Eurozone June Inflation Commentary: Mid-Term Bearish Outlook for the Euro, with Short-Term Rises Presenting Opportunities for Bears

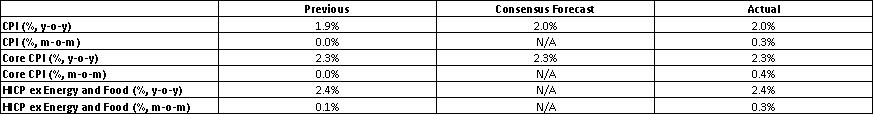

TradingKey - On 1 July 2025, the Eurozone published its June inflation figures, which met market consensus: headline CPI edged up from 1.9% in May to 2.0%, while core CPI held steady at 2.3%. The modest 0.1 percentage point rise in headline CPI stems largely from seasonal effects. Given the sluggish economic recovery and declining oil prices, the Eurozone’s inflation downtrend is expected to persist. This “low growth, low inflation” environment suggests that the European Central Bank will likely maintain its rate-cutting cycle, putting downward pressure on the euro over the medium term (3-12 months). In the short term (0-3 months), however, factors such as Trump’s tariff policies and global de-dollarisation trends are likely to weaken the U.S. dollar, supporting a temporary EUR/USD rally. This creates a strategic opportunity for investors with a bearish mid-term outlook on the euro to establish positions.

Source: TradingKey

On 1 July 2025, the Eurozone published its June inflation figures, meeting market consensus: headline CPI edged up from 1.9% in May to 2.0%, while core CPI held steady at 2.3%, unchanged from May (Figure 1).

Figure 1: Eurozone Inflation Data

Source: Refinitiv, TradingKey

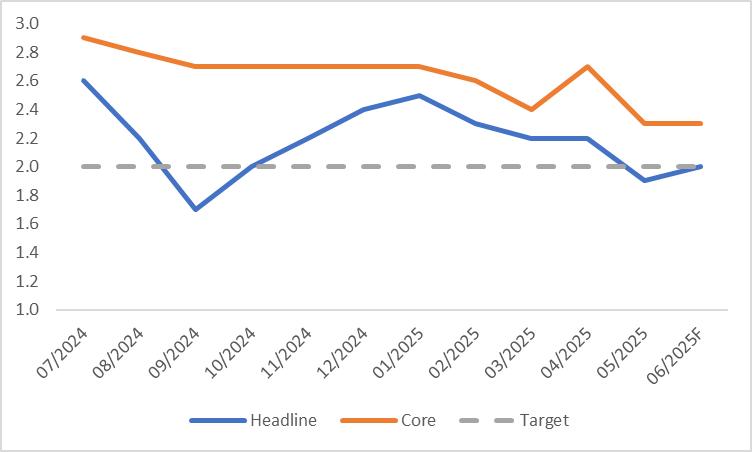

Since early 2025, Eurozone inflation has been on a downward trajectory, driven by a weak economic recovery and falling energy prices. Headline CPI growth declined sharply from 2.5% in January to 1.9% in May, dipping below the European Central Bank’s 2% target (Figure 2). While June’s headline CPI ticked up by 0.1 percentage points, this increase, largely due to seasonal factors, is insufficient to alter the ongoing trend of slowing inflation.

Figure 2: Eurozone CPI (%, y-o-y)

Source: Refinitiv, TradingKey

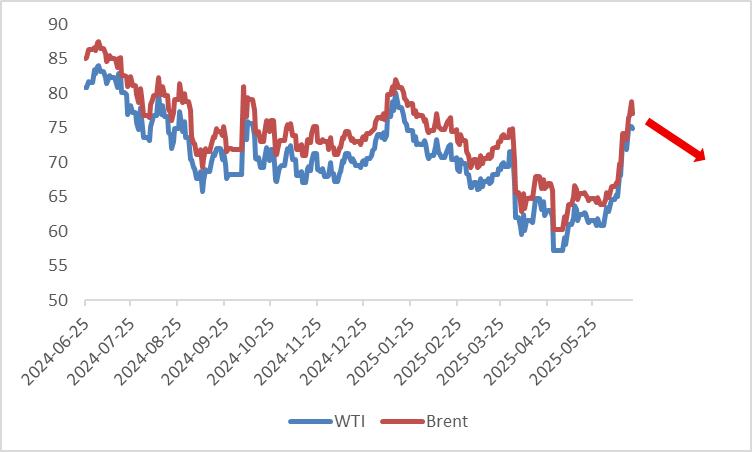

Despite a recent uptick in international oil prices, crude oil prices are expected to gradually decline over the coming quarters due to supply-side factors (Figure 3). On one hand, OPEC+ continues to maintain significant spare capacity. On the other hand, potential energy policies under a Trump administration could further suppress oil prices. This decline in energy prices is likely to translate into lower inflation readings, further depressing the Eurozone’s CPI. Consequently, the European Central Bank (ECB) projects an average inflation rate of 2.0% for 2025, with a further decrease to 1.6% in 2026.

