Silver lingers below $37.00 as attention shifts to the Fed decision

- Silver prices remain vulnerable to the performance of the US Dollar and interest rate expectations, placing the Fed decision in the spotlight.

- Israel-Iran hostilities or comments may support upside momentum if the Fed's rate cut expectations for September remain firm.

- XAG/USD steadies below $37.00 after reaching its highest level since 2012.

Silver (XAG/USD) is trading lower on Wednesday, pulling back from multi-year highs after a sharp rally in June that saw monthly gains of more than 10%.

The price peaked at $37.32 earlier in the session before slipping below the $37.00 psychological barrier, which now acts as immediate resistance.

Profit-taking near long-term highs is contributing to the pullback. However, broader market focus remains on the Federal Reserve (Fed) policy announcement, which could significantly influence the short-term direction for Silver.

The Fed is widely expected to keep rates unchanged at 4.25%–4.50%. However, attention will shift to the Summary of Economic Projections, which will show how officials view the path for interest rates, inflation, and growth. According to the CME FedWatch Tool, markets see a 65% chance of at least a 25 basis point rate cut in September.

Fed Chair Jerome Powell's press conference, scheduled for 18:30 GMT, could be crucial. If he signals confidence in disinflation and downplays external risks, expectations for a September cut may firm, supporting Silver. A hawkish tone would likely weigh on prices.

The weaker US Dollar (USD) has also been a key driver. A declining USD makes Silver more affordable for foreign buyers, thereby increasing demand.

At the same time, rising geopolitical tensions, particularly the Israel–Iran conflict, have renewed demand for safe-haven assets.

In this context, Silver remains sensitive to changes in interest rate expectations, the US Dollar’s trajectory, and global risk sentiment. All three factors will be shaped by the Fed's decision on Wednesday.

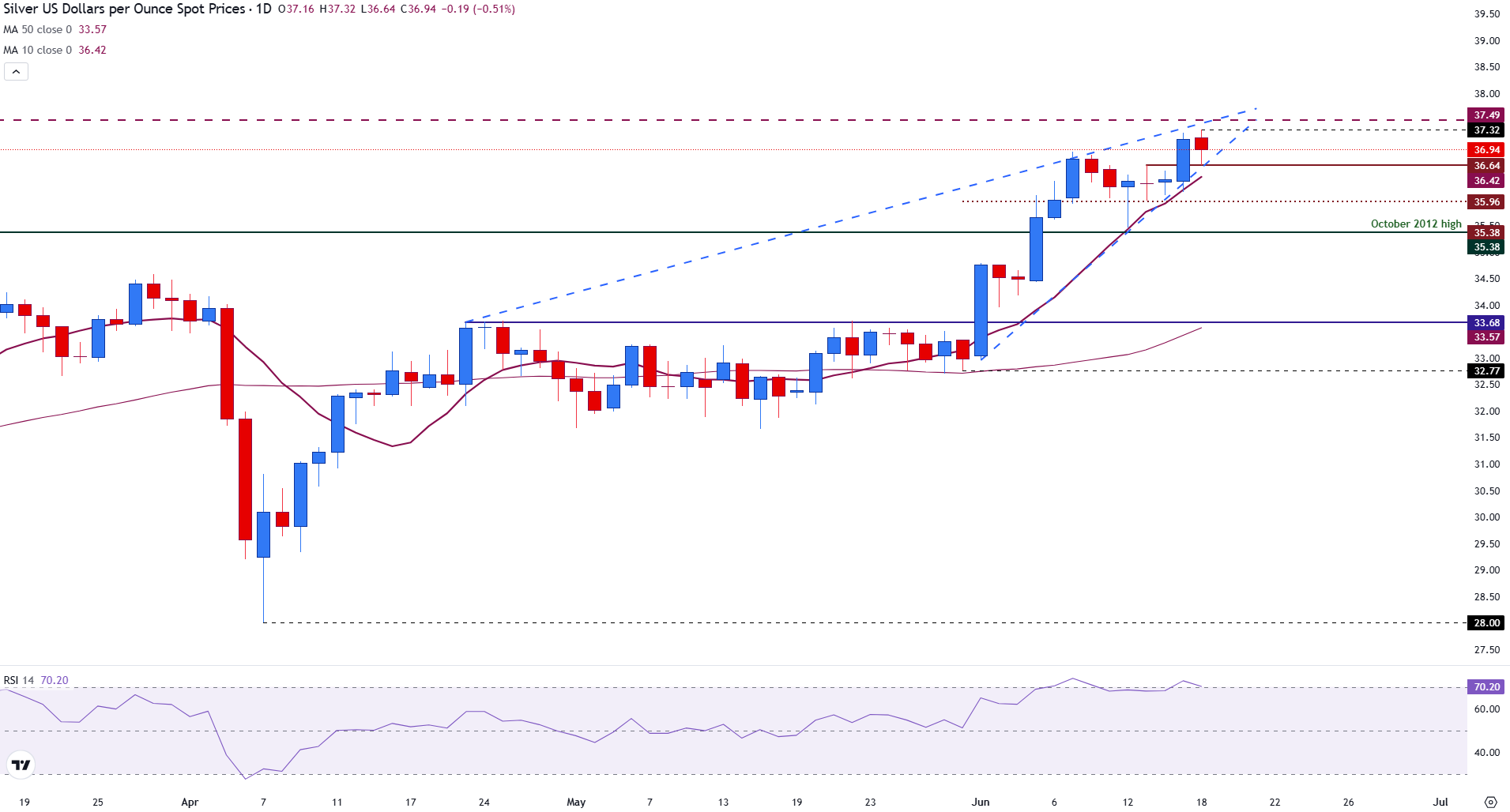

Silver technical analysis: XAG/USD stalls below $37.00 with RSI threatening overbought conditions

Silver (XAG/USD) is trading around $36.86 on Wednesday, slightly lower on the day but holding above key short-term support following a strong rally in June. Price action remains bullish overall, with the metal respecting a rising trendline and pulling back from the daily high of $37.32.

The 10-day Simple Moving Average (SMA) at $36.41 is providing dynamic support, while the 50-day SMA at $33.57 remains well below the current price, reinforcing the strength of the uptrend. A break and close above $37.49 would confirm a bullish continuation, potentially opening the door to test the psychological $38.00 level.

Silver Daily Chart

The Relative Strength Index (RSI) is currently at 69, positioned just below the overbought territory. This suggests momentum remains strong, but the risk of short-term consolidation or profit-taking is rising.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.