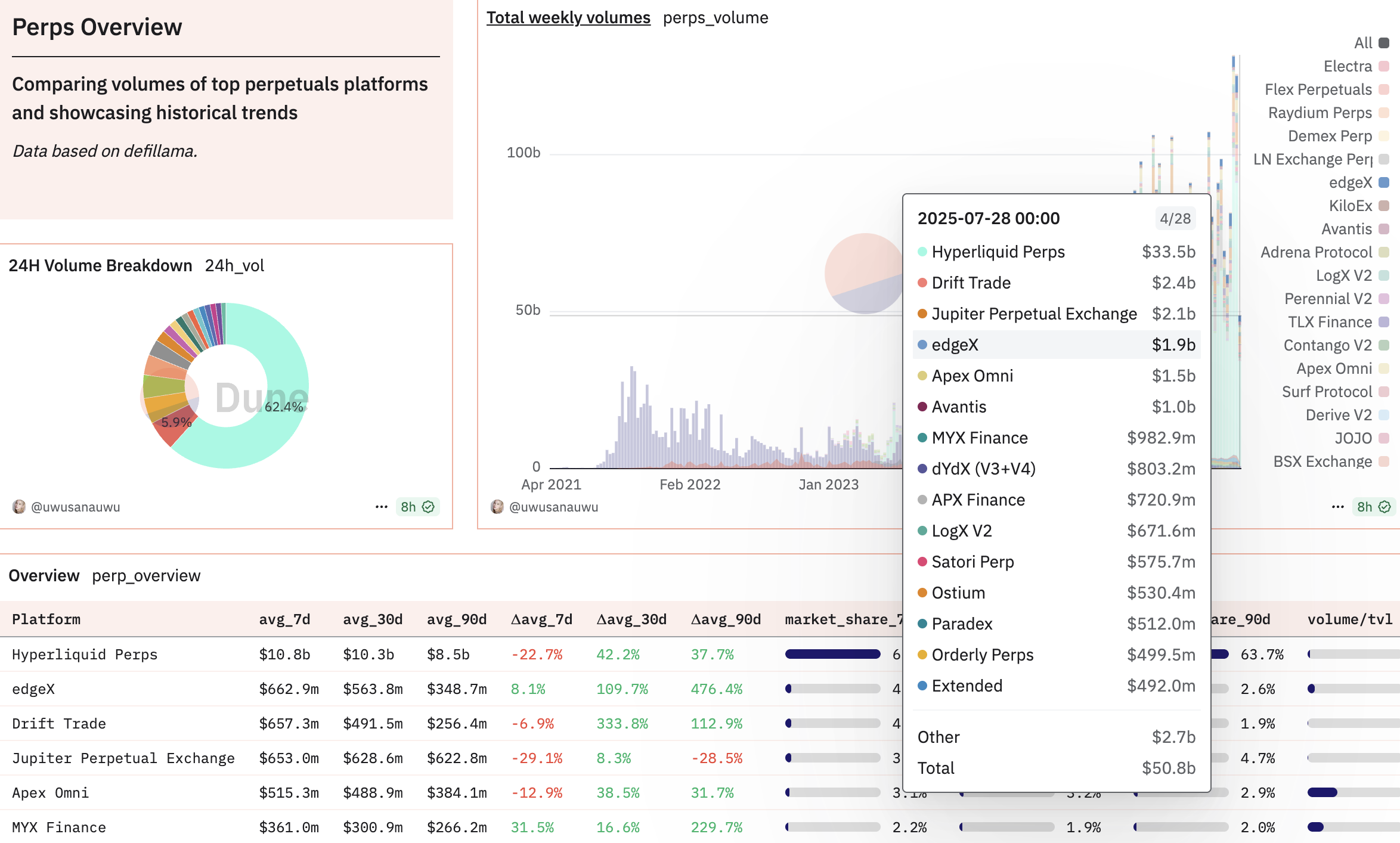

Perpetual platforms’ trading volume. Source: Dune

Perpetual platforms’ trading volume. Source: Dune

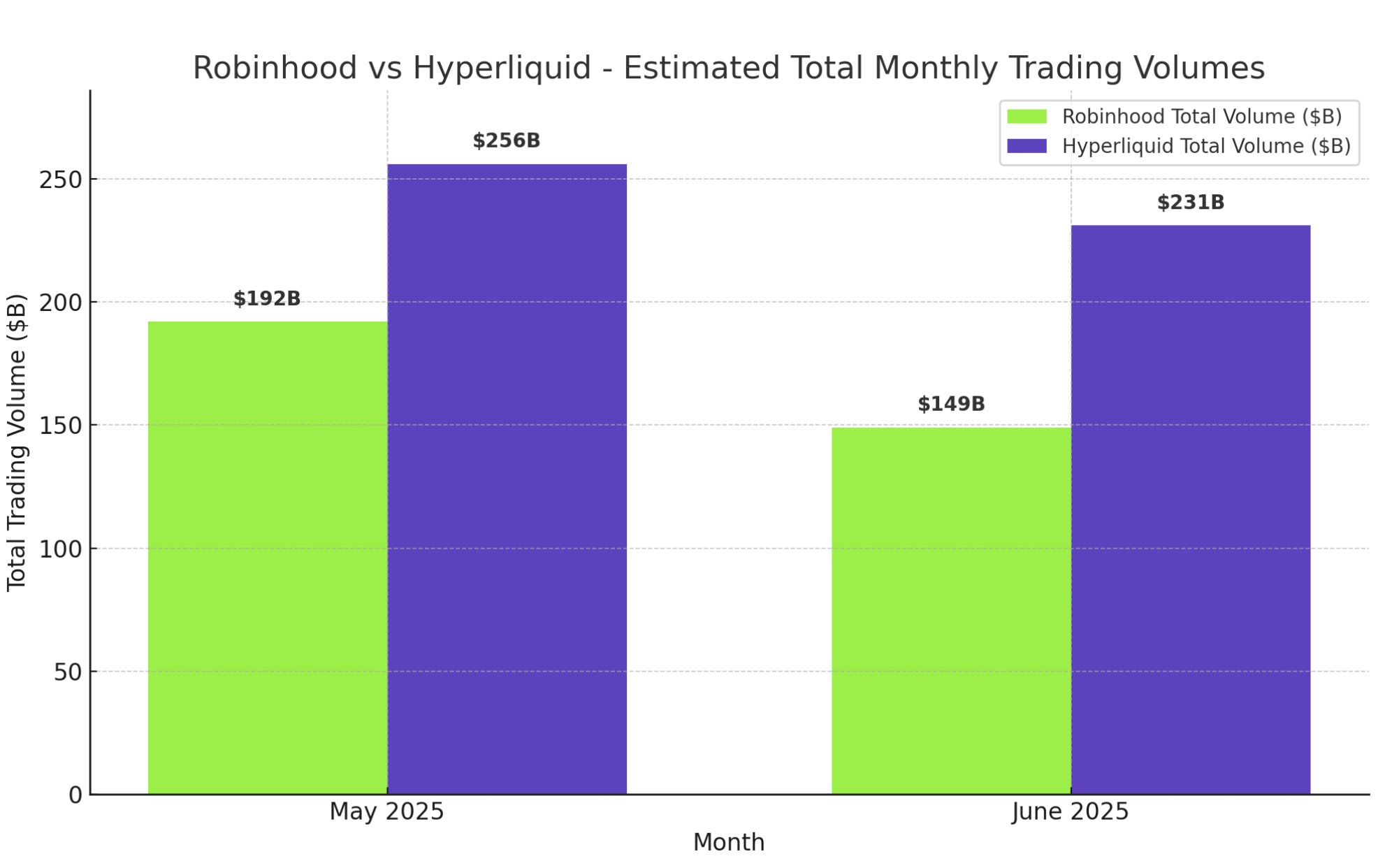

According to June 2025 data, Hyperliquid’s trading volume reached $231 billion, slightly down from $256 billion in May.

Meanwhile, Robinhood saw a sharper decline, from $192 billion to $150 billion in the same period. These figures show that the gap between a young DEX like Hyperliquid and the CEX giants is narrowing.

Volume comparison between Hyperliquid & Robinhood. Source: Jon Ma on X

Volume comparison between Hyperliquid & Robinhood. Source: Jon Ma on X

“Coinbase, Robinhood, Binance need to pay attention. Remember when people said DEXs couldn’t scale? Hyperliquid proves them wrong,” investor Lex Sokolin shared on X.

According to an in-depth analysis by Artemis Analytics, Hyperliquid is seen as a “rising star” of the new growth cycle. This highlights its rapid development and its potential threat to the dominance of traditional centralized exchanges.

“In just 2 years, Hyperliquid is quickly rising to become a similarly sized business as Robinhood,” noted Steven from Yunt Capital.

One of the standout features that sets Hyperliquid apart is its “Liquidity-as-a-Service” approach. According to an investor and DeFi expert, this strategy “increases its valuation and is probably one of the best trades one can take in size for the next few years.”

However, possibly due to its rapid growth, Hyperliquid recently experienced a brief user interface outage. This prevented users from placing, closing, or withdrawing orders, although front-end operations operated normally. Following the incident, Hyperliquid pledged to refund users affected by the short-lived API issue, which impacted trades and positions.

While it’s still too early to say that DEXs will completely replace CEXs, Hyperliquid’s growth is increasingly blurring the lines between the two models. Its stability and steadily increasing trading volume have made Hyperliquid a vivid example of the true potential of decentralized exchanges.