Figure 3: Crude Oil Prices (USD/bbl)

Source: Refinitiv, TradingKey

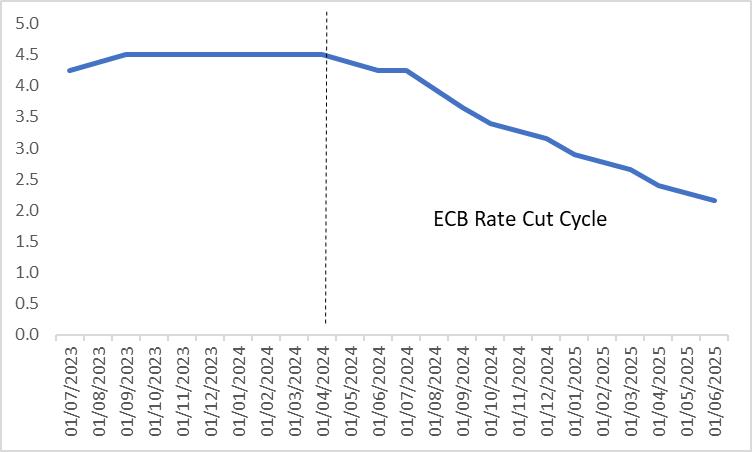

Given the slowing economic growth and the fact that inflation is no longer the Eurozone’s primary concern, the European Central Bank (ECB) initiated a rate-cutting cycle in June 2024. To date, the ECB has reduced its policy rate by 235 basis points (Figure 4). With the Eurozone’s fundamentals—characterised by low growth and low inflation—remaining unchanged, we expect the ECB to maintain an accommodative monetary policy going forward. By the end of 2025, the Eurozone is likely to enter a low-interest-rate environment.

Consequently, ongoing rate cuts are expected to weigh on the euro’s value over the medium term (3-12 months), leading us to maintain a bearish outlook on EUR/USD. In the short term (0-3 months), however, the US dollar is likely to weaken due to Trump’s tariff policies and global de-dollarisation trends, which could temporarily bolster the euro’s exchange rate. This presents an attractive opportunity for medium-term euro bears.

Figure 4: ECB Policy Rate (%)

Source: Refinitiv, TradingKey

Eurozone June Inflation Preview: EUR/USD Expected to Rise Initially, Then Decline

TradingKey - On 1 July 2025, the Eurozone will release its June inflation data. Market consensus anticipates the headline CPI to rise slightly to 2.0% from May’s 1.9%. Core CPI is expected to remain steady at 2.3%, consistent with May’s reading. We align with these market expectations. However, we attribute the 0.1 percentage point increase in June’s headline CPI primarily to seasonal factors.

Against the backdrop of a sluggish economic recovery and bearish oil price expectations, the broader trend of declining Eurozone inflation is likely to persist. The combination of low growth and low inflation suggests that the European Central Bank (ECB) will likely continue its rate-cutting cycle, which is expected to weigh on the euro’s exchange rate over the medium term (3-12 months).

In the short term (0-3 months), however, the euro is poised to benefit from a weakening US dollar, driven by factors such as Trump’s tariff policies and global de-dollarisation trends. This dynamic is likely to push the EUR/USD exchange rate higher in the near term, presenting an attractive opportunity for medium-term euro bears to position for a potential decline.

.jpg)

Source: TradingKey

On 1 July 2025, the Eurozone will publish its June inflation figures. Market consensus projects the headline CPI to edge up to 2.0% from May’s 1.9%. Core CPI is expected to remain unchanged at 2.3%, consistent with May’s reading (Figure 1). We concur with these market expectations.

Figure 1:Eurozone Inflation Consensus Forecasts

.jpg)

Source: Refinitiv, TradingKey

Since the start of 2025, Eurozone inflation has been on a downward trajectory, driven by a sluggish economic recovery and declining energy prices. The headline CPI has shown a particularly pronounced decline, dropping from 2.5% in January to 1.9% in May, falling below the European Central Bank’s (ECB) 2% target (Figure 2). The anticipated 0.1 percentage point uptick in June’s headline CPI is primarily attributed to seasonal factors and is unlikely to reverse the broader trend of sustained disinflation in the Eurozone.

Figure 2: Eurozone CPI (%, y-o-y)

.jpg)

Source: Refinitiv, TradingKey

Despite a recent uptick in international oil prices, crude oil prices are expected to gradually decline over the coming quarters due to supply-side factors (Figure 3). On one hand, OPEC+ continues to maintain significant spare capacity. On the other hand, potential energy policies under a Trump administration could further suppress oil prices. This decline in energy prices is likely to translate into lower inflation readings, further depressing the Eurozone’s CPI. Consequently, the European Central Bank (ECB) projects an average inflation rate of 2.0% for 2025, with a further decrease to 1.6% in 2026.

Figure 3: Crude Oil Prices (USD/bbl)

.jpg)

Source: Refinitiv, TradingKey

Given the slowing economic growth and the fact that inflation is no longer the Eurozone’s primary concern, the European Central Bank (ECB) initiated a rate-cutting cycle in June 2024. To date, the ECB has reduced its policy rate by 235 basis points (Figure 4). With the Eurozone’s fundamentals—characterised by low growth and low inflation—remaining unchanged, we expect the ECB to maintain an accommodative monetary policy going forward. By the end of 2025, the Eurozone is likely to enter a low-interest-rate environment.

Consequently, ongoing rate cuts are expected to weigh on the euro’s value over the medium term (3-12 months), leading us to maintain a bearish outlook on EUR/USD. In the short term (0-3 months), however, the US dollar is likely to weaken due to Trump’s tariff policies and global de-dollarisation trends, which could temporarily bolster the euro’s exchange rate. This presents an attractive opportunity for medium-term euro bears.

Figure 4: ECB Policy Rate (%)

.jpg)

Source: Refinitiv, TradingKey