GBP/USD inches higher as Fed holds rates, maintains 2025 cut outlook

- GBP/USD trades in tight range after Fed holds rates at 5.25%–5.50%.

- Fed’s SEP shows slower 2025 GDP, higher core inflation at 3.1%.

- Traders await Powell’s press conference for clarity on rate path.

GBP/USD trades within a 40-pip range, exhibiting mild volatility on Wednesday, after the Federal Reserve (Fed) stood pat on rates and hinted that it is still expecting two rate cuts this year. At the time of writing, the pair trades near 1.3450, posting modest gains of 0.20%, as traders await the Fed Chair Powell's press conference.

Sterling trades near 1.3450 after Fed sticks to its script, projecting two rate cuts next year

As expected, the Federal Reserve kept the target range for the fed funds rate unchanged at 4.25%–4.50%, reaffirming that the U.S. economy continues to expand at a solid pace, with strong labor market conditions. The Federal Open Market Committee (FOMC) reiterated its commitment to monitoring risks associated with both sides of its dual mandate and confirmed plans to further reduce its Treasury holdings.

June projections from the Summary of Economic Projections (SEP) indicated a slight downgrade in the 2025 GDP growth outlook to 1.4% from 1.7% in March. The forecast for the unemployment rate was revised from 4.4% to 4.5%, while the core PCE inflation projection is projected to rise by 3.1% from 2.8%.

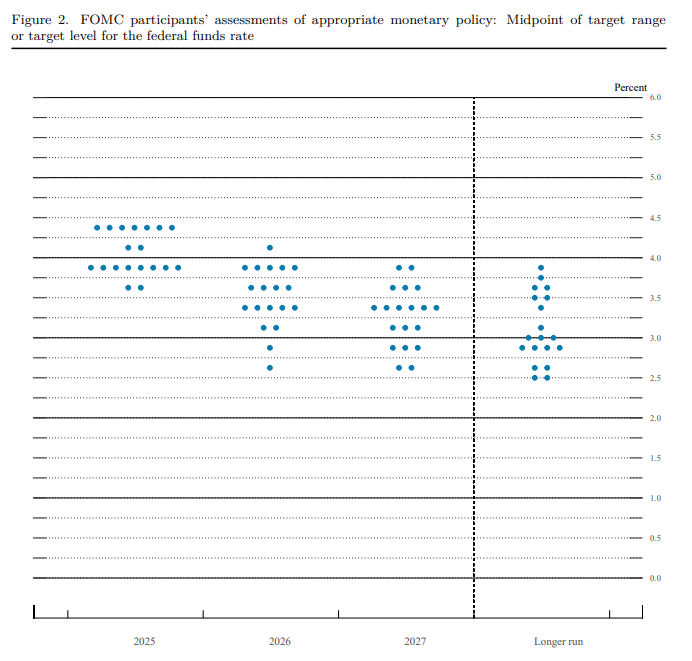

The median fed funds rate projection for 2025 remained at 3.9%, suggesting that Fed officials still expect two 25-basis-point rate cuts this year.

Source: Federal Reserve Dot-Plot

GBP/USD Reaction

The GBP/USD is currently trading within the 1.3450 – 1.3500 range as of writing, with key resistance levels located at the 20-day SMA tops at 1.3535. If Powell leans dovish, further upside is expected, with 1.3600 being the next target, followed by a test of the yearly peak at 1.3631. Conversely, a hawkish Powell tilt, with a drop below 1.3400, is on the cards, clearing the path to test the 50-day SMA at 1.3376, ahead of 1.3350.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.25% | 0.86% | 0.03% | 0.59% | -0.62% | -0.45% | 0.67% | |

| EUR | -0.25% | 0.50% | -0.22% | 0.35% | -0.74% | -0.70% | 0.43% | |

| GBP | -0.86% | -0.50% | -0.68% | -0.15% | -1.22% | -1.18% | -0.07% | |

| JPY | -0.03% | 0.22% | 0.68% | 0.54% | -0.97% | -0.83% | 0.21% | |

| CAD | -0.59% | -0.35% | 0.15% | -0.54% | -1.14% | -1.04% | 0.07% | |

| AUD | 0.62% | 0.74% | 1.22% | 0.97% | 1.14% | 0.04% | 1.17% | |

| NZD | 0.45% | 0.70% | 1.18% | 0.83% | 1.04% | -0.04% | 1.13% | |

| CHF | -0.67% | -0.43% | 0.07% | -0.21% | -0.07% | -1.17% | -1.13% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).