Here is what you need to know on Wednesday, June 18:

Following Tuesday's volatile action, financial markets stay relatively calm early Wednesday as investors await the Federal Reserve's (Fed) policy announcements. Alongside the policy statement, the US central bank will also release the revised Summary of Economic Projections (SEP). Ahead of this event, the US economic calendar will feature weekly Initial Jobless Claims and Housing Starts data for May.

The US Dollar (USD) benefited from safe haven flows as United States (US) President Donald Trump's comments suggested that the US could get directly involved in the Israel-Iran conflict. “We now have complete and total control of the skies over Iran,” Trump said and added that Ayatollah Ali Khamenei is "an easy target." The USD Index rose 0.7% on Tuesday and Wall Street's main indexes lost between 0.7% and 1% on the day. Early Wednesday, the USD Index stays in negative territory at around 98.50 and US stock index futures trade marginally higher.

US Dollar PRICE This week

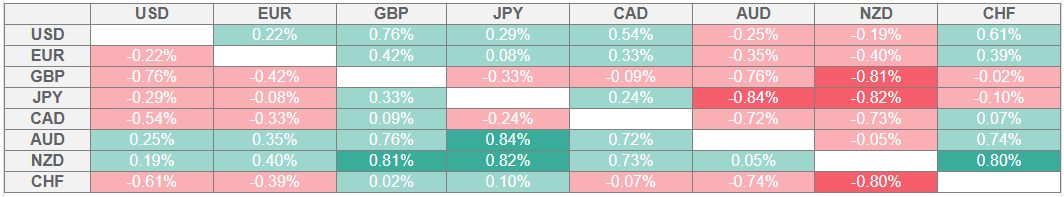

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The Fed is widely expected to leave the policy rate unchanged at the range of 4.25%-4.5%. Interest rate, inflation and growth projections in the SEP could trigger a market reaction. Later in the session, Fed Chairman Jerome Powell deliver the policy statement and respond to questions from the press.

The UK's Office for National Statistics reported early Thursday that annual inflation in the UK, as measured by the change in the Consumer Price Index (CPI), edged lower to 3.4% in May from 3.5% in April, as expected. On a monthly basis, the CPI rose 0.2% following the 1.2% increase recorded in the previous month. GBP/USD showed no immediate reaction to these figures and was last seen trading marginally higher on the day slightly above 1.3450. The Bank of England will release its interest rate decision on Thursday.

EUR/USD stages a rebound and holds steady above 1.1500 after losing more than 0.5% on Tuesday. Later in the session, several European Central Bank (ECB) policymakers will be delivering speeches.

Gold closed the day flat on Tuesday after failing to clear $3,400. Early Wednesday, XAU/USD moves sideways slightly above $3,380.

Oil prices shot higher in the second half of the day on Tuesday, with the barrel of West Texas Intermediate (WTI) posting its highest settlement since January above $73.50. WTI corrects lower early Wednesday and trades below $73.

The data from Japan showed in the early Asian session that Machine Orders declined by 9.1% on a monthly basis in April. After closing the previous three trading days in positive territory, USD/JPY edges lower and trades at around 145.00 in the European session on Wednesday.

Are you looking to stay ahead of market trends? Join Mitrade’s WhatsApp channel now to unlock endless trading opportunities!

By following Mitrade on WhatsApp, you’ll gain:

Leading Edge: Real-time market updates to track price movements in forex, commodities, and indices.

Professional Insights: Expert analysis and trading strategies to boost your performance.

Global Perspective: Stay informed on central bank policies, geopolitical events, and macroeconomic trends.

Scan the QR code to join instantly and receive timely notifications, ensuring you never miss critical market insights.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